Free money cost me HOW much?!

While Mrs. SSC was paying the bills, she noticed that Discover had a cash-back reward offer for her personal Discover credit card that she uses for her ‘allowance’. Anyway, Mrs. SSC noticed that there was an offer of “spend $2k/month for the next 3 months and get $300 FREE!” Mrs. SSC thought this was awesome, since we have a second Discover card account that we use as our primary household credit card for bill paying/grocery/gas/etc… type of card that gets paid off every month. So, she went to see if she could sign up for this awesome deal with our household Discover card, and any guesses on whether it was offered on that account or not? Hmmm? Anyone?

No, is the correct answer.

So, for the card we typically have a fairly consistent amount spent on each month, there is bubkus in regards to additional offers. On the more meager monthly spend card (Mrs. SSC allowance spending) there was this nice reward offer. So then, would it be worth it to use that card for groceries and gas and get an extra $300 in a few months? Sure. But, really Discover just wants her to boost her spending to match that of our other account with them… As my 3 yr old would say in a sing-songy voice “Ooohhh, Discover….”

So, Hooray Us! for getting an offer to get cash back above and beyond their typical rewards, but it strikes me as devious or scheming in how it was presented.

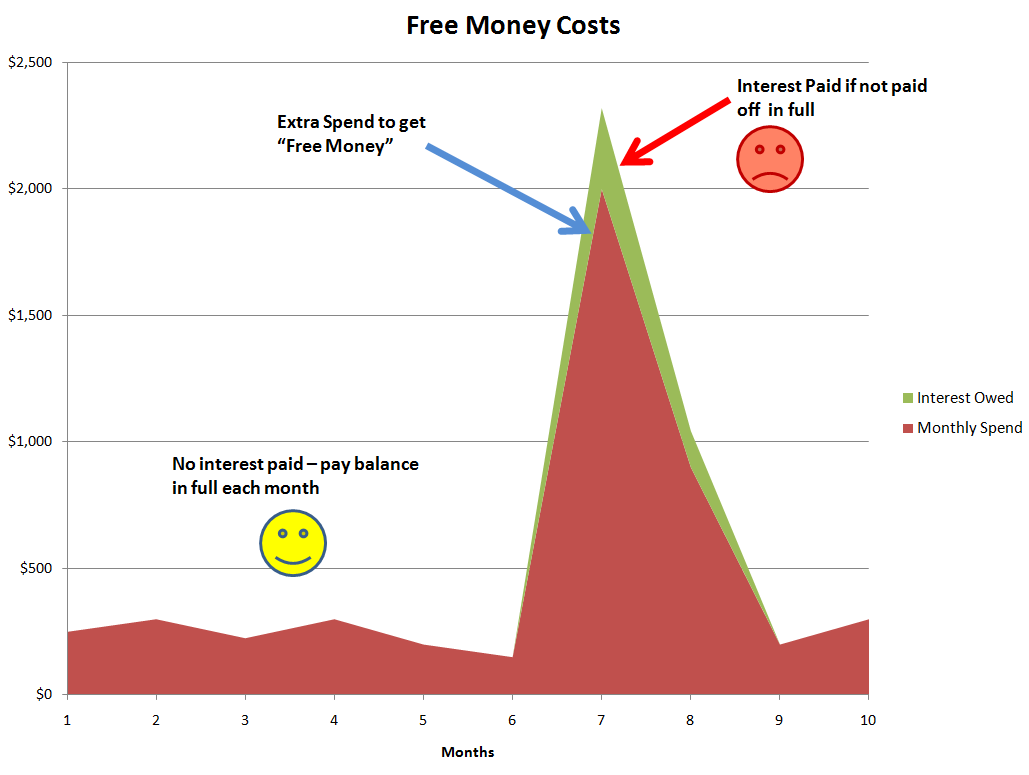

Although, thinking about it now, I guess it’s just plain business. They see someone not spending much on their card each month, so why not try and lure that person to spend 3-4 times the amount they normally spend. Especially with the holidays, if you give a consumer a target of say ~$2k to hit and get “rewarded” with a free $300 to spend at Amazon among other places, well, it would seem that it should be a no brainer to spend that amount and get your “free money”. Then maybe they are over their usual budget and can’t pay it all off at once and then interest accrues. Who wins there? Discover.

But think about this in the case of most consumers.

Hell, let’s use me as an example of said consumer, from just a mere 7 years ago. I carried revolving debt and was constantly paying towards it, because my spend was way over my pay-down each month. Yes, yes, I know, Bad Mr. SSC, and you can read about that more here. But I would’ve been delighted at that offer. Spend $2000/month and get $300? Hell yeah, free money! But is it really? Let’s say I had just 16% interest (I paid late occasionally, so it was probably closer to 18% – cringe!!) over the course of one month, that interest would be $320. Someone check my math, I could be way off…. They’ve already gotten their “free money” back plus $20 if I don’t pay it down for just 1 month. 1 month! That’s it.

So for all those analysts sitting inside the machine that is called Discover, they’ve just earned their bonuses. Think about it. If they get just 10,000 people to accept this offer and not pay their additional $2k spend down for just one month, they made Discover an extra $200,000!! That’s just from the $20 extra per person that doesn’t pay it all down. And that’s not compounding that with the fact it will probably take more than 1 month to pay it down, so just by this one little offer, they will most likely make more than they put out there to give away as free money. Genius Discover, pure genius!

For those not in a situation to pay that balance off, it’s lose, lose. But I wouldn’t have known that or thought about it back in the day, and they would’ve made way more than the $300 they “gave” me. I would have never realized I just stole from myself because it was worded as spend blah amount and get Blah amount FREE!

Have you ever gotten taken by something that seemed great but you realized later, “This free money cost me SO much more than it was worth?”

I’d love to hear that younger Mr. SSC wasn’t the only one that wouldn’t see past that “free offer” and get taken for much, much, more.

Emily @ Simple Cheap Mom

December 11, 2014I did check the math… 16% of $2,000 would be $320 per year, not per month. But I liked your analysis anyway. I’m often motivated by all these specials and sales and I need to remind myself to check to see if I’d actually save money.

Mr SSC

December 11, 2014And that’s why Mrs. SSC handles the finances. ☺ Nice catch, I forgot the Annual in APR. But the younger me would’ve still gotten to that point with it as I was bad at paying down debt each month.

Mrs. Maroon

December 11, 2014I’ve never been one to carry a balance on a CC. If such an offer came up, we would likely shift our spending long enough to the other card to get the cash.

But I also consider our approach to personal finance to be the exception to the rule in today’s society. I firmly believe that you are dead on in your characterization of the Discover execs cashing in those huge bonuses. Likely for lavish vacations. Makes me wonder how many of them live beyond even their large paychecks…

Mr. SSC

December 12, 2014I would agree that FIRE folks in general are the exception rather than the rule in regards to how we handle our finances. My family encouraged credit card spending and living above my means when I had just gotten my job offer. I wasn’t even working yet, and they wanted me to start living like I was because like they said “You’ll be able to pay that off in no time…” Growing up with that model as my only finance experience, and well, it led to all those “Bad Decisions” posts.