Layoffs are Looming! Would you be ready?

It’s also no secret that companies have been laying people off left and right. We’ve been fortunate enough to not have to deal with this yet, however, our time has come. Mrs. SSC’s company has been making waves about “re-org’s”, consolidation of departments and the like since February, and it had been rumored there would be layoffs, but it hasn’t been official until the last few weeks. They recently found out that there will be 12-15% staff reductions all across the board, with larger cuts most likely in Mrs. SSC’s group. No one is safe. Being true to their nature as a huge bloated bureaucracy, they plan on releasing little info and dragging the process out into October. Yippee!!

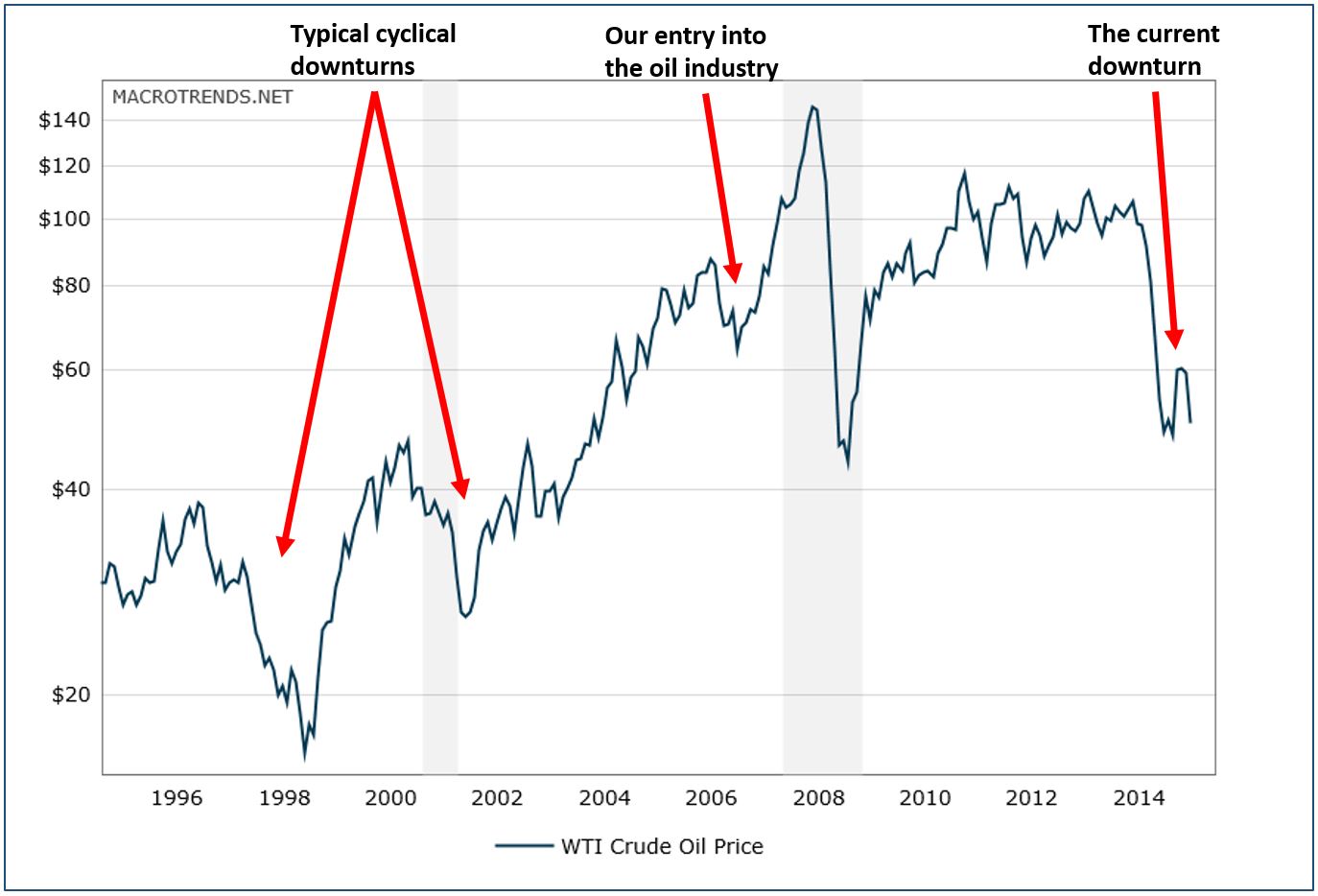

Alternatively, back in March my company announced that we can “keep on, keeping on” indefinitely with oil around $50-$60 a barrel. We did some minor reorganization, stopped our hiring campaign, and put raises on hold. They still paid out bonuses though, which was nice, and my move was well timed, so I already got a nice raise just by moving, so it isn’t too bad.

This week will mark the kickoff of the layoff cycle with a release of some info, possibly blank org charts, websites to see how you will be affected, and the like. Yep, everyone gets to essentially re-apply for their job and compete with others that may also apply for their job. Joy! Being a large company though, some people have gotten more information quicker than others. For instance, on a recent fishing trip a friend of mine told that he knows his boss’s job and likely his job is gone, as his group is going from 21 to 11 people. He’s kind of freaking out, because he’s a sole bread winner for his family, and no-one is currently hiring. However, he has a pretty good savings account, and he and his family live fairly well below their means. While he is worried, he isn’t super worried because they carry almost no debt, just the mortgage, they have a good savings account and emergency fund, and they have an amazing support group available from their church should things get really, really, bad. Another friend of ours who works with Mrs. SSC, recently had his wife get laid off from a different oil and gas company. Since he is now the sole bread winner and also works with Mrs. SSC he is more than a little worried about what could be coming. Again, they live pretty well below their means, and manage to save a decent amount. His job still covers their bills, and they can still save some along with that. So, while they are worried, they are not as worried as some other friends of ours, but no-one wants to be out of work, and have to start tapping into emergency funds and savings while scrounging for a job.

In my new company, I’ve only come across 2 people who mention that they save money outside of their work retirement plans. Two people… One of them is a new hire, and he follows the model of “pay yourself first” and then live off what’s left over. For instance one week, we were going out to lunch (I know, I know) and I invited him and he said he was going to be pretty broke the next 2 weeks because of a miscalculation with transferring funds to a Vanguard account. Apparently, he’d set it up to make a “monthly” transfer and it hit his account twice. Instead of dipping into his savings or other funds, he just shrugged his shoulders and said, “Nope, can’t afford it for the next 2 weeks.” Commendable, because I would’ve just used “other money” and then “rewarded” myself on saving twice as much as I’d planned. Sidenote – I still have bad financial ideas sometimes. The other person has “outside of work” retirement accounts, and a fund for a retirement home rather, a house to live in in retirement already and they’re only in their early 30’s. The rest of the people from our work group looked at us like we had tentacles growing out of our heads when they heard us talking about Vanguard funds, retirement savings, expense ratios, and the like. One person said, “Why are you talking about retirement, that’s like forever away!”

That leads to conversations of other people we know that are not in the same boat. Specifically, a couple that makes two oil industry salaries and are freaking out about layoffs, because they still live paycheck to paycheck with little to no savings, much less emergency fund savings. Yes, you did read that correctly. This couple, in their 30’s with children, still gets occasional help out from their parents with bills and vacations. They like extravagant vacations, and they take them as often as possible. In between vacations, their spending habits aren’t reigned in well either, because that’s just the lifestyle they are used to. They know they should be saving more, or any really, but between little things here and there, and kid functions, and birthday parties, and groceries, they just don’t manage their funds well. They are really worried, because with a layoff from just one of them, their house of cards could easily crash down. They’re taking the ostrich head in the sand, fingers crossed approach and hoping for the best.

This attitude and lifestyle of spend, spend, spend rings true with more colleagues of ours than you might think, hell it’s probably not much different in your industry either. For the occasional person that may be thinking about retirement early, or retirement at all, everyone else is thinking about more ways to spend their paychecks. It’s just mind boggling to me that people don’t save more. I have to say though, if I was still single and hadn’t met Mrs. SSC, I’d think I was doing alright maxing out my 401k, and having my debts paid down. If I was diligent enough to actually have them paid down, which is doubtful. Even then, I would probably still be only a few paychecks away from disaster. It was living with Mrs. SSC that got me to realize how to break that spend, spend, spend cycle and start focusing on investing, saving money, and paying off debt.

As the weeks move on, things will be pretty stressful around here. Maybe we’ll luck out and Mrs. SSC will get to retain a spot on the payroll. Maybe she’ll get laid off, and get to figure out what to do next? I know we’ve already figured out exactly how it will affect our FFLC date, and our savings though. Since this post has already gotten so long, I’ll go into that in detail next week with part two of this crazy adventure! Yeah, layoffs!!

Source: Macrotrends, Inc.

Tawcan

July 28, 2015Uneasy times, hopefully Mrs SSC will retain her spot and pay. On the other hand, you guys are well on your way to FI and maybe this could be a good change for you guys.

The economy is still very volatile, interesting times for sure.

Mr SSC

July 29, 2015We hope so, but man are they dragging it out and releasing little info. It could turn out fine though, so we’ll just wait and see.

Fervent Finance

July 28, 2015You guys have put yourself in a great situation to not really have to worry about this! Although it is still stressful, it is not make or break! Maybe if she gets laid off and doesn’t find another comparable job for 6 months, at least you’ll lose the child care costs! Although you may not have F-YOU money yet, you put yourself in a good position not to stress like others.

While I am no where near FI (about 10 years away), I could still pivot quite well from a layoff. Mainly because I’m single and rent though. Being flexible is key! Good luck, I’m rooting for both of you not to get laid off!

Mr SSC

July 29, 2015That’s a great point. We are set up fairly well to weather this, even without a comfortable F-You money stash.

Flexibility however this shakes out is key, as we’re not sure she would even go back to O&G if she does get laid off.

Mark@BareBudgetGuy

July 28, 2015That’s a crazy situation to be in! I was laid off in 2008 not too long after graduating, but it was out of the blue. I can’t imagine being told about upcoming layoffs and having to wonder.

Mr SSC

July 29, 2015It’s stressful, but then again, since it’s out of her hands, there’s not much to do but sit and wait. Keep working of course, but there isn’t much to do proactively anyway.

Even Steven

July 28, 2015I half picture anyone in the oil industry riding around in big Cadillac’s with steer horns on the front, only to get out in an all white suit and cowboy hat. So I guess it’s not shocking to hear some of the oil industry workers living above their means, although with all that being said I can probably find just as many if not more in the banking industry doing the same thing.

Mr SSC

July 29, 2015If you switch that to big trucks, you’d be closer. I only wear my white suits on days that end in Y, haha! It’s easy to get into the habit of just spending because you can, proably regardless of the industry. It’s definitely a habit we’re lad we got out of sooner than later.

May

July 28, 2015Good luck – I hope everything works out for you. My company is in the middle of restructuring too so things are interesting. I hear people around talk about being broke and then I think – wow what are you going to do if you are out of work? My SO and I faced the possibility of both of us being out of work at the same time back in 2008. We are in different industries and it never occurred to us (stupid perhaps) that we could both be jobless – maybe one of us but both was a real wake up call. Still shudder when I think about it. We are monitoring things closely and saving as much as we can.

Mr SSC

July 29, 2015Thanks, I hope everything goes well with your restructuring too. I would have made the same assumption of not considering both of us out of work if we were in different industries. At least I left that company and got out of the departments that are getting cut the most, so that’s one big fear removed for us. I mean my company could also do layoffs tomorrow, but they’ve been pretty transparent with where we sit financially and what it would take to start doing layoffs, so I feel a little better, but hell, I don’t control the price of oil. I did find that extra savings helped with the peace of mind a little more though.

TheMoneyMine

July 28, 2015I also work in the O&G industry (in Houston) and I went through the exact same situation 6 months ago. About 15% were let go across the board and this was the time my (now) wife and I were getting married (I also wrote a post about it).

Similarly to you, we have done our analysis of how a job loss would affect our finances. We have a solid emergency fund and while this wouldn’t be great to be laid off, it wouldn’t be the end of the world either.

You seem to be in a similar situation. You have an emergency fund. There’s usually not much you can do in these situations, so it is mostly out of your control.

I wish you to weather the downturn as well as we did and focus on what you control : do your best at your job and continue your journey to FI!

Mr SSC

July 29, 2015Yeah we had some friends go through this 6 months ago, and their companies are still cutting, just a lot quieter about it. It’s more of a musical chair re-org, those who get chairs keep paychecks and those who don’t get to leave…

We are set up fairly well for this though, and like you pointed out, it’s totally out of our control, so we aren’t stressing too badly about it, more figuring out how things would shake out in the ripple effect of it.

Glad to hear you weathered the downturn well and I’ll have to stop by and check out some of your posts, looks like good reading!

TheMoneyMine

July 30, 2015If you stop by and you find a post that is indeed good, doesn’t hesitate to leave a comment. If you think it sucks, well, just don’t be too harsh.

But in any case your point of view would be appreciated! 🙂

Mr SSC

July 31, 2015Will do definitely, it’s always nice to find new blogs!

Chef @ Fry The Financial Fish

July 29, 2015Great Post SSC!

First off it is not worth your time to stress about company reorg because it is out of your control- what is important is to focus on the things you can control such as upgrading your resume- staying on top of contacts outside your company via linkedin/or contacts with headhunters in your industry so that if something were to happen you already know about other opportunities outside your company.

Having an emergency fund with min of 6 months of living expenses is very important to make sure you are covered financially- The last thing you want to do is worry about raiding your 401k because you don’t have money set aside. I wouldn’t pay too much attention to your coworkers – there is generally a lot of paranoia around speculation over these sorts of things. Silence is golden- It is best just to focus on your own plan and not broadcast to others that you are prepared. Some people may take it the wrong way if you give them advice.

Chef

Mr SSC

July 30, 2015Thanks Chef!

Yeah we found out her dept. is getting a 30% cut so she’s been working on her resume a bit. Beyond that, we shouldn’t have to raid any savings, and depending on how it plays it out it could be a benefit for us in some way. We are just figuring out how we would proceed and moving forward since it’s entirely out of our control. Good advice!

Chef @ Fry The Financial Fish

August 6, 2015That is one of the big reasons I switched companies early in my career- The company I started out with went through 3 big reorgs and layoffs within a 4 year periods. That kind of turnover is really unhealthy and really adds to the stress in the workplace.

Also it affects my long term career there as everyone is focusing on clinging to their current job rather than planning ahead. I felt that my manager didn’t have my long term interests in mind since she was to busy focusing on doing what’s necessary to keep her job. Keep your chin up and try not to let it affect you too much.

Chef

Mrs. Crackin' the Whip

July 29, 2015I feel for you. A layoff would not be fun. We both want to keep our jobs because of our future plans. But if one of us got laid off; we would be okay and for that I’m grateful.

Mr SSC

July 30, 2015I think we’re in the same boat. Things might get tighter, but we wouldn’t lose the house or any craziness. Yeah, because of future plans, we definitely don’t want to lose her income, but it’s out of our hands at this point.

Our Next Life

July 29, 2015What a stressful time for you guys. Good luck with the layoffs — and just dealing with the stress of it all! It must at least be some comfort to know that you’re in good shape financially to handle it, if it happens. Sometimes I fantasize about getting laid off (well, really, I fantasize about the severance package), but this post put me back in my place, and reminded me to be grateful for my job!

Speaking for my own industry, the spend, spend, spend mentality is the same. My company is based in a high cost of living city, and all of my colleagues are constantly griping about how expensive it is. Well, yeah it’s expensive, if you BUY THAT STUFF. I mostly keep my mouth shut, but have given some bits of advice to colleagues here and there over the years.

The colleagues you mentioned who still get money from their parents are a good reminder that the children of rich people usually end up broke, because when money is in endless supply, they don’t appreciate it or learn how to save it. Love that Warren Buffett is leaving very little to his kids (relatively speaking — we could retire several times over on what they’re each getting), and leaving most to the Gates Foundation.

Good luck!

Mr SSC

July 30, 2015Thanks, it’s tough to not get stressed by it, even though we should be sitting fairly well. We were debating the best strategy for the severance package last night when we found out her dept. was getting cut 30%. This situation made me grateful that I left that company over a year ago, and even more grateful for my job too! It would be totally different if we were both let go at the same time. Yipe!

Haha! I love that, “Yeah it’s expensive, if you buy that stuff!” I feel the same way sometimes.

There was a story of another millionaire/billionaire that left an inheritance to his granddaughters with strings attached like, “you must live a normal lifestyle and you get XX $ amount early. Kids in wedlock = XX $ amount more. Party like Paris Hilton, you lose XX $ amount.” Pretty good setup in that they will be well taken care of as long as they don’t turn into crazy partiers and just blow the money and take it for granted.

Amber Tree

August 2, 2015Your situation must bring indeed some stress. By thinking ahead of what the impact could be, I believe you are now 2 steps ahead of most people. Step 1 is your way of living and the emergency fund you have.

I hope all turns out positive for you and your family

Mr SSC

August 6, 2015Same here! 🙂 We are definitely prepared for it, and no matter how it turns out, there are positives for each scenario. We’ll just have to wait and see.

Mr. Modern Millennial

August 6, 2015SSS,

Turning down lunch with friends because you actually can’t afford it: that’s a pretty focused guy there. I would like to think I would have done the same, but I’m not sure that I would have.

I’m reading this a couple days after your initial post and it looks like oil has gone down further. I hope that everything works out well for your family. I know too well how basic daily living can become stressful when big potential transitions are on the horizon.

Take care,

Dylan

Mr SSC

August 6, 2015Yeah, he’s pretty focused and sticks to his guns regarding spending. I’ve gotta give him credit for that!

Oil is up and down and up and well, I just wait for someone at work to mention it, and don’t follow it closely. We’re just in the “wait and see” mode for the next 8 weeks though. Tick, tock, tick, tock… Hahahaha

OnlyKetchup

August 31, 2015It’s amazing once you realize how most people run their finances. Looking forward to reading the follow up post.

Mr SSC

September 1, 2015Yeah seeing other’s finances is eye opening and makes you realize how many different ways you can live, and what different things get prioritized in different households.

Mrs. FI

October 1, 2015Mr. FI are in a very similar situation where I, too, have a job with an end date. We received the announcement a few months ago stating our business is coming to a close in the near (whatever that means) future. It’s been interesting to see how people react to the imminent demise of their positions depending on their “what if” financial preparations (or lack there of). I’m glad you’re also in the situation where, if Mrs. SCC were to lose her job tomorrow, you would be okay. It’s stressful, but at least you have SOMETHING to fall back on, unlike that 30-something couple you mentioned living paycheck to paycheck 😉

Mr SSC

October 3, 2015Man, sorry to hear that about work. Mrs. SSC tells me that work is a nightmare and has just been getting worse. Fortunately, we’re days away from that being over as we should get word next week. It has ranged a lot of the guys telling their stay at home wives, that they may want/need to start looking for work, to people freaking out because they’re living based on this job’s paycheck and not their spouses lesser paycheck. Even with us, it has been a roller coaster of emotions though. Finding out how it impacts us financially, and then the myriad of scenarios and spreadsheet “realizations” that Mrs. SSC put together helped with the “we’ll be okay” side of it. However, the emotional “you’re done with work” aspect has been harder. Even though she hasn’t been super happy it’s still not a great feeling getting told you weren’t chosen to stay.

It could always be worse though, so I’ll take any little win.