Our money went where? June 2016 Update

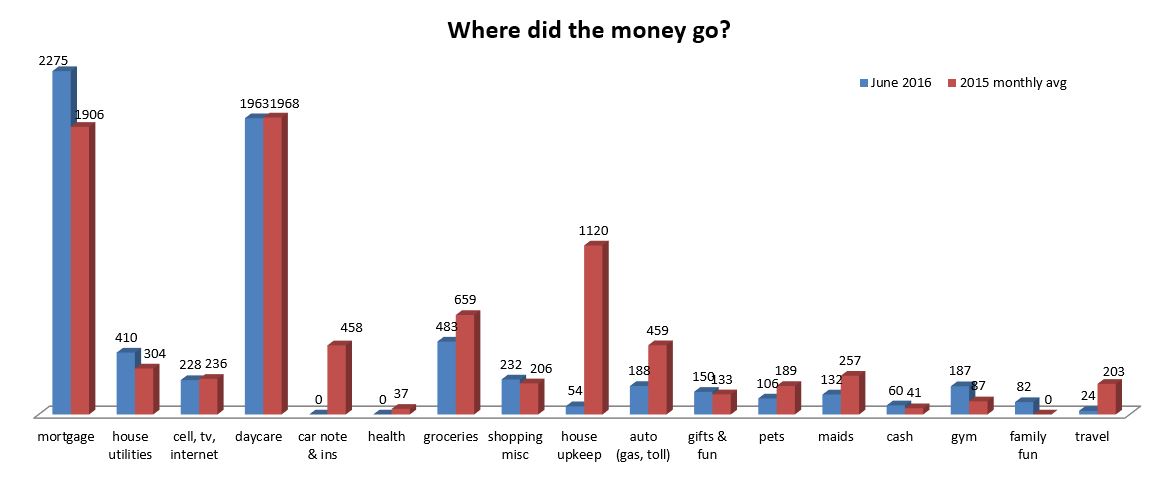

Well, another month has come and gone and we are now halfway through the year. So far tracking how our our “real” budget numbers compare to our anticipated Fully Funded Lifestyle Change costs we seem to be pretty close. We have been averaging $4035/month spending and that’s assuming no mortgage, which ends up being ~$48420/year needed. We like to add in a little slush/cushion to round up to $55k, which is what we are generally assuming our year to year costs to be and we’re right on track. Heck, we’re even under budget, which I will never complain about. So what were the big hits and little misses that we saw this month?Time to get into some details!

First off, we did end up signing back up for flood insurance so that set us back $370 for a years worth. Something about a month straight of rain (27″ total) and seeing the water in our street reach the sidewalk 3 times and we figured, we’re idiots for not having insurance. So, we now sleep peacefully again, and could care if the water gets up the sidewalk or even into the house. Bring it on rain! Kidding, that would still suck. If I forgot to mention it last month, I finally added an umbrella insurance policy as well. I had been forgetting about it until I got the new car and was on the phone with insurance and they asked if they could help with anything else, and I thought, why yes, yes you can… Umbrella policy – activate!

Beyond that, our spending was relatively low this month, and our June compared to 2015 average is looking nice on the chart below.

Now for the little wins. Mrs. SSC got an extra $2k for her vacation getting paid out, so that was nice. We switched utility companies and went with Energy Ogre – a no contract brokerage of utilities you might say. Thanks for the recommendation Jacob! Since Texas is deregulated, you get to choose who you buy energy from, and while I had perused a lot of plans, one of our readers turned me onto this company. They analyze your past usage and choose whatever company has the best deal for your house. Then they set up your account, and you get billed from whomever they choose and they can shop you around every 6 months as deals expire and new ones come available. They charge $10/month for this and have no contract so we can cancel at any time. Pretty sweet and saves me hours down a rabbit hole comparing plans, rates, contracts, etc…

The “scary” news for this month is that we are now officially down to one income until October, GASP!! Based on our average spending and the income from one salary, we will have a whopping surplus of… wait for it…. $75/month! Eeeeek!!!!

Much like our 6 extra weeks of unpaid maternity leave for Mrs. SSC with both kids, we planned on this and should be sitting pretty. We had upped our cash reserve quite a bit (although most of you may think it’s still fairly anemic) on the off chance we both got laid off. Thank goodness that didn’t happen, but we’re still sitting on a bigger than usual cash reserve, and we have set aside even more cash to buffer this period. Fingers crossed Mrs. SSC gets enough students signed up for her classes or her pay will get cut even more, and then we’ll really be making some cuts. Ack!!!

Speaking of cuts, what about the cable TV, as that was supposed to get cut this month. Sigh — I called up to cancel and after 5 minutes of jibber jabber about what channels we watch, our favorite features of our dvr (there are none), and more, the rep informed me that’s fine, we’ll cut your service, but since there is a year on the contract it will be $225 or so to cancel. After a brief heated discussion regarding timing and contracts, we realized whomever I had spoken with before that informed me I could cancel at the end of June penalty free was mistaken. Bastards! And stupid Mr. SSC always signing contracts. Looking back, I now vaguely remember that when we switched we were of the mindset that A) we don’t mind having that bill as long as we’re working and can cut the cord when we enact our Lifestyle Change and B) even after the discounts, the bill was still ~$60/mo cheaper than ATT. So, yeah… One of those things where our mindset has changed yet again over the past year and we don’t want to afford it. On the plus side, I did get another year of all the discounts, so except for this month, our bill will be the same. This was when I started discussing with the rep that the cancellation fee would pay out in 2 months, so, yeah I think I’ll just go ahead and cancel. 🙂 Granted, it only takes 3 months now for the payout, and I did discuss that with Mrs. SSC, but we’re sticking with it and will drop it next year. Unless her income drops because noone signed up for her classes, yipe!!

Well that was it for our month, nothing major, no big changes, except losing a sizeable income, and no unexpected surprises. Whew…

How was your year so far? Good, Bad, or Ugly?

Fervent Finance

July 12, 2016June was a great month for me. Kept the expenses down while socking away a bunch. I’m sure you could cut back your 401k contribution until October and still max it out to get some cash flow while the Mrs. isn’t getting a paycheck, correct?

Mr SSC

July 12, 2016Nice that you had a great June, with that vacation and getting relocated, that’s always good to hear!

That’s a good idea about the 401k cutback until then. That would free up some cash, and since I’m not concentrating on maxing it out (yipe!!) that would still be fine. I just have it set to the amount needed to get the company contribution, because our 401k’s are currently at a good point for when we get to 60’ish. We just need the “gap money” to cover until then, but I also I don’t want to miss the free money from work contribution.

Thanks for the idea!

Thias @It Pays Dividends

July 12, 2016Whoa you have tons of leeway each month now that you are down to one income 😉

Good to hear you planned for the loss before it happened. Before my wife decided to stay home with our daughter for a year, we ramped up our saving to make sure we had a sufficient supply in case we needed it. Luckily, we haven’t needed to dip into that much over the last year.

Mr SSC

July 13, 2016I know, it was a relief to see how much cushion we’d have, whew! 🙂

Since we knew it was coming, we have a strategy to work around it, and hopefully don’t need to use the savings we have.

Maggie @ Northern Expenditure

July 12, 2016June was fabulous for us! We traveled and hit a big number for us in our savings! I’m really excited for Mrs. SSC. I hope you really enjoy teaching this year and I can’t wait to hear all about it!

Mr SSC

July 13, 2016Yeah, you guys had a great June as well! I’m sure there will definitely be some posts about her new teaching gig. 🙂

TheMoneyMine

July 12, 2016June was a great month for us as we were on vacation for the first 2 weeks, but it wasn’t as great a month for savings haha.

I didn’t know Energy Ogre, it is a very good business idea but is it still worth it for 10$/month? Every year, in January, I change our electricity contract to the cheapest. Powertochoose.org lists all the providers in Texas and is surprisingly easy to use. We got a deal this year at 7c/kWh. This is so cheap we now pay less for our house than we did for our apartment.

When the kids will be out of day care, that will definitely improve your cash flow!

Mr SSC

July 13, 2016I get sucked into using that power to choose site by looking at different options like could we save more by using the “free nights plans” or other variables and then I realize I’ve spent 2 hrs looking at it just to save what is probably only $20/yr…. I’ll keep track and let you know, according to another reader they also used it and still save 40% from previous even with the $10 charge, so we’ll see. 🙂

I can’t wait for the kids to be out of daycare, that was our main reason in wanting to live near good public schools is so we can have that cash back once they’re in kindergarten. We have some friends whoa re looking at private schools and they are essentially $12-$15k/yr per kid for elementary school. Elementary school!

Tawcan

July 12, 2016June was pretty good for us. Looks like you’ve made quite a bit of change to reduce your expenses even lower. Great stuff on getting flood insurance. You’re so right that a peace of mind is a good idea. Gotta be able to sleep at night right?

In terms of cable, you should just cut it without talking too much with the prep. We’ve been without cable for 5.5 years now (in fact we don’t even have a TV). Don’t miss it at all.

Mr SSC

July 13, 2016I’d love to be able to cancel online, but they won’t let you cancel without a rep talking to you and trying to do everything they can to keep you from cancelling, it’s like the Sirius/XM model. No easy cancellation ever…

I can see that it would be an easy transition to cutting the cord for us, and we may still go ahead and just pay the cancellation fee and do it, but we’ll probably wait until our contract is finished out and then do that.

Mr. PIE

July 12, 2016June was another month of us seeing out our cable contract. Damn Verizon! Parasites!

Our budget continues to do well and we now wonder how we spent so freely before. Would spend even less if it wasn’t for the damned cable contract.

We now drink less beer and wine although our two week vacation has that looking not so good. Well, I mean good in the sense of good wine or beer ( or both) is always an essential of a good vacation. Ice cream budget also sky high right now. What a budget problem!!

Mr SSC

July 13, 2016I think the same thing sometimes about our previous spending. Mainly like this, “How is it we’re living really comfortably now, and spending so much less, and what in the heck were we spending so much on before?” As far as cable goes, once the contract ends, I will cut it out. I’ll figure something out with football next year, but even that has been difficult to watch sonce the kids are more active and doing things, so even viewing some games will eventually get seriously cut back for family reasons I’m sure. 🙂

Meh, vacation is vacation and time to relax and enjoy some nice beer and wine or both, so for me, I don’t see it as necessarily a bad thing. 🙂

Erik @ Hippies de Land Rover

July 12, 2016It’s great to hear you’re doing well expenses wise.

Living with one income might be an strange feeling and quite scary if it last long, but decisions are made and life’s goes on! Good luck with students singing in for the class!

Cheers!

Erik!

Mr SSC

July 13, 2016Exactly, we have plans and contingency plans and they all change depending on what’s priority in our lives currently, but regardless there is always a plan. 🙂

Life definitely moves on whether you want it to or not, but it’s nice feeling in control and knowing we’re pretty adaptable to it’s changes.

MDbyFIRE

July 12, 2016June has been steady for me–no big changes or unexpected expenses. I’m anticipating a small pay increase in July, so I’m interested to see how that changes my numbers for the second half of the year!

Mr SSC

July 13, 2016Any pay increase is always nice and esepecially if it can help contribute more to savings or whatever you want to put that extra towards. Congrats on having a good June as well!

The Green Swan

July 13, 2016Cut the cord, you can do it 🙂

June was good hear, we had a couple long weekend trips to see family. Expenses stayed under control though. Thanks for your update.

Mr SSC

July 13, 2016It’s nice when you get to enjoy things and still keep expenses low. We were a bit surprised that our expenses stayed low, it felt like we were spending more freely, but that wasn’t the case. July might be a bit high because of birthdays, family visits, and out of town friends visitng, but we’ll see how that shakes out next month. 🙂

Mrs SSC

July 13, 2016Let’s cut the cord! No more cable! Let’s do it!!!!!!! Come on Mr. SSC – it won’t be scary! I mean, yeah, you might have to talk to me more, and look at me more, since you won’t have the TV to look at – but I’m not that hideous 🙂

Mr SSC

July 13, 2016Hmmm, so now we’re having conversations on comment sections – of our own blog even. Interesting… Reminds me of the PIE’s, lol.

If you’re down for paying the cancellation fee, we can do it, I’ll just cancel the antenna return on Amazon. 🙂

Mr. PIE

July 13, 2016Hey, it is now known as SSC therapy- curing your general problems one post at a time. Marital, social, financial, you name it. This blog has answers to them all. ??

Mr SSC

July 14, 2016That’s a good name, SSC therapy. 🙂 Have any issues – put them in the comments and we’ll let others hash it out for you! Hahahaha

Mrs. PIE

July 13, 2016There’s nothing wrong with that! all communication is good communication. And who knows, without cable there is potential for full conversations! ??

Mr SSC

July 14, 2016Full conversations?! Whoa, whoa, whoa…. that sounds a little scary! 🙂 Maybe if we start with a short, “how was your day, dear?” type conversation and ease into these “full” conversations you’re talking about. 😉

Our Next Life

July 13, 2016Glad you guys activated the umbrella insurance! Let’s hope you never need it, but we sure are glad to have ours… especially since we’re always slandering people left and right on the blog. Haha… jk. Also, seeing you guys converse on your own blog totally made my day. 🙂 Whether you cut the cord now or cut it later, you’ll be glad you did.

Good luck getting lots of students in class, Prof SSC, so you don’t have more unexpected pay cuts. But I have total faith that you guys will figure it out one way or another!

Mr SSC

July 14, 2016I mainly thought we’d need it for the slander/liable lawsuits that will eventually start coming our way. Did I mention I was partnering with TMZ to get some more traffic on here and generate some mad revenue? That’s our new side hustle to supplement Mrs. SSC’s income loss! Yeah, Celebrity scoops, paperazzi “snoop” shots, and lots of ridiculous claims (i.e. clickbait) to drive up our traffic. Come to think of it, that would make for a great April Fool’s Day post. 🙂

One way or another we’ll definitely get it figured out, even if we don’t have to go the TMZ partnership route. 🙂

Mrs Groovy

July 14, 2016Very smart of you to switch to Energy Ogre. I knew I liked TX for a reason. Our electricity is from a coop and it’s cheaper than other companies we’ve been with. But there’s no choice involved. It’s all just based on your address. We’re on an equal pay system of $123/month which may seem high. But considering we both work from a 2-story house and we’re home A LOT, it’s not bad. We’re mindful, but not strict with the A/C. Good luck with the cable co. That’s one good thing about a Time-Warner – no contract and go right into a retail store to cancel. No questions asked.

Mr SSC

July 14, 2016It’s amazing all of the options that are out there for energy. If you want it all to come from renewable sources you can do that, if you want nights and weekends free, you can find those plans. That alone is the reason I think paying $10/mo to let someone else shop it around for me is worth it. I spent WAY too many hrs reviewing each of the plans I liked and comparing to see if we could really benefit more from one or the other. Death by analysis, or over analysis, lol.

I’ve always been in your situation where you get to the house and find out who your provider is and that’s who you get. No choice or anything in the matter.

As far as cable, we have 3 choices at our address, Att, Direct TV, and Entouch, which is actually only 2 choices now that ATT and Direct TV have merged. At some point in the future it won’t matter because we won’t have any of them to deal with. I like the no contract deal – it’s like if you provide a good product, why do you need to lock someone into it and not let them have the free will to go somewhere else if you don’t meet their expectation? If only more companies followed that model, maybe their service would improve. 🙂

Dividends Down Under

July 15, 2016I don’t know energy ogre, but congrats on making the change and that it’s working out better for you 🙂

June was an expensive and big month for us, but for good reasons (pre-paid for 3 years of self hosting on Bluehost for the blog ). We also signed me up to start some further education, what a month.

Tristan

Mr SSC

July 15, 2016We thought we had done the 3 yr pre-pay and then on our 1 year anniversary we got a renewal and realized Mrs. SSC must have thought I wouldn’t stick to it for 3 years, lol.

Good luck with furthering your education, that can entail some big expenses but usually has a good payoff.

David @ Thinking Thrifty

July 18, 2016June saw me ticking along nicely. Although, I have since had bad news at work and could well face redundancy within the next 6 months, I certainly need to up my hustle and save a lot more than I am managing at the moment just in case!

Mr. SSC

July 27, 2016Oohhhh that sucks about the redundancy. Hopefully you’re in a field with an easily transferable job and the whole industry isn’t in a downturn.

Glad June was good for you and extra savings in case of layoff is a good idea. We did that when we were in that boat.

Prudence Debtfree

July 20, 2016All the best with life on one income! Is Mrs. SSC getting her courses ready? Or is she allowing herself some kick-back time? That first year of teaching is filled with learning curves that can take a surprising amount of time and stress. It gets much, MUCH better after that first year. From here to October, I’m sure you’ll manage brilliantly on your income. You’ve got your padding already in place. Smart!

Mr. SSC

July 27, 2016Thanks! She’s creating her courses and labs as we speak, no downtime this summer! She was hoping to get to teach at least 1 prebuilt course but alas, not fall semester anyway.

She’s looking forward to next summer when she will only be working toward tweaks and getting to relax with the kids more.

Our layoff padding is still in cash, so instead of investing that right now, we’ll just dip into it if needed. Hopefully not needed but at least it’s there. ?