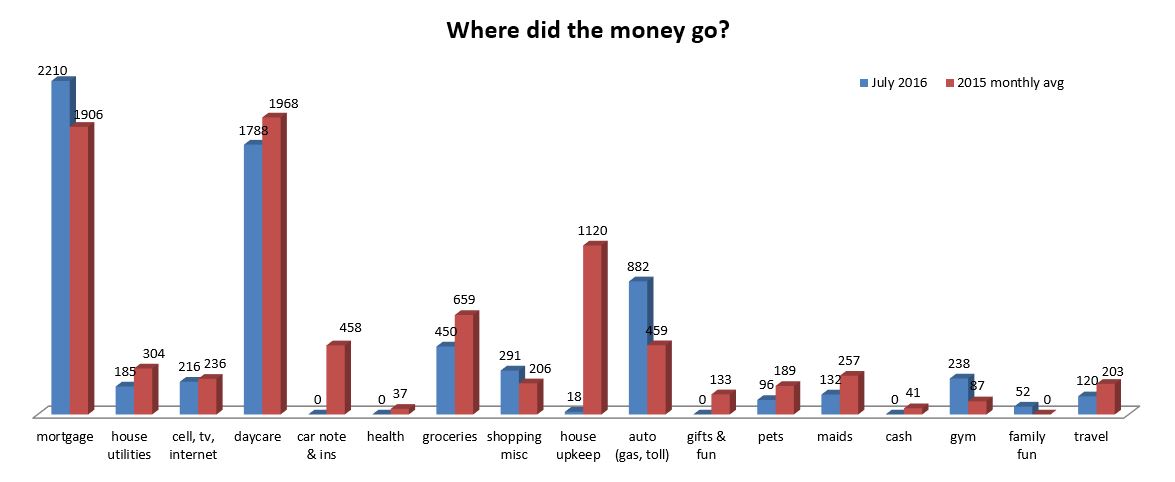

Our money went where? July 2016 Update

Let’s talk about the “positives” first!

It was a great month for investments, right?! Those were up over 4%, woohoo!! We’ll just assume this trend will keep going for eternity… Kidding, clearly, I’m kidding.

It was a good month for groceries, and that was even having fellow blogger Nick over at The Money Mine and his wife over for a cookout. It was great meeting them and getting to hang out in person!

Utilties are down, cell/tv/internet is lower and next month should be even lower than that. I renegotiated our Direct TV bill to our “discount days” which lowered it almost $50/ month, and it will stay that way for 2 years, allegedly. I also ditched ATT for internet and went with Entouch, where we are now getting 3x the download speed for $10 less per month. So far, that’s a Win too!

Car note and insurance – since we paid off the remainder of Mrs. SSC’s car, and only pay insurance every 6 months, this is a nice breath of fresh air. It’s like money going back into our account.

The house upkeep is low this month, with the only purchase being a new mower blade. Good bye old worn out blade!

Daycare is lower and will be even lower in August as our oldest begins free public school! Yeah free! We’ll still have some after school care costs, but they’ll be significantly lower than full time daycare.

Also, Pets and maids are in the lower than usual category.

An even nicer positive is that we got a windfall from my work as well. One of my incentives paid out this month adding about $4k bring home to the kitty and $6k of stock. Yeah free money/stock!

Now, for the not so positive items!

Auto category jumps out as negative, when this is actually a great win! Mrs. SSC had to pay $725 for her yearly parking pass on campus. I know right?! That’s frigging expensive! BUT, if you take the $725 out of the $882, then we’re actually at ~$160 on gas and tolls down from our usual $460 monthly avg. from last year. That’s a BIG drop! Yes, it will go up some when the school year starts and Mrs. SSC is driving more, but I’ll enjoy the lower costs while they’re around.

Gym is another category with a big jump. We got a family plan membership since Mrs. SSC is no longer able to go to her corporate gym. My work subsidizes a small part of it, but I have until next January to apply for that. The way oil prices are going, I think I’ll start submitting them monthly, so when that perk gets axed, I can at least be caught up, lol. Also, swim lessons bumped it up $100/month for both of the kids to take lessons. Our oldest can now swim about 20’ and tread water, so that’s a great win there!

Mortgage is up, but that’s for house taxes, when we had to pay an attorney $304 to lower our tax bill. They lowered it $612 and we pay them half. Our stupid neighbors don’t contest the 10% increases in home valuations thinking it means their house is worth more. Ugh… This year we had to go around and take pictures of things that would drive our price down to help with the lowering of the cost. Stupid taxes…. Next year we’ll just fight it ourselves and see how that goes.

Back to school supplies cost a little bit between clothes, shoes, and the weirdo list of supplies they have for a kindergartener. That kid is growing like a weed and can’t seem to stay in a pair of shoes very long. We (well, mostly Mrs. SSC) saved a lot of coin on the supply list though by shopping around.

FFLC (Fully Funded Lifestyle Change) UPDATE

All this points to a year of projected spending around $47000, again, barring any financial boondoggle left to jump out and get us this year. If you want to give it a whirl and see what you may need for your FIRE plans, here’s a link to our spreadsheet that you can use.

We are also getting ever closer to our FFLC/FIRE goal as we’re now at 89% of the way there!

Fingers crossed that the economy doesn’t tank, war ensues, and/or the stock market gets wiped out. Always a ray of sunshine around here!

Well, that was our July.

Hopefully yours was also more positive than negative!

The Green Swan

August 2, 2016Thanks for the update!

We get our little one in swim lessons occasionally too. We just took him out for the summer thinking we will be swimming with him regularly in the weekend at our neighborhood pool and get him enrolled again in the fall. It’s expensive, but it’s a great activity for him and he loves it. Plus my wife was a swimmer and my parents live on a lake so teaching him young will come in handy.

Mr SSC

August 3, 2016I was a swimmer growing up, and with the heat and amount of time we spend at the pools we have in the neighborhood, we figured it would be a good investment. He was doing well at the end of last year, but you can’t be too careful right? 🙂

Mr Crazy Kicks

August 2, 2016Nice move on getting your taxes lowered. I’d be interested on how you plan to do it yourself next time.

Mr SSC

August 3, 2016Essentially, in Texas they can raise it by ~10% each year which can get out of hand pretty quickly. So we’ve gone the route of a tax agent handling it for us and we pay half of what they save us.

To do it solo, you have to fill out forms and request it to be lowered, then you can try their online solution which may not lower it as much as in person, but you don’t have to go to a hearing. If you get denied there, you go to an informal hearing and present your case.

It seems really hit or miss regarding if it actually gets lowered, but if you can spare the time, why not try it that route. We’ve only had it lowered 2 out of 3 years going with the agent.

Tracy

August 2, 2016Yes, please do talk more on having your property taxes lowered. That is something I know nothing about…

Mr SSC

August 3, 2016From what I’ve found online for Texas, it is like this. I may put out a short’ish post about it from some helpful links I’ve found detailing ways to help increase your chances of winning. But it seems very subjective to the panel members moods that hear your case.

Essentially, in Texas they can raise property taxes/valuation by ~10% each year which can get out of hand pretty quickly. So we’ve gone the route of a tax agent handling it for us and we pay half of what they save us.

To do it solo, you have to fill out forms and request it to be lowered, then you can try their online appeal which may not lower it as much as in person, but you don’t have to go to a hearing. If you get denied there, you go to an informal hearing and present your case. Possibly a formal hearing after that as well. So it does take time.

It seems really hit or miss regarding if it actually gets lowered, but if you can spare the time, why not try it that route. We’ve only had it lowered 2 out of 3 years going with the agent.

Amber tree

August 2, 2016You can see the joy on the faces of the creatures when they see the FFLC reach 89 pct! That is awsome progress.

And meeting up with other bloggers for a cookout sounds great fun! We metup with a dozen of them and had a good weekend.

Mr SSC

August 3, 2016Thanks! It’s nice seeing it getting so close!

Meeting up with other bloggers has been fun, and freeing with a part of your “secret identity” is being revealed. 🙂

Hopefully we’ll get to meet up with the folks from Ditching the Grind for lunch today as they pass through Houston.

Brian @ debt discipline

August 2, 2016Looks like a good month. Congrats on reaching 89% of your FFLC goal! Nicely done! I’v always considered looking into lowering my house tax bill, just not sure how to go about it. It’s something I need to investigate more. My bill is too high.

Mr SSC

August 3, 2016Thanks! Here, protesting your tax bill is made fairly simply. On our neighborhood general communications page, every year there is a thread of “How do I protest my tax bill” and then at least a dozen people posting links to websites and forums and saying, I did it myself, saved money, and it’s easy! We’ve just taken the easier “pay someone” to do it route previously.

Next year, we may try and fight it ourselves, but you can always start with googling “How do I lower my home tax valuation in Blah state/county?” I found a lot of good resources for our county that way.

Our Next Life

August 2, 2016At least with the taxes, you can soon take comfort in knowing that they are paying for that FREE public school. 🙂 Seems like it was a good month overall for you guys — curious to see how things shift as you adjust to the new paradigm of Prof SSC’s lower paying but more positive job. July was great for us — we saved a ton and the markets gave us a huge tailwind… not convinced the market gains will stick, but the charts sure are pretty at the moment! 🙂

Mr SSC

August 3, 2016Seriously, it’s never “free” anything, but at least it’s not a $12-$14k/yr tuition on top of still paying for that “free” school. 🙂 Our plan is working!

It’s nice looking at the growth recently in the investment realm, but yeah, like oil prices, I’m curious when the peak is going to hit and they slide back down again, like most of this year, and last year…

Prof SSC’s paycut will cause some adjustments with our spending, but I think she’s already worked out a good plan for that and how it will be affected. Of course she did this prior to even accepting the Prof job, since she’s just like that.

In reality, we can still most likely make minor to no spending adjustments and still save ~$3k/month once her pay starts up again. Down from what it was but still nothing to dismiss and our timeline still remains at mid 2018 with that plan. Yet another reason we were glad we had been saving so heavily prior to this event!

Dividends Down Under

August 2, 2016That’s awesome that you’re nearly 9/10ths the way there! Awesome job reducing several of your expense categories down – in a world where things are often increasing in price that is impressive. I understand the need for the gym, as long as you guys use it (easier said than done for some) it will be worth the extra cost!

Tristan

Mr SSC

August 3, 2016Thanks! Mrs. SSC worked out the “payout” on the gym usage, and it looks to be worth it so far. I like having a cold water lap lane and that’s been great for some cross training, plus I forgot how much I liked swimming. Even though I’ve never been much of a gym rat, even I have been using it 1-2 times a week. With Mrs. SSC’s using it 3-5 times a week working out it seems to be getting used. It will get revisited next year when it rolls around since it could taper off, but we’ll see.

Mr. PIE

August 2, 2016We were all happy campers in July with market help. Even Vanguard energy sector fund VENAX only lost 6% last month.

Are you still all set with football viewing come September?

Nice progress on goals and your continued efforts on savings trimming !!

Mr SSC

August 3, 2016So far, I’m golden with football viewing for the fall, it will just be finding time. 🙂 Until next year when I can cancel the contract with Direct TV, then I get to try the over the air viewing stuff again.

We’ll cross that bridge when we get there and until then, I’ll appreciate one more year of unfettered football access!

Prudence Debtfree

August 2, 201689% of the way there sounds mighty good! I’m so glad you’re giving your kids swimming lessons. Some things are definitely worth the cost. Good job on being proactive to lower some of your expenses. I tend to think about those things but not do them. It all adds up.

Mr SSC

August 3, 2016With the amount of time spent in and around pools we figure it’s definitely worth it. They were getting there just working with us, but having a “real” teacher and schedule for it has improved our oldest’s ability by leaps and bounds!

We’re about at the point where our expenses will bottom out and not get lowered anymore, and that’s fine. Yes, we can cut the cleaning service once a month visit, and Direct TV will save about $60/mo but it’s kind of getting to a diminishing returns point on any further cuts.

We’ll just keep monitoring things and try to keep our spending at the level it is and go from there. Like you said, it all adds up!

Hannah

August 3, 2016You guys are doing great! That lower daycare bill is seriously amazing- last month we never paid for childcare (we did get some free babysitting for a date), but I can’t believe how inexpensive life is without the bill.

Mr SSC

August 4, 2016Thanks! It feels the same with the car payment being gone too. It’s like, yes it was zero % interest but it is nice all of a sudden not having a recurring expense going out the door every month. Although, it just gets rolled into savings or wherever it is needed, but again, it’s nice having that money freed up.

I’m excited for a few weeks from now when daycare goes from two full time to a much lower 1 full time and 1 after school care situation. 🙂

Edifi

August 4, 2016With the wife transitioning through a break and a different job with different hours/commute/balance, have you been able to gauge any “hidden” costs of employment. Any idea how much still being employed (vs. taking a sabbatical in between) helped in securing the new position?

Mr SSC

August 9, 2016The main hidden costs with her new job have been her parking pass for campus ~$700 for the year, and a small laptop she can use to take back and forth to class and run her lectures from ~$300. Beyond that, even when she starts commuting it will be less than before as she will be on campus fewer days.

I think being employed while searching helped. One of the specific things they were asking about was, “Are you going to get laid off?” Maybe they are afraid of getting someone to use that position through the downturn and then jump ship when the industry picks up. She explained very well that, no she wasn’t getting laid off but this was more of a career transition that she had passed up to go into the industry. Now she wants to explore teaching again.

Mrs Groovy

August 4, 2016Good stuff happening over there at your house! I’d like to know more about Entouch. Three times the speed for less?That’s pretty dang good in my book. Is that a local provider?

I’m glad you got to meet a fellow blogger. It sounds like a lot of fun.

Mr SSC

August 9, 2016Yep, Entouch is a local provider but man, their rates and prices are unbelieveable. ATT was $60/mo for 18 mbs/sec download and their plan was 40 mbs/sec download for ~$50/mo. That was month to month no contract even!So, they had a special where if you wanted to sign a contract for a year, you could get 115 mbs/sec for the same price $50/mo. At the end of the year, feel free to throttle it back and reduce the speed and price, or keep that speed for $65/mo or change to something else.

Meeting the fellow bloggers has been fun, definitely.

The Jolly Ledger

August 8, 201689% of the way there! That has to feel sooooo good. Also the decrease in daycare costs is going to accelerate the savings I hope!. Good luck to Prof SSC as she begins her new career!

Mr SSC

August 9, 2016Thanks! While the decrease in daycare is nice, it doesn’t buffer the 6 figure income loss with the new job. BUT, I wouldn’t change a thing because the lowered stress and increased happiness with the family life these last few months has been awesome!

Evan

August 8, 2016I challenge taxes for some clients it is ridiculously easy in most places. It is crazy that some people don’t bother to do it…in most places in the country it is crazy how property taxes are handled. Such a scam.

Mr SSC

August 9, 2016That’s the main reason we were thinking of doing it ourselves, it just seems so easy and arbitrary as to whether they get raised or not.

TheMoneyMine

August 8, 2016What’s expensive in the groceries category is the guacamole! 🙂

Our numbers for July look very good on our side too. July is the month we receive our discounted stocks purchases, this time at the price it was in Jan. That was a roughly 25% discount this time, enough to be worth an entire month of savings by itself.

On the gym membership, I can only tell you to use it while you have it. Ours were cut end of last year, so no free gym for us this year.

89% through to FIRE is awesome, this is exciting! How many more months do you think are left?

Mr SSC

August 9, 2016That fresh made guacamole really adds up if you’re not careful! 🙂

I had heard that our gym subsidy was going to be cut, as late as last November, and yet, the submission form and page and links are all still active, so I submitted last month’s yesterday. 🙂 I still expect it to go away at any point, but even if it does, we use it enough for it to “pay out” as far as we’re concerned. I have really been enjoying swimming again and forgto what a great all around exercise that it is.

As far as getting to 100%, I think with the drastic reduction in our savings due to the lowered income with mrs. SSC’s new job, we’re probably still looking at summer 2018. Things could swing one way or another and bumpr that up a little earlier, but I’ll still work until at least July 2018 to get my company’s incentive program payout then. So even if we hit our number before then, it would be follish to leave that money on the table. Dang golden handcuffs! 🙂