Our Money Went Where? September 2016 Update

First off, let’s address the interesting stuff – how is our projected FFLC budget and savings holding up with this new job change, and are we still on track for our Summer 2018 date? Amazingly, we planned well for the loss of a paycheck until this month, and even compensated enough that we were able to keep investing $3k/month, yeah!! Now that Mrs. SSC is getting a paycheck again we can double that to $6k/month! Alllllright!! While that isn’t as amazing as our high savings target for last year, I’ll take it considering how much our quality of life has improved with this job change. Since we’re looking for more of a Lifestyle Change with a less hectic pace and more family focus, this has been a winning move all around! Yeah, more exclamation points!!

Barring a financial meltdown in November which crashes the market (I wonder what could do that) we are still projected to hit our 25x projected yearly spending need plus ~$200k to pay for a house. However, this assumes a 4% growth in the markets until then. Clearly, this could all change in another month or two or sooner depending on the market. If that’s the case, we’ll keep on keeping on and building our egg until things recover or we decide to move along with our plan anyway.

If things keep moving along as usual however, then summer 2018, I will most likely pull the plug and transition to Stay At Home Dad (SAHD). Our spending will decrease, but so will our income, and Mrs. SSC’s bring home as Prof. SSC will not be enough to cover everything. So, we would be looking at a spending deficit of essentially our mortgage per month. We haven’t decided the best way to tackle that yet, as in, do we take our “forever home” money and use that to pay off our house and then just use that sale money to roll into the next house? Should we leave it invested and just use the investments to pay the mortgage or some other option we haven’t thought about yet? Feel free to give us your opinion on that.

September Spending Positive Notes

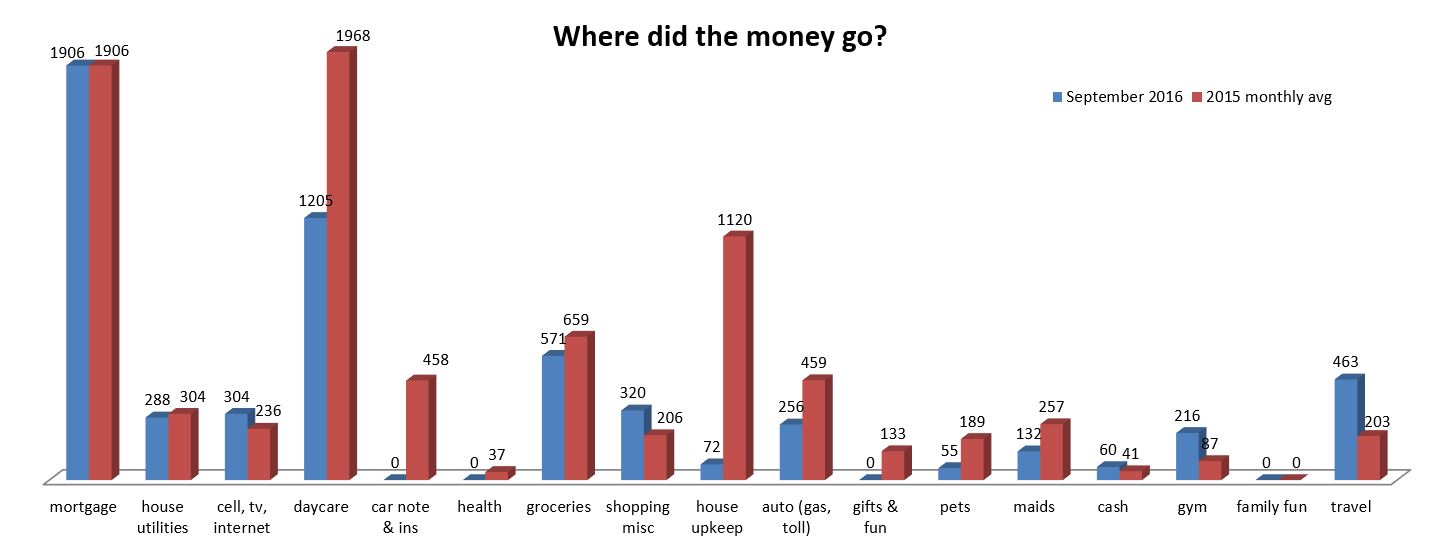

Daycare: Yes, our plan is coming to fruition with public school decreasing the cost of daycare. Plus, this isn’t a continued cost that just gets rolled into private school, so yes our plan of not living within 15 minutes of our offices is working perfectly. Lower mortgage, finally lower commute costs, and now lower education costs as well. Wins all around!

House upkeep: Still no word on the fence repair, so it is still at a low compared to last year. Nothing outside the usual maintenance things – insect killer for the yard – darn you sod webworms! More ant killer – so many ant piles…

Groceries, Utilities, Commuting (autos), Pets: Lower is better – no big surprises here.

September Spending Negative Notes

Cell, TV, Internet: While this should be about the same, we still keep getting hit with ATT even though we haven’t had service from them since June… I’m waiting another week when their “20 days” time line is supposed to take effect for our refunds back to June, but yes, we got charged again. Thanks for the great service ATT… WTF… I at least have a transcript of our conversation in my email box and as a screen capture to use as ammo that this should have been settled already. Ugh…

Travel: This is higher because of a $180 ticket to FinCon next year – yeah FinCon!! We also have a short weekend trip planned to the hill country to just get out of Houston next month. Otherwise, nothing out of sorts here.

Gym: That’s just our family plan and swim lessons although that will be offset by my company some, but it gets used often so we’re fine with that.

September Wrap up

That’s about it for our spending – like I said, no major surprises and I’m sure the December update post-election will be more exciting once we see what happens with the markets based on that outcome. Joy!!!

Let us know if you have any suggestions for how best to deal with the spending shortfall if I pull the plug in 2018 and we’re still in H-town with a mortgage. Is this buildig to be a perfect storm for a “One More Year” scenario? Will the markets be in the toilet and it won’t matter anyway? What are your thoughts, we’d love to hear them!

Brian @ Debt Discipline

October 5, 2016Looks like a great month. Interesting question on what to do with the mortgage. Do you think the sale price of the current home will cover the cost of the forever home? If so than it just a math question. Which way do you lose less, by paying off the mortgage now or by running a deficit each month.

Mr SSC

October 5, 2016No – on the current sale price covering the forever home. We put down 20% but aren’t throwing extra at the mortgage because well, we don’t plan to be here long enough to make it worth it and we don’t trust real estate as an investment/asset.

If we paid off the home, I think the sale would most likely cover the “new” home or close enough that whatever loan we took would be teensy.

Yeah, it will most likely come down to math though…

Laurie @thefrugalfarmer

October 5, 2016You’re doing great! I’d say get out of town ASAP and get a home you can pay for in cash. If you still are stuck in town I probably wouldn’t pay off the mortgage b/c you’re planning on leaving eventually anyway, right?

Mr SSC

October 5, 2016Yeah, that’s our current thought, but since Mrs. SSC likes her teaching gig, then she may want to keep doing that for another year or so, while looking for a spot at a different university. Maybe by then she’ll be “over it” and ready to move. Who knows. 🙂

I agree with probably not paying it down just because we don’t trust real estate as an asset. It’s never worked that way positively for us so far anyway, lol.

Maggie @ Northern Expenditure

October 5, 2016Congrats on the decreased childcare costs! (My kids just started swimming lesson again, too! They love it… I however, do NOT love walking around the pool with the 2-year old threatening to jump in the entire time!) Also, I’m SO EXCITED to meet you guys at FinCon!

Mr SSC

October 5, 2016Thanks, it feels lovely! (the decreased child care costs that is) hahaha

Our 3 yr old has just gotten into the “Jump!!” mode around the pool, so I feel you on that one. On the plus side, she’s way more confident and way less shy around the water now, and not in the overconfident not afraid to drown aspect yet, just more of the this is fun, not scary side of it.

I can’t wait to meet you at FinCon – Mrs. SSC is planning on staying home currently, that many people in one place gets her anxious and drains her energy. Introvert anyone? 🙂 She thinks it would be fun to meet all the bloggers just not everyone else, lol. I can’t wait, I think it will be a blast!

Elephant Eater

October 5, 2016I may be dense but, why do you need the extra $200K? Does this mean you plan to sell your home and spend an additional $200k for a new one b/c you will be moving to a higher COL area? In either event, these are good types of problems to have where you are trying to optimize between two positive expectancy decisions. If no clear cut winner on initial analysis, we tend to just make the decision that feels best and don’t look back and second guess.

Glad to hear things are working out with the lower income as we’re playing armchair QB watching you guys do something similar to what we’ll start transitioning to ourselves in a few months.

Mr SSC

October 5, 2016Ahhh, yes, the extra $200k. The shortest answer is that we don’t take into account our current home value because we may just get back the 20% we put down on it when we bought it. The longer answer is below.

So, our main assumption for our FIRE costs were no mortgage and no daycare, which would mean we pay off our “forever” home in cash when we move. Because we got burned on a transaction when we showed we wanted to put 40% down on a home, when we made the offer on this house, we kept it at a “normal” 20%. Also, because we planned on moving either through work or due to FIRE/FFLC within 5-8 years, we haven’t thrown massive amounts or even tiny amounts extra at our mortgage.

Therefore, our home should net us our 20% back and possibly whatever it may have appreciated, which is little to nothing from what we paid for it. We feel we won’t lose money, but don’t see it appreciating very much if at all on top of our purchase price.

So, we set our “forever” home target price around $200k and if we have any extra from our current home sale, say the 20% we have in it, then we may put that towards the new home or moving expenses or what not. Currently we see that as “extra money” because we may or may not make it, since it’s all dependent on real estate trends at the time we decide to sell. Maybe it will go up and we can net a good chunk of change, but we don’t count on it.

Because we’ve been burned on losing cash on our last house, and Mrs. SSC in her previous home ownership situation, then we see paying off the house and hoping we get it back as a riskier option than just paying the mortgage each month.

We’ll probably go with what you suggest and pick the option that lets us sleep at night, whether it’s the “financially best” scenario or not. 🙂

You’d be amazed at how planning for something like that (reduction in income) and already just living off of one salary has made the transition quite easy for us. We thought it would be WAY tighter and I have to say I haven’t felt the pinch or any pinch at all so far.

Good luck with your upcoming transition!

Mrs SSC

October 5, 2016I’ll make it even simpler. We have about 100k equity in our house, and we expect our forever home to cost around 300k…. so, that is our extra 200k

Elephant Eater

October 6, 2016Kind of reminds me of our blog post writing/editing process. I write a 5,000 word post, Mrs. EE tells me 4,000 make no sense and we publish 1,000. Perfect! 😉

Mr SSC

October 6, 2016Haha, exactly! 🙂

Tawcan

October 5, 2016Woohoo FinCon! Can’t wait to meet you in person finally.

Nicely done to decrease childcare cost. Baby T1.0 just started preschool twice a week. At $210 per month we thought that was money well spent.

Mr SSC

October 6, 2016I think the social interactions are really good for them, and just getting an occasional break for Mrs. T has to be nice too.

Can’t wait to meet you at FinCon as well! It’ll be exciting!

The Green Swan

October 5, 2016Nice month, thanks for the update. Normally I’d say to avoid throwing the extra money to pay down the home, but since you know that will go to your next home anyway (and don’t plan to have a mortgage at the new house) why not live that way already rather than put it at risk in the market?

Mr SSC

October 6, 2016That is definitely one train of thought, it mainly comes down to which we feel safer in, a real estate market or the stock market. Fortunately we won’t necessarily have to approach that for a couple more years though. 🙂

Whichever is less volatile at the time will probably get our vote though.

Mr. PIE

October 5, 2016Gotta love that reduction in daycare. Understand the euphoria so well. You will be doing cartwheels when the rest disappears!

Glad you could get some time planned in the hill country. It’s good to escape, chill…much needed for the sanity of all.

Question for you, does the groceries line item include household supplies like bathroom stuff, kitchen roll, cling film, cleaning products…. blah blah, blah..? We include household items in groceries and are at $1k per month. Needle won’t move much further there for us right now.

I feel your pain with ATT. Bleedin parasites and blood suckers all in one. Getting our TV fix with Antenna, Sling TV and Tunnel Bear for various BBC shows via the cunning hidden VPN.

I look forward to hopefully meeting you at FinCon. Mrs. PIE won’t make it unfortunately.

Mr SSC

October 6, 2016I can’t wait for it all to start disappearing, and the summers moving forward will see a big drop as they’ll just be in the occasional camp, but home full time. At least until Mrs. SSC’s sanity or patience disappears, lol.

The grocery line item covers “things bought at the grocery store” which some months may include things like plastic wrap, paper towels, etc… However, most of that lands under shopping because it’s “not bought at a grocery store.” 🙂 Since I don’t run that part of the spend tracking (thank goodness) I had to ask about the breakdown myself, hahahaha….

So, for the most part, it looks to be just shy of your shopping budget ~$900, with some months a little lower on average ~$700-800. We get a lot of the toilet paper, paper towels and those sorts of items thru Amazon pantry and they seem to have pretty good prices.

Oh, ATT… Yep, they finally (31 days after getting a promise the bills would get refunded) posted the refund credit amount to our account. In the next 6 weeks, we should get that check mailed to our house. (Palm smack to forehead and shaking of the head) 6 weeks… I’m pretty sure the Pony Express was faster, but hey at least we’re finally “cancelled” with them. 🙂

Mrs. SSC won’t make FinCon either but I’m looking forward to meeting you there too!

Edifi

October 5, 2016Woohoo, fincon in Texas?! We signed up, too! The irony is that we hope to be early retired out of state well before next fall.

Mr SSC

October 6, 2016Woohoo FinCon! Nice with being able to ER and skedaddle before then, good for you! I can imagine that will be a nice feeling, even if you do have to come back here for a conference later that year. 🙂

Jacq

October 6, 2016Could you get a consulting gig to cover the deficit? Part time sort of thing, set your own hours?

Mr SSC

October 6, 2016That’s a possibility, but it would depend if the downturn is still going on. My thoughts are the downturn will probably still be going on to some degree then and oil will probably still be around $50-$60/bbl which may mean it’s still a crowded consulting market.

However, because it could still be tight, I may be able to negotiate a 3 day a week part time schedule with my current company when I give notice. Allegedly, when you give notice to leave and you’re not going to a competitor, the negotiations come out in full force along the lines of “what can we do to get you to stay?”

If that’s the case, I’ll hsve some sort of part time arrangement worked out ahead of time to be able to offer them, especially since I’ll be leaving but staying in town as a SAHD. That could drive it home to them that I just want more family time, and 3 days a week would work better to fit that schedule. It’s worth a shot, but who knows. 🙂

Jacq

October 6, 2016Any consideration to using the time now to set yourself up as an EHS (environmental health and safety ) consultant? It could give you an edge.

Or contract/document approver? Something that your expertise garners a high price, but could be done once the kids are in bed.

Finance Solver

October 6, 2016Sounds like a great month. I wonder what could cause a financial meltdown in November also.. hmm..

September was a great month for me, spending wise. I’ve gotten to the point where my expenses are almost minimized and there’s no way else to decrease my expenses. Going forward, I’m going to try to increase my income and wonder how that’s going to pan out.

Mr. SSC

October 21, 2016Haha, yes, what could cause a meltdown in November? 🙂

We’ve just about hit the point where we can no longer minimize our expenses – in our opinion. I know anyone else could come in and say – cut cable (happening next summer), cut the maids (only when we quit work, lol), and other minor things like that, but since they’re not accounted for in our “FFLC/FIRE” budget, we’ve effectively identified our baseline.

At least the baseline we’re comfortable with. Good luck with working on increasing your income! 🙂

Ms. Montana

October 7, 2016I love that our community has such great public schools. I remember paying for childcare when I was still working, and being so happy when that cost was over. They are starting to roll out more and more public preschool options here as well, which helps so many families. Thanks for a great update!

Mr SSC

October 11, 2016I can’t wait until that drops off completely. It really was one of our criteria when house hunting, mainly for this reason. We have friends that are looking to move because they will have 2 kids in schol soon and the public schools near their house aren’t great, and the private school is about $14k/yr per kid…. For kindergarten!

I’m just glad that we planned so we aren’t in that same situation.

Mustard Seed Money

October 7, 2016I am really interested to see what happens with the market after the election. Some pundits think the market will tank if Trump becomes president while other think that the market is being propped up for Clinton and will tank after she is elected. But like you I am definitely looking forward to seeing what happens.

Mr SSC

October 11, 2016I’m interested to see how it will fare too. We’ve actually held off on investments this month, until we see if it is going to tank or not. At the least, we are only losing a month or so of interest, but at best, we might get some stocks on a sale. 🙂 Not that I’m oping for that, I’d much rather have everything keep chugging along.

Less than a month to go now…

Our Next Life

October 10, 2016Wooooo Prof SSC! 🙂 🙂 🙂 And I looooooovvvvvve seeing that child care number coming down — it has always made me feel heartburn on y’all’s behalf. Haha. And yay for FinCon! So excited that you are coming. My advice: don’t fall into one more year syndrome. You only have so long with your kids, so I’d rather you go back for a second act after they are out of the house than miss out with time with them now. Just my two cents. 🙂

Mr SSC

October 11, 2016You’re not the only one that loves seeing the childcare number drop. 🙂 FinCon ought to be fun. I guess I should look into booking a room now too so I can stay on site.

That OMY is going to be tricky to navigate. You make a good point though about the time with the kids. My main thought is that with the summer 2019 incentives, it would be close to $60k on top of any other bonus that may come in April. That alone would cover the mortgage or rent for ~3 years.

It would be a slippery slope, in that if I don’t leave in August’ish 2018, then I may as well ride it out through the holidays. At that point, it’s only 4 months until bonus time, and then only another 3 months until the incentives hit… If I went that route, it would deifintely be a hard line at July – post incentives coming into the bank account.

Such a tough decision. We’ll see, maybe the markets won’t tank and this will be a moot point by then. 🙂

Fruclassity (Ruth)

October 10, 2016I am out of my league insofar as offering financial advice goes here, but I do advise finding a new acronym for stay-at-home-dad. SAHD sounds . . . sad. And I don’t think that will be your reality. How about “BUD” for badass-uber-dad? All the best in November! The world wishes you (and the rest of us) well.

Mr SSC

October 11, 2016Haha, I think the same thing when I type out SAHD. 🙁 I like BUD though, maybe I’ll use it instead. 🙂

Yes, good luck to all of us in November, even though no matter how it shakes out, one of those 2 idiots is getting elected. ugh…

Millennial Boss

October 15, 2016I’ve never seen daycare cost in a budget before but now terrified to have kids. $1900 AHHHH!!!!! Looks like you’ll be ridding yourself of that cost soon. Congrats to you both.

Mr. SSC

October 21, 2016Ah, yes, the daycare shock. We get that a lot, especially the months where it’s just higher than our mortgage cost. Sigh…

Fear not, unless you’re both working, then fear away! In our situation, it still paid out to do daycare/preschool and there are possibly cheaper options around, but we liked the learning curriculum they followed at ours, and it’s walkable from the house. Win, win!

Soon that whole cost will be a thing of the past because of kindergarten and when i am not working, then I’ll be able to do the stay at home dad role and avoid any of the after school care costs as well.

If you’ve never thought about it, daycare can be a huge sticker shock. We’re just glad it’s not a constant that turns into private school costs which are about $13-$14/k per kid per year. For grade school for goodness sakes. That was a HUGE driver in not living closer to work, and staying closer to good public schools.

ZJ Thorne

October 27, 2016I can’t wait for you to be a SAHD. Quite a lovely transition to family happiness.