May 2016: Our money went where? It went Bye Bye!

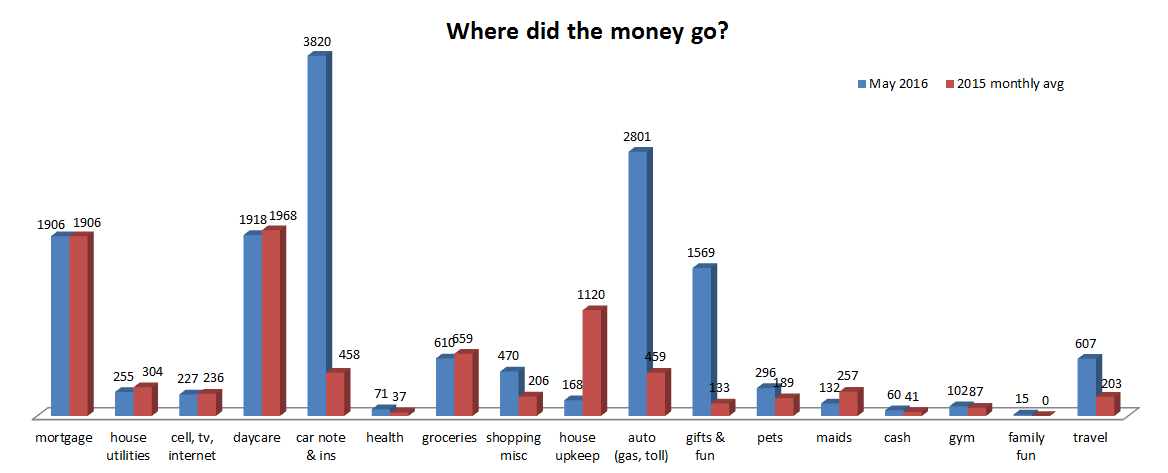

Daycare – We did get a week free for vacation, but it was a 5 Monday month, which wiped that out, plus $100 for next years’ registration for our youngest, and $30 registration for our oldest over the summer.

Our water bill was $20 higher than usual, running the sprinkler again occasionally, or at least until the deluges began…

Maids dropped by 50% as we now only have a monthly deep-cleaning visit. Because, yes we are spoiled.

Pets were ~$200 more because of the yearly visit and vaccinations for one dog.

House – $167.55 is about on par with yearly average – nothing special here.

Family fun – $15 to celebrate #2 being daytime potty trained – yeah almost done with diapers!!

Travel – We spent about $600 wich was spread across the dog sitter, several restaurants, museum admission, extra gas, and the like.

Shopping – $288, whereas usually we are below $200. Bought Dutch Oven ($65) to make bread, new books for our oldest, and other minutia that adds up…

Shockingly, groceries were only $610 even with pricey beach groceries and buying special and additional food for our youngest. She’s been dealing with hives recently, and we’re stumped as to what is causing them. We’ve removed dairy, eggs, red food dye, and some other things from her diet, but that caused us to replace a lot of food we previously had bought. The dye is because she had a bad outbreak after eating a pink cupcake and we thought, ah-ha! since that dye seems to be pervasive in a LOT of foods. We haven’t hit a point yet to start reintroducing foods, and still can’t see a pattern on when hives occur and foods eaten. Poor kid…

Now to the big hitter items, the ones that rocked the budget, Yeah!!

Cars – Remember 6 months or more ago when Mrs. SSC did the analysis on downgrading her car and it didn’t pay out to do it? Well, Mr. SSC had just gotten his car repaired to fix an alignment issue, when the dealer was pointing out all these expensive little things to recommend getting fixed. I went to the dealer due to the warranty aspect, but of course nothing was a “warranty” item. However, he did remind me that our car, a Hyundai Genesis did cost more to own than other cars, ~$0.95/mile according to Edmunds. This was our last big purchase that had the mindset – “whatever, we can afford it”, but now, I don’t want to afford it, plus, after getting rear ended twice, once with major repairs, my car can’t hold an alignment for more than a few weeks and it is trying to eat my “new” $600 tires, gah!!! Before we spend a lot of coin getting that bug worked out, I thought about looking to see if I could downgrade to a used, low mile, good mpg, reliable, commuter car. With my analysis, and projected 5 year repair costs along with better mpg ratings, I had a slim margin to still make it worth trading. Effectively, I could be saving about $750/year in gas, and about $150 in insurance, and the rest is just projected maintenance costs.

Most used cars in that range were still outside what we could spend and still come out ahead, until I noticed the $4900 in incentives that VW was offering for their new Jettas. I’ve always liked them, so I ran the numbers and sure enough, that fit our plan and was only $2000 higher than their used Jettas. Over Memorial Day, they added another $1k in incentives and when I looked into it I could be out the door, TTL included with only $2200 out of pocket. Since the 2015 and 2014 low mileage used cars were within $1k of that $5900 lower incentivized price, I went with the new 2016 Jetta TSi. It has none of the bells and whistles of my old car, except for a backup camera, but I have been loving it. It’s a straight up commuter car that fits the kids, is fun to drive and our budget will get a little breather since the mpg should be around 30-32 mpg daily, maybe higher, versus the 19-20 mpg I was getting in my Hyundai. Also, the insurance went down $140 per year, so that fit my projection.

When I got home from picking it up Mrs. SSC said, “By the way, I went ahead and paid off the note on my car. Since I won’t be getting checks deposited to that credit union, I didn’t want to deal with changing that all online, so I just paid it off.” So, no more $309 payment or whatever it was per month, but that was the other “unexpected” ~$3500 car cost. Mrs. SSC also got her car registered and inspected ~$150, and my $250 in repairs didn’t help this category this month. But, we now again, own both of our vehicles and are down to just having home debt, so yeah for little wins?

Gifts – The last big expense of the month. ~$1400 for swing set/playhouse for the little ones birthday/Christmas and next birthday, lol, and this includes a setup fee. Yes, ONL, I was thinking about your post of being frugal vs. hiring someone when we chose the setup by someone else. We read the online reviews that said it took a solid 10-12 hrs or 2-3 8 hr days with 1-2 people to get it completely set up. We decided that we would pay someone to do that, because, I won’t be spending a weekend getting frustrated putting together a nice playhouse/swingset and it will actually get done before the weekend is over, Yeah! There were also Mothers’ Day, Grandpas birthday, and end of the year gifts for teachers that added to our larger expenditures in that category.

As for our savings – well, it was just 401k this month since the extra money went to cars and swing set. Only $953 left over in the black, but that’s still better than in the red haha! We should get a nice boost next month since Mrs. SSC will have ~3 weeks’ vacation time paid out, but then we start no paychecks for her until October 1st. Yipe! We are hoping once life stabilizes this fall and I start getting paid again, that we should still be able to save an extra $3000/ month.

Looking at our savings we are 84% of the way to our goal! If the market can maintain a 3%/year return we should be able to hit our goal mid-2018, hooray! Of course, if Mrs. SSC likes her new job, she may try to spend an extra year in Houston, even if Mr. SSC quits the summer of 2018. This is mostly because everyone says the 3rd year of teaching courses is always the easiest – because you have the material and you have mostly perfected it the last couple years. It’s hard to tell what we will be doing the Fall of 2018, but in any case, I am sure it will feel good to know we are FI, even if we are not FIRE. Mr. SSC side note, I really want to be doing more fishing and not working…

How was your month? Any big loans paid down, big purchases made, or anything pop up you weren’t necessarily expecting? Let us know!

The Green Swan

June 1, 2016Those were some big hitters this month! Glad you still kept it in the black.

Mr SSC

June 2, 2016Yeah, but as some pointed out, paying debt shouldn’t be a line item so maybe not as bad as we thought? 🙂 I’ll take in the black any month though!

Fervent Finance

June 1, 2016Being an accountant, I wouldn’t consider paying down debt and expense – so you really had a better month than you let on! 🙂 That play set sounds like a blast for the kiddos.

Mr SSC

June 2, 2016We’ll have to post some pics when it gets put up, but we haven’t told them yet, just to leave it as more of a surprise. 🙂

Mrs. SSC’s take on the car note was that it is an ongoing expense, so paying it off relieved us of that, but kept that $3800 or whatever it was from going into savings so it’s an expense, lol. Eyeroll….

Maggie @ Northern Expenditure

June 1, 2016May wasn’t great for us either (on our savings), but we didn’t walk away from it with a new car! I think you probably got the better deal! 🙂

Mr SSC

June 2, 2016And so far I’ve commuted a week and a half on one tank of gas, and it’s even a smaller tank. Usually, I can get through most of a week on an 17.7 gallon tank…

Besides being more fun to drive, I think we’ll free up some gas money each month at the very least, it should hit my projected number, but it could be a bit more. Yeah!

Elephant Eater

June 1, 2016Congrats in advance for getting another out of diapers. That is huge for the finances, environmental impact and just a generally less grossness in your life (though with kids there is still plenty of that)! Having taken the opposite approach and set up a swing/playset for ours, you made the right decision. The engineering of those things is pretty simple, but the engineering of how to break them down into the greatest number of possible pieces to stuff it into the smallest box with no space for any air pockets is an engineering feat up there with putting a man on the moon. It took us every bit of two full weekend days to get ours together.

Have a good June and hope you can get it all back on track.

Mr SSC

June 2, 2016Thanks! We read a lot of reviews and the consensus was that it would take me about what you took to put it together, and I realized we should just suck it up, pay for it and have it done. Glad I made that call.

We’ll be back on track after this month, because, well, Mrs. SSC won’t get a paycheck until October after this week ends, so… Yeah, kind of a forced return to normalcy, lol.

Alexander @ Cash Flow Diaries

June 1, 2016Sorry to hear about the additional expenses. Those vehicles always have expenses at the worst time. I had a bad month too for expenses in May but it was mainly because of wedding costs. Im hoping to bounce back here in June and try and make it a positive month.

Mr SSC

June 2, 2016Wedding costs can be a killer! We have a destination wedding next year that could add in a big chunk of costs. Maybe we should lok into doing some airline travel hacking and get those covered early on!

Good luck in June getting back on track!

Our Next Life

June 1, 2016Given how many hours it would take, I think the setup fee is money well spent! I’m super glad we hired out our lingering issues, and have completely absolved myself of any guilt. 🙂 Your car numbers make total sense to me, too. When we bought our Subaru Outback, we ended up going new for similar reasons. Old ones retain so much value that we would have saved like $1000 to get a used car with 50,000 miles on it. Um, no thanks. So high five for breaking the frugal rules on both of those! 😉

Good luck making the leap into lower pay land! But it sounds like you guys totally have this, and will still hit FIRE on a quick timeline.

Mr SSC

June 2, 2016Isn’t being guilt free a great feeling? 🙂 I realized the same with the cars, that for the price range I was constrained to to make the numbers stay positive, used Jettas in that range already ahd about a years worth of miles on them (for my driving) and for $2k more, I could get that year’s worth of miles back, and know it wasn’t abused during that time. 🙂 Peace of mind is a wonderul thing. Also knowing that they hold their value and the incentives effectively wiped out a lot of the initial depreciation, well, like you said, it was a pretty easy call to make.

Thanks, the transition should be easy, just a “forced” keep doing what we’re doing sort of thing. At least it really isn’t changing our timeline, plus it could be setting us up for an even more epic FIRE or at least more comfort in knowing we’re not walking the tightrope financially until we’re 60, mwahahahaha

Tawcan

June 1, 2016Totally makes sense when you crunch out the numbers on your car. Hitting your goal by mid-2018 would be pretty awesome!

Mr SSC

June 2, 2016I know, lots of fun stuff this month even with expenditures being high. The car numbers only make sense, if I constrained myself to a certain price range. When I evaluated a used mazda 3 hatchback – my true prefered car, it was about negative $2k over 4 years, so that went out the window. I kept it strictly financial, and fortunately I love VW, and they fit perfectly in that constraint I had. 🙂

I’m also looking forward to 2018, that rocks, it seems so close!

Mrs. PIE

June 1, 2016I’d agree that paying down debt shouldn’t be a ‘budget’ line item. It affects cash flow, sure, but overall it balances out over the long term and even saves interest.

Happy to read your analysis of car choices. We’ve not assessed a car purchase by cost to run and that’s something we will have to do going forward. Don’t get me wrong, we don’t have crazy cars, just a Subaru and a jeep, but both purchased without ongoing costs in mind. Also interested to hear about the small difference in buying new and used for cars that hold their value. Lots of food for thought. Thanks!

Mr SSC

June 2, 2016Well, the loan was zero percent interest, and Mrs. SSC’s point was that without paying it down it would be $309 or whatever per month for another year and change which is an expense. More importantly to her, it was $$ that didn’t get saved, which she automatically buckets as “expense”… Seriously. 🙂

We didn’t think about the ongoing cost until after we’d gotten the Hyundai and realized it was twice the true cost to own per mile than our previous cars. At that point, we didn’t care because we could afford it, blah, blah, blah, and it wasn’t that big of a deal. Now we care, or at least I do. Mrs. SSC was in the “keep it profitable” and I can do it if i want camp. 🙂 I’ve been having fun with the new car and it feels so much more nimble in traffic and overall fun to drive even if it is a very plain Jane on the amenities side. I like basic. 🙂

One more thought on costs going forward, I had a hyundai accent, and a VW fox back in the day and could get 4 new tires for them under $150. I got an Explorer and it was 4 new tires for $350 and that was waiting for a big sale to come around. My Hyundai cost almost $660 for 4 new tires and they weren’t even premium ones, whereas my new car I’m back in the “under $200” range to replace all 4. It’s the little stuff like that that can make a difference over time. Air filters cost more for the Hyundai, everything cost more, it was ridiculous…

The Jolly Ledger

June 2, 2016We did the same with our 0% interest car loan. Paying it off and getting it off the books sure felt good. Now I don’t even think have to think about loans. Once the car depreciates enough, I will also cut the insurance down to liability only to save around $400 per year.

Mr SSC

June 3, 2016Yeah, it will be nice not to have that $300 whatever it is each month showing up. 🙂 I just found it funny that I came back from paying $2200 for my car deal, and she was non-chalant, out of the blue “Oh, I paid off my car loan” lol. No biggie, but it just struck me funny.

Laurie @thefrugalfarmer

June 2, 2016Look into corn and corn-related stuff for your kid’s allergies. Our son struggled with food “intolerances” (they weren’t bad enough to be called allergies, apparently) and we “narrowed” it down to: 1. anything with corn (high fructose corn syrup included), anything with MSG (google this: there are a zillion other ingredients that contain some form of MSG). Once we took away those things he was fine, and eventually grew out of the allergies. Our chiropractor told us that his body was actually doing what it was supposed to do: reject this pseudo-food. But eventually his body got used to it as we gave it to him in super small doses and his body takes pseudo-food pretty well now. Although I’m not so sure this is a good thing. 🙂 Also: keep Children’s Benadryl on hand at ALL times – allergic reactions can turn serious quickly. Whenever she has a reaction, give it to her (check with the doc first, but this is what we did and I’m SO glad we did.) We had an instance one time where a woman put her “lemonade” (spiked with vodka ) at eye level of her 4-year-old and our 4-year-old (at the noon hour at a picnic) and Sam and the other kid drank some. The corn immediately had him in hives and had his breathing suffering. I had to make a mad dash to the store with him for some children’s Benadryl. It was really scary. After that, I kept some in my purse and in the car always. Still do to this day.

Mr SSC

June 3, 2016Ugh, corn is on our list to try next if these don’t do it, and MSG wasn’t on the radar. Nice one to point out, thanks! We’ve been giving her a dose of Children’s Benadryl once a day, and sometimes she doesn’t need that, but then the next day she will get a little break out again. We’re at the point of reintroducing the things we think aren’t causing it, like milk, dairy, etc.. but will keep corn in mind next. I shake my head thinking about all the stuff we’ve cut out already and I think corn was low on our list, because well, red dye seems like a front runner, but we haven’t been able to reintroduce that one yet just trying to get it to clear her system. Thanks again for the suggestions!

Dr. J @ MedSchool Financial

June 4, 2016The maids doesn’t have to mean spoiled, it can also translate to being efficient. If the cost works out to where the extra time is spent adding value to your lives and fits into the overall financial picture, I think thats great.

Dr. J

Dividendsdownunder

June 7, 2016Ugh, what an expensive month, that sucks! We tried to find the middle of the road for our car, not too new where it costs a lot up front (and/or repayments) but not too old where it needs a lot of repairs. We have a 2007 Mazda 3. We haven’t had any trouble with it since we got it 2 years ago, just an annual checkup for a couple hundred dollars.

Our May was pretty good, our savings rate that we just posted was above 50% for the first time – woo 🙂

Tristan

Kim

June 12, 2016It’s possible your daughter may have a gluten allergy. My daughter has it and had the same symptoms. Ironically, I just found out I have it too.

Mr SSC

June 13, 2016We thought about that, but this weekend, she ahs been hive free, and medicine free since Thursday. She still ahs been eating bread and other foods with gluten, and no response to anything yet. I’m curious to see if it appears again when she is at daycare. That seems to be aprt of the pattern – hive free weekend, then daycare and theys tart flaring again by lunchtime. We get reports on all of her food, snacks, etc.. and they’ve been great with dealing with no red dye. We can’t see any trend other than that one so far. The dr. recommended the elimination of red dye and then reintroduce it after a few days with no hives and see if it triggers it. So if she stays clear today, tonight she gets a sticky red popsicle and we’ll see if anything happens. Thanks for the comment and suggestion. It’s definitely one to think about especially if nothing else shows up.