How we got FIRE’d Up!

“What if everyone in the Personal Finance community could write about how they found their goals? Maybe newcomers would relate to one of these stories and decide to make these goals their own? What if that could help someone FIRE?”

Since this blog has been around for a while now and we may have newcomers that haven’t read some of our initial stories, here’s our version of how we got “FIRE’d Up.”

We met as interns and hit it off. When we started our careers, we both had just gotten out of school, moved across the country (me from Denver, Mrs. SSC from Chicago), bought a house, got married, and started our life together. It was a whirlwind!

Fast forward a few years and we noticed our spending had been getting higher than we wanted. We figured there had to be a way to reduce it, so we tried a challenge to reduce it 10% the next month, and lo and behold, without really trying it dropped almost 25%!!

Is it a Want or a Need

This revelation also led us to tracking our spending to see what else we could cut back on, and this is when we employed our mantra, “Is this a want or a need?” before making purchases.

That phrase alone led to another 25% drop in spending and by reviewing our spending tracking we saw we spent a lot at Target, Costco and restaurants.

So, we moved restaurants into our “allowance” funds meaning if we went out to eat, one of us is paying with our personal money. We also dropped our Costco membership, because for us, the savings weren’t worth it, and we tended to overspend. Finally, we limited Target trips to once a month, and only bought what was on our list. No more impulse buys for us!

The Catalyst for Change

Our catalyst to find a better way came about like most people, from dissatisfaction at work. I had gone from spending 2 miserable years in a group I wasn’t happy in, to one that I could thrive, have fun, and drill wells, woohoo!! Mrs. SSC had the opposite happen and was transferred into a position where she wasn’t challenged, happy, or appreciated. Wanting something more and knowing there had to be something better, she started looking for resources on early retirement. Surely, we should be able to retire before 45, since that was SO far away and she was SO miserable.

Enter Mister Money Moustache

Mrs. SSC had been looking for outlets and resources to discover a better way to live life and get purpose back. She had also been trying to convince me that we could retire early, and I sort of agreed, but didn’t actually think it was possible. According to Mrs. SSC, “I’ll listen to almost anyone’s advice but hers” (Mr. SSC sidenote – that’s not actually true) so she decided she would find some other opinions on the matter.

After some searching she found the champion of FIRE, Mister Money Moustache. Now, a quick disclaimer – if you’re new to this realm, please, go read some MMM, HOWEVER, I would recommend you start at the beginning when his posts were relatable, and he wasn’t just recommending high priced investment companies, reviewing Teslas, and the like. That early writing was what got most people sparked with the idea that they too could buck the trend of “normal” and retire early!

She had been reading his blog for a bit and telling me about it, but I wasn’t a fan. I mean, why live on $25k/year when I got a degree to not live like that anymore?! No thanks! I wasn’t on board and was now staunchly against this radical lifestyle change.

What Changed?

Frankly, it was having the kids that changed everything for me. They really do grow up quickly and I was missing a lot of it due to work. Couple that with a move to Houston where our commute changed, our schedules changed, and life got even busier. We were on an unsustainable path and I realized that I too didn’t want to do this forever.

I still wasn’t convinced we could do it until Mrs. SSC showed me our last few years our spending. That was when I had my “lightbulb moment” (our back and forth email exchange where I finally “got it”) and realized we could Early Retire and not drastically change anything because we had already been living comfortably well below our means!

Not Early Retirement but instead a Lifestyle Change

After we were both on board with our plan, I realized all this time Mrs. SSC had already been executing it, just not telling me. Okay, she told me, but it never really sunk in how well she had been at keeping up our savings, investing the extra and more. Way to go Mrs. SSC!! Early on we realized that it wasn’t the Early Retirement we wanted, it was just a Lifestyle Change, which led us to come up with our FFLC acronym which stands for our Fully Funded Lifestyle Change.

Since then, we’ve been doing what we can to get there, and making drastic changes in a lot of places. Mrs. SSC left her corporate gig and took a 6 figure pay cut to teach and follow that dream. We realized we may move out West for a bit and just rent, we re-evaluated our risk profile and got our FFLC date moved up even sooner, and we keep tracking it all in our spreadsheet to see how we’re doing.

That is the abridged version of how we got to where we are and what got us FIRE’d Up.

Thanks again to Nick at The Money Mine for the challenge! Any of you willing to take the Fire’d Up challenge like Maggie over at Northern Expenditure?

It would be awesome to read more stories!

TheMoneyMine

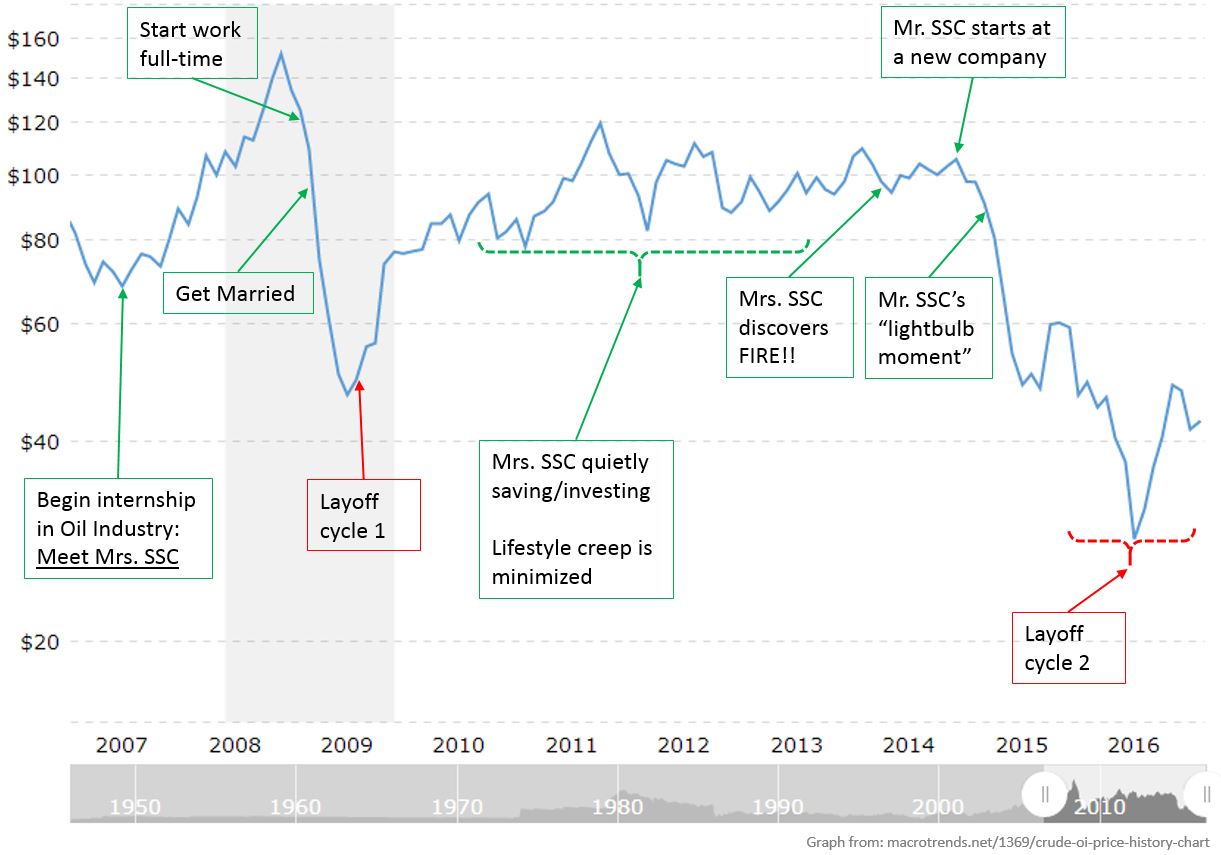

August 10, 2016I love the story (and how your graphed your story on an oil prices chart)!

That you were able to start reducing your costs by 25% just by checking Want vs Need is pretty amazing. Another proof that, even without being as frugal as MMM, there’s a lot that can be done just by control spend.

(also I can’t help but notice that oil plunged shortly after Mr SSC’s lightbulb moment… the butterfly effect?)

I can imagine how kids and a sucky job would be a trigger for many people and this is amazing how much progress you’ve done since Mrs SSC started saving.

Your chart can soon be updated to show your FFLC date!

Mr. SSC

August 10, 2016Checking the oil price chart often, I realized that it did have some unique perspective on our timeline. Especially just noting how rocky the industry has been since we joined it. The trend was ~$80 or more but every time it jumped up or down, our mgmt would freak out and make cuts, whether it was people, budgets, or both.

It is amazing how even just being mildly frugal can add huge returns back into your bank account. 25% is drastic regardless of the level of spend.

I think there could have been a butterfly effect going on. Seeing the steep continued drop and realizing, “Oh crap, I just started a new company and oil is tanking. I’m going to get laid off… Whoops…” was the biggest catalyst for me.

Realizing, okay, we will be okay, we really don’t spend a lot, and we can cut that fairly dramatically if need be – at that point we were both really worried about both getting laid off and coming up with contingency plans left and right with ALL sorts of scenarios thrown in. That was what drove it all home for me.

Mr. PIE

August 10, 2016Love this post and that of Nick, Maggie.

Mrs. PIE and I were only recently kicking around ideas on telling ore about our “story” and these posts get us FIREd up to do that. How we met, the steps and mis-steps along the way. The spendy years, the cost of kids daycare, the respective epiphanies, the “why the hell did we not think of this before?” discussions. I think we could tell quite a tale of life on each side of the pond and a number of calamities along our journey.

Especially love the way you layered the price of oil onto the events. If I could steal a piece of that idea for our post on getting FIREd up, that would be awesome. Downstream royalties of course will be paid in due course.

Mr. SSC

August 10, 2016Oh man, the mis-steps alone could keep us with posts for months, aye yi yi… Especially, the “why the hell did we not think of this before” moments, but then we wouldn’t be the people we are today because we wouldn’t have those same experiences, and all of those philosphical thoughts about changing the past. 🙂

As far as stealing ideas, feel free to steal away! 🙂 I’d love to read the post you described about yourselves. Get to writing it already, hahaha

Matt @ Optimize Your Life

August 10, 2016Great story. Thanks for sharing!

I feel like a lot of us probably found FIRE via MMM. I’m impressed that your discovery of him seems to be based more in “I want to retire early, so I will go find a guide.” Mine was much more random. I think I had just opened a Roth IRA and was looking for investing advice. I ended up on an article about index funds and kind of stumbled upon the whole concept of FIRE by looking through his archives.

Mr SSC

August 11, 2016He definitely has some great stuff, but the early stuff Mrs. SSC was sending me was very extreme still, and wasn’t the best to convince me of that minimalistic/not typical American spending sort of lifestyle.

Now I realize that our spending is probably high for some people and probably way low for others, but that’s okay, because it works for us, just like MMM’s budget works for them.

earlyretirementnow

August 10, 2016That’s a cool timeline. I’m glad you were able to save a lot of money during the good days when WTI was high. Just like Big Oil, my sector (Big Finance) goes through cycles and I try to live like every year is the last good year in the cycle and new layoffs are just around the corner.

Also: I can totally relate to your MMM view. I enjoy the vintage MMM more than the Tesla driving. 🙂

Mr SSC

August 11, 2016I’d always heard oil was cyclical and a volatile industry (pun intended) but until I got into it and we saw that first round of layoffs right off the bat, it was a bit of a wakeup call. Even then, it wasn’t until this last major crash and downturn that we both pondered, “What would we do if we got laid off that isn’t in the industry?”

That led Mrs. SSC back to teaching and me to the reality that we could actually FIRE/FFLC in a few more years. Sooner, if she finds an “outside of Houston” teaching gig or I find a similar lower paying BLM gig in a nice out West enviro.

I think the passion and same drivers aren’t there anymore and you can tell in the writing for MMM. His vintage stuff though, you can definitely tell there’s passion and a better connection there.

Mrs Groovy

August 10, 2016I love hearing about the woman behind the man – go Mrs. SSC!

I’m so glad that having kids was your wake up call. We thought that would work for our broke cousins, but sadly it did not. They’re just raising kids who will not get along well in the world.

C’oeur d’Alene and Whitefish have been on our radar for a while. Absolutely stunning! But a little too pricey for us. I think it’s a good idea to rent first.

Mr SSC

August 11, 2016Definitely, I firmly believe that behind every successful man, there’s at elast 1 stronger woman that helped get him there. 🙂

Those two towns are definitely pricey, but I’ve found some good deals close to there that wold still work well for us – yes, I still house hunt on Zillow/Realtor. Renting would remove some of that initial shock, and if we liked it enough, we could figure out a way to buy around there. Especially CDA, as it was spendy when we first looked at it, and has only gone up since. Sigh… Maybe hope for a real estate correction, hahahaha.

Maggie @ Northern Expenditure

August 10, 2016I love the graph of oil prices with your life events! That’s an awesome and hilarious way to document it all! When I think about our “lightbulb moment” as you say, I wish it was ten years earlier! And looking at the graph, I can see that you probably wish your lightbulb moment was pre-oil tanking! (though your salary hopefully didn’t follow the same trajectory!) I’m loving this series!

Mr SSC

August 11, 2016I think if my lightbulb moment was ten years earlier, we may not have had kids, and I surely wouldn’t be writing this right now. 🙂 I would like to have dumped way more in the market back in ’08/’09 though… Sigh…

I thought the graph would be funny, especially since I have looked at it and mentally put those things on there in the past, especially when I changed companies. I really thought I’d be axed since I fit the “last in, first out” profile and may not have ahd enough time to prove I’m worth keeping.

Nope, my salary went the opposite trajectory, and I’m SO glad I made the switch when I did because had I stayed at “comfortable but miserable” company, I definitely would have been laid off in 2015.

Tawcan

August 10, 2016Love the story and the graph of oil price. I wish I knew more about FIRE when I was in my 20s, would have done thing very differently.

Mr SSC

August 11, 2016It’s like the quote from Office Space when Peter was asked what he’d do with a million dollars and he says, “Nothing. I’d do nothing.” His friend replies, “You don’t need a million dollars to do nothing. Take a look at my cousin, he’s broke, don’t do sh!t.” Haha

I think that would’ve been more my trajectory if I’d discovered FIRE in my 20’s. I just didn’t have much motivation other than “finish school, for reasons unknown.” Although, my 4 month hiking adventure did almost spawn a nomad broke world traveler lifestyle, but I decided that was my fall back if school didn’t work out, lol.

The Green Swan

August 10, 2016That’s a great story, thanks for sharing! And I like the oil price chart with the overlay of life events! My path is similar, but slightly different. I will have to put it on my list to lay out the details about what got me FIRE’d up! Stay tuned.

Mr SSC

August 11, 2016Glad you liked it! I’d love to read your version and anyone else’s about what got them FIRE’d up. That was a great idea from Nick.

Usually when I find someone’s blog, I read their “about” page, and go through the archives, but I don’t know everyone’s back story, and this is a great peek into that.

Edifi

August 10, 2016Nice graph! It’s a good lesson that that you’re overpaid in the booms to cover the busts (and that your own success may depend more on external factors than your own abilities).

Got to treat every paycheck like it’s your last!

Mr SSC

August 11, 2016Actually,I was underpaid, relative to peers and industry, until I left right before the crash. Ironically, this last downturn I’ve been paid more and had more padding to my pension/retirement than all the previous time at the other company.

I agree, definitely treat every paycheck like it’s your last, because I could get a handshake and “thanks but we don’t need you anymore” any day with oil prices sitting where they are.

Dividends Down Under

August 11, 2016Very nice graph, it’s funny how we can link global events to personal changes in our lives – but it does happen of course. I think the first thing that inspired me/us to change our financial ways was reading TheSimpleDollar 2-3 years ago and how you can change your mindset around money. That was very powerful and set in motion a huge amount interneting to find everything else that we have done 🙂

Tristan

Mr SSC

August 11, 2016Thanks! It’s nice that there are blogs out there that can inspire people and get them to re-evaluate their mindset on spending, money, and life in general.

I’m sure this one won’t always be around, but while it’s here hopefully it can get some people convinced to flip the script on their current lifestyle. 🙂

Dividends Down Under

August 11, 2016To inspire even one person to make a huge change in their life is a wonderful thing and should never be underestimated :).

Tristan

Mr SSC

August 11, 2016That is an excellent point! 🙂

Matt @ The Resume Gap

August 11, 2016Fun to revisit your FIRE “origin story”! I can’t remember how I originally found it, but I started reading The Simple Dollar blog back in 2006, back when it was just one guy’s story of trying to get his family out of crippling debt. Early retirement wasn’t even part of the discussion, but the content about debt and frugality definitely helped lay the groundwork for me. I was still a broke college student, so I hadn’t had time or money to inflate my lifestyle. Like you’ve experienced with MMM, the feel of blog changed over time and eventually it was sold to some media company, but thankfully a thousand other writers have picked up where it left off.

Mr SSC

August 11, 2016Amen to other bloggers picking up where others have left off. Even though the tone and content of some of those orignial inspirational logs have changed, if it wasn’t for them, who knows where we’d be.

Thanks for the comment!

Elephant Eater

August 11, 2016Too funny that Mrs SSC turned you off on MMM’s $25k/year budget. I tried to get Mrs. EE into this through ERE and Jacob’s $7K/year budget. That went over real swell!

Agree that kids changed everything for us. Prior to that, ER was a want. After, we new we needed to do something different. The difference between wants and dreams to needs and concrete goals is night and day

Mr SSC

August 16, 2016I can only imagine how a $7k/yr budget went over. 🙂

Kids have changed perspective on a LOT of things. They are still a prime motivator for our Lifestyle Change, as we want more time to spend with them before they’re heading out the door to start their lives.

Pellrider

August 12, 2016Saw you from the Mustachians on Facebook. Love the blog. Sharing it on my page too. Great blog. Adding to y reading list.

Mr SSC

August 16, 2016Awesome, thanks!

The Jolly Ledger

August 12, 2016It’s amazing how these cycles have driven most of our aha! moments. Fear is a great motivator. Luckily, I was hired a few years prior to the 2008 bust, avoided the massive layoffs even though they shut my site down and increased my 401 k contribution to 15%. In hindsight it was a good call, but still I wish I would have been more aggressively saving earlier.

Mr SSC

August 16, 2016I’d never noticed it was on the downturn of the oil price and beginning of this current cycle until I was making that chart. 🙂

I think knowing that we could both be out of work had us really looking at our doomsday budget scenarios. Reviewing all of the spending, and costs, and future spending assumptions is when it clicked that this really was doable! (smack palm to forehead…)

Finance Solver

August 14, 2016Thank you so much for sharing your story! It’s weird cause a couple of my friends moved to Houston for job opportunities because they were hiring a lot of undergraduates but they’ve been hearing horror stories of how a lot of upper management has gotten fired.

Change in lifestyle is definitely the way to go and spending on things on that’s needed is a sure-fire way to save!

Mr SSC

August 16, 2016Yep, there have been a lot of layoffs, firings, and staff reorganizations going on since just after we got to Houston.

It has been nice that we’ve been able to keep our lifestyle comfortable but not lavish and minimize it to the things we need. It definitely helps free up some money for investing and getting to make a Lifestyle Change sooner than later. 🙂

Pamela

August 16, 2016Great story. You guys have really come a long way in your financial journey. I think there is a breaking moment for everyone when they have had enough and want a better life for themselves. For some it is a slow realization, and for others it is an instant recognition

Kara

August 17, 2016Mrs. SSC, so sneaky in the best way! This is a great story. Very relatable and inspiring!

Prudence Debtfree

August 17, 2016This makes me a bit sad about the fact that my husband and I started so late. We don’t have a FIRE plan; too late for that. We have a “freedom to retire as soon as my retirement pension can kick in” plan (3 years) – which, considering where we were financially only 4 years ago, is no small deal in itself. Thanks for sharing the origin of your FIRE story. Mrs. SSC is pretty smart! And how amazing is it that you were able to reduce your spending so drastically even with your initial, modest ramping up of mindful accounting.

Ms. Montana

August 24, 2016This is great to hear. I think Mr. Mt had a hard time buying into the early retirement idea as well. Until one day we ran the numbers and I was like, “You know, we are pretty darn close!” So we took a year off. =)

Mr SSC

August 25, 2016That’s awesome that you guys got to take a year off! When I finally bought into it, then I thought, argh, why does it feel so far away?! Are you sure we can’t just make it work now, hahahaha