January 2016 Budget Update: It’s retooled!!

This month was ridiculously boring on a budget and spending front! Yeah, I count that as a win!!! Comparing January 2015 to January 2016, we overspent in Jan. 2016 by $55. Most of this was attributed to a new haircut for me, and a set of clippers for cutting our oldest’s hair at home. I went from a longer sort of hairstyle to a shorter more trim style, but I didn’t want to end up like Mrs. SSC and have to get it redone once or twice, so I went to a good stylist to start with. Now that it is cut well, I can resume my usual haircuts at the cheaper places. Cutting our oldest’s hair was actually easier than I expected, and it should get easier the more we do it. Plus, Mrs. SSC decided that now that her short hairstyle is dialed in, she can also go back to the cheaper places. She has figured out that it currently costs about $1/day for her new haircut, so she is shopping for a lot cheaper place to get it cut. Plus, she trusts me, so I can trim it in between cuts now that we have clippers. Mwahahaha…..

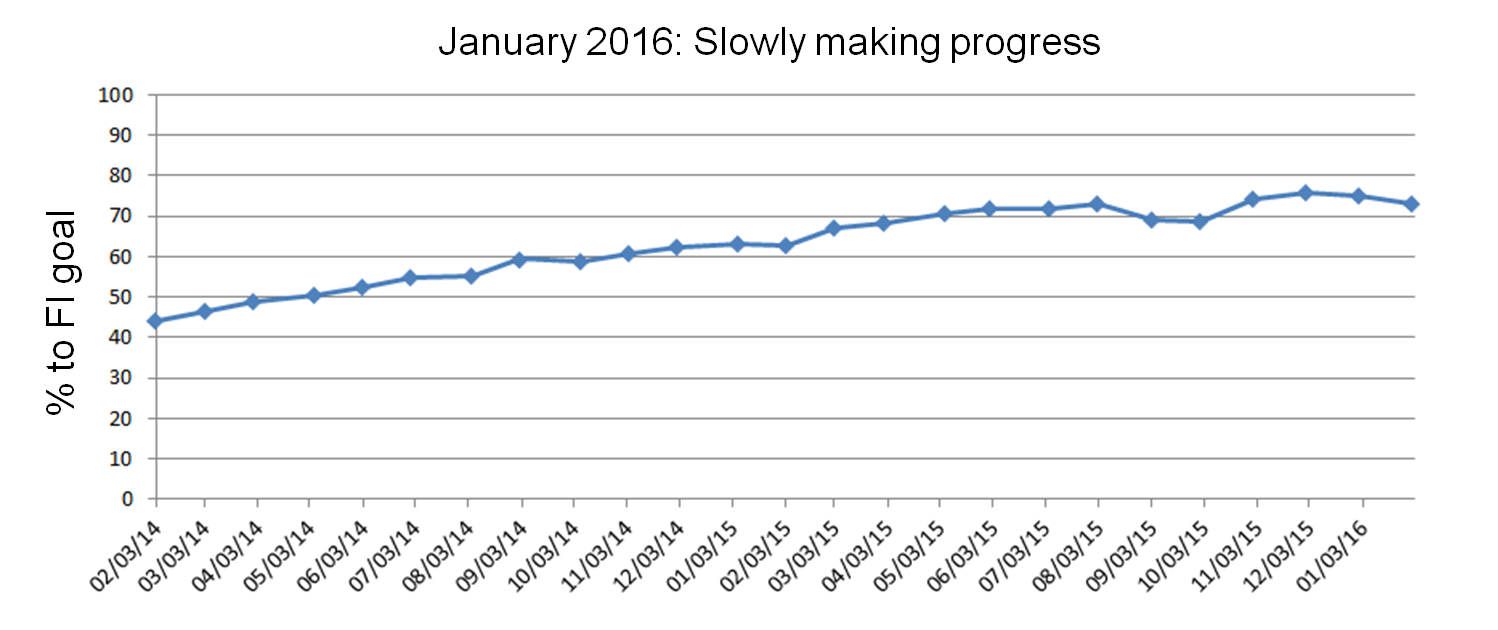

As you can see in our overall chart of “% to FI Goal” – our numbers are dropping, and no longer climbing. Booo….. That was expected after our year review showed that our only growth in 2015 was essentially from our contributions. Whoa! Oh well, markets are out of my control, so whatever… As far as our “how to deal with the market” approach, I’d be in the BUY, BUY, BUY camp, and get stuff on the cheap, which we are. However, for the immediate short term, we’re stocking up our cash reserves more than investing in the market. We have a decent nest egg, but since savings accounts have such a low return, we don’t like keeping a lot in there. With our industry being where it is (in the toilet, and today I saw gas was $1.49/gallon) and the stock markets tanking as well, we decided we’d rather know that our $5k will still be $5k in 6 months if need be, and not $4.5k or less. Don’t worry, we have more than $5k saved, it’s just an example number. If it wasn’t for hedging our bets that we would need to tap into some of those investments in the next 6-12 months, we would still be throwing more money into the stock market and not building up our cash reserve above our normal emergency fund amount. Especially, if we just throw in the towels and decide to become ski/snowboard bums for a few years.

Time for a new segment we’re rolling out called, “Crazy stories from Lay-off land!” Yes, as people are getting axed left and right, the water cooler talk is getting more and more crazy. For instance, I heard of a couple that had both gotten laid off, and burned through all their savings in about 3 months. Now they’re really scared, because the industry hasn’t picked up, neither one has gotten a job again as they were banking on (literally), and they’re out of savings. The main reason this happened, they didn’t cut spending back immediately and just kept spending and living like they were still getting paychecks…

On a similar thread, a friend of mine at work is about to commit to a $300k mortgage, even though he thinks buying is a bad idea, and renting is better, he is still proceeding with buying a house. This is compounded by his wife interning for a company where if she gets an offer, it will be in a town and state that is not Houston, TX and they would move there rather than stay here. Mind-boggling!

Another friend of mine got caught in the middle of leaving his company to join a new one. He’d gotten approved for the job and it just needed the CEO’s approval (smaller company). He hung up the phone with his “new company”, went to tell his current boss he was done, and by the time he got back to his office he found out the “new company”, had cut the department he had gotten a position in. They sold the asset and were exiting that whole area. So, he was told there weren’t any positions available for him now, because that boss now had to find spots for his current employees that didn’t have an asset to work anymore. Sorry about the timing. Oooops…

Finally, my mentee/protégé was at a party this weekend and she was the only one of her friends that wasn’t laid off yet. At the whole party… It was about 20 other geologists and engineers. She said it was a bit awkward, especially when they started asking, “Well, why haven’t you been laid off yet?” Yipes, I think I’d need a few cocktails to stay at that party!

On a lighter note, a group of us have decided that if we all get laid off, we will follow one of our colleagues back to her parent’s farms, start a co-op, and we will just farm. She has 300-400 acres and farm equipment that we can use that is just sitting idle. The only draw back – none of us know anything about farming, especially, “what do you farm in Michigan in the middle of winter?” Answer – “I don’t know, use a greenhouse?” (shrugs shoulders) Oh, and it’s in northern central Michigan, so, there’s that down side as well. Laurie at Fruclassity was just mentioning the unseasonably warm 40 degree weekend in neighboring Minnesota, so maybe not too high on the list of back-up plans. Brrr…. It would be an exciting one I bet!

That was our January, fairly mundane, thank goodness. Hope your January was pleasantly uneventful too! Let us know if you want more number details, even less number details, or if you’re still reading. For those still reading – congrats, you made it!

Mr. PTM

February 1, 2016Boring is good when it comes to reviewing your spending against your budget! I’m a budget voyeur so I love to see the numbers, but tracking at an ultra-granular level doesn’t provide a proportional level of value…at least for me. Bummer about all the workplace uncertainty, but you seem to have a positive mindset and even better: a plan!

Mr SSC

February 2, 2016I agree, when boring and budgets combine, it’s a win for us. I will probably bring back the numbers and maybe just not mention as much about it unless something jumps out.

Since we track it anyway, it’s just a snip and paste, essentially, to get it in there.

I find that having plans help put my mind at ease, even if it’s a really uncomfortable situation.

amber tree

February 1, 2016Sounds like lot’s of fun at the water cooler in your office! 😉 Some of these stories are indeed mind blowing…

Too bad that the financial goal tracker is trending downward… O the upside, you buy now at lower prices…

I hope all turns out well for you ad your industry.

In the mean time, enjoy the mountains.

Mr SSC

February 2, 2016The around the office chatter has been entertaining lately. It’s just been ahrd to find a way to post it and it not sound judgey or “ranty”. I’d love to see the goal tracker increase, but at least it’s not nose diving…

Prudence Debtfree

February 1, 2016I like your new approach to numbers. Not a “budget voyeur” as Mr. PTM is : ) Those are truly bizarre stories! The guy getting the $300,000 mortgage especially. I used to be pretty bad with money, so I do understand the tricks our brains can play on us . . . to some extent. How does he rationalize that decision?

Mr SSC

February 2, 2016Thanks, I think we’ll hit a middle ground, and maybe post the numbers, but keep the talk about them at the level of this post, if at all. When the AC breaks ($7k) it’ll get mentioned but not labor over the minutia.

That guy has been SO stressed about possible layoffs and rumors so I was as shocked as you that he was bidding and putting an offer in on a house. Especially since his wife has a high probability of getting an offer for a city that they would move to…

His rationalization is non-existent, except that his wife is driving this bus essentially. She wants to own a house, he sees it as a financial and literal anchor holding them down if they get it. It is moving forward just the same though….

Tawcan

February 1, 2016I’ve always enjoyed going to the coffee breakout room at work. So many great stories are told in that room. 🙂

Boring is good and I like that FI progress graph, it’ll definitely keep you motivated.

Mr SSC

February 2, 2016There hasn’t been much “how’d your weekend go” talk lately, and it’s all just layoff speculation, finance related, and “what do I want to do with my life if I get laid off?” Don’t worry, that post is coming soon.

The new graph was inspired by Eat the Financial Elephant, they had one, and we liked the concept, and it’s definitely motivating.

Fervent Finance

February 1, 2016Let me start with “people are f’ing nuts”. Haha love the stories. I was in H-town last week for work (my first time). It was all work and no play, so I didn’t get to see much though. Every building I walked by was an O&G name I recognized though.

My January was fairly mundane as well, which isn’t anything to complain about.

Mr SSC

February 2, 2016Let me start by agreeing with you. 🙂 I’ll take mundane budget update every month and be perfectly happy.

Yeah it does seem like almost every building in town is an O&G company. Fun sidenote, the glass towers that are Chevron’s current building are the former Enron offices. That’s where it all went down, and I had one more reason to not solely rtely on a pension from work…

Isaac

February 1, 2016I love seeing the actual budget numbers (especially since I’m using the SSC spreadsheet to track my own spending) so would love to see the more detailed numbers – hopefully you guys decide to bring them back!

January is the first month we’re truly tracking. Honestly, my biggest takeaway was income being more than I anticipated, as I’ve never really thought about how much my wife spends/gets reimbursed for business expenses – I always just mentally lumped it in with our monthly credit card spending, so was good to see that number on paper. Additionally, January saw a renewal of her life insurance policy and the installation of an automatic car starter (definitely not a FIRE move, but with a newborn and having to hop in the car every morning when it’s 20 degrees, I feel it was a worthwhile long-term investment).

I’m looking forward to finding what our average monthly spending is (I have an idea, but want to see if we’re paying more attention how much it will come down) and then having that month where there are no “unusual” expenses and we see it go down

Side note – I’d love to see a post where you guys go in-depth on your college investing philosophy – I’m just throwing $250 a month into a 529 account right now but have no idea if that’s too much/too little

Mr SSC

February 2, 2016Haha, nice that you’re using the spreadsheet and tracking numbers! Even better that it’s working out better than you thought. Like you, I had a rough idea of our numbers and all of that, but I still looked at Mrs. SSC like she was a loon when she kept saying we could live off of $40k/year. It wasn’t until she had hard data that I realized, “Holy crap, she’s right!!”

We track the detailed numbers anyway, so they will probably make a resurgence, but I won’t belabor the details like before, unless there is some unusual occurrence.

Great timing on the college post suggestion, because we’re working on that exact post, and a couple of others dealing with kids and FIRE/FFLC. We can tweak the college post to give more numbers behind our choice, but there is more in depth behind what we feel is fair for school.

Oh yeah – Ummm, kudos on the auto car starter. If I dealt with that situation, I’d justify it too. It’s about finding a nice balance between usefulness, practicality, and your current situation. 🙂

Alyssa @ GenerationYRA

February 1, 2016Oh my gosh – your stories! Especially the one about your friend leaving a company, to find out his new gig was completely eliminated. Yikes! Always make sure to get a signed offer letter before making any sudden decisions? Also, digging your how to deal with the market approach. Quality stocks, at sale/low prices!

Mr SSC

February 2, 2016Agreed on getting the signed offer first. When I left my company, I didn’t tell them until all the paperwork was signed, drug tests had cleared (no worries, but another 2 weeks of formality) and I got the OK from my new company HR that I could give notice. Seriously, there was about 8 weeks of looking, then almost 4 weeks of dealing with paperwork, offers, HR, background check, etc… from the time I interviewed until I was cleared to pick my start date.

Yeah, if you don’t need to touch your investments anytime soon, buy the heck out of them while they’re low. We did that back in ’08-’09 and it really helped the portfolio when the market came back up again.

Elephant Eater

February 2, 2016Too bad I like you guys so much. I just payed $1.65 a gallon over the weekend and just as I was feeling all good for me, I thought about you guys and felt a little guilty for a second. Only a second though. We would like to find some other weekday ski bums! 😉

Mr SSC

February 2, 2016I enjoy the low gas prices as much as anyone. Like a friend of mine said, “It’s the double edge sword, Yeah – low gas prices! Oh wait – low gas prices….” lol

The conversations we’ve been having lately keep getting more and more real. Not that they were fake before, but in terms of, “if we both really get laid off – F this, let’s move”.

We love our current situation with regards to getting to walk to daycare and even elementary school, and our house situation is great – cul-de-sac, lakes and pool also in walking distance, we just wish we could take a big scoop and scoop up that whole little environment and drop it out West. If only there were seasons, or topography, or even snow. With no jobs though, all that becomes moot. Although, we’d probably ride it out here for 4-8 months just because we’d have to actually finally decide on where to move to, bwahahahaha…..

Laurie @thefrugalfarmer

February 2, 2016Absolutely crazy water cooler stories!! Man, we have been there, done that, making stupid decisions when on the verge of a financial crisis – I highly don’t recommend it. 🙂

Sell the McMansion, cut expenses and save like a boss. NOW. Before it’s too late and you’re going “Oh, crap.” Wake up, people!!!!

Yeah, greenhouses are the way to go in the winter in states like MI and MN. We’ve not done that; instead we grow lots in the summer and preserve to last all year long. Well, at least, we’re working on that. 🙂

Mr SSC

February 2, 2016Those stories are pretty Bat sh!t crazy in terms of what people are rationalizing or just not accepting of the current situation. At least one of my colleagues is due to move apartments, and she calculated what she could make working at Starbucks or equivalent job, and found a new apartment that had rent she could pay on that salary, not her current 6 figure one. That’s looking ahead and being realistic.

I think I would like a little greenhouse when we get to some snow states. Mrs. SSC does not seem to be down with communal style living on a farm though, so it doesn’t sound like that’s a solid plan for us… She just keeps sending me job notices for mountain towns asking – “Would this be more up your alley?” lol

I’ll have to check out that gardening book you recommended, it looks similar to one I was flipping through in B&N recently. Nothing beats experience, but it’s handy to go into something with some knowledge. 🙂

Our Next Life

February 13, 2016Coop farming in the middle of the northern midwest… what could go wrong? 😉 But hey, backup plans are good!

It’s interesting to see that you guys are bolstering your cash already, and that’s making me wonder if we should do that, too. We currently have a little over a year’s living expenses in cash, but have focused most of our savings on our investment accounts. Figured we’d boost up our cash out of this year’s bonuses, and next year’s. But good food for thought!

Mr SSC

February 15, 2016That plan got squashed fairly quickly by Mrs. SSC – it involved a deadpan stare followed by an eyeroll and head shake NO… lol

Bolstering our cash is essentially getting to a point were you guys are. We’ve had a decent cash supply and emergency fund cash supply, but nothing like a year’s worth on hand. Again, differences in risk tolerance and that sort of thing, because we put it in investments thinking, if we need more than 6 months living, we can sell stuff. However, since it could be more likely one o both may not be working by the end of the year, then we decided a bigger cash stash good to ahve because even though it might only get 0.8% interest, it won’t lose value like our investments keep doing. 🙂 Also, selling anything now would be adding insult to injury. Sure, it’s all paper money, and not “real value” until you sell it, but still, no point in eroding equity at this stage of the game.