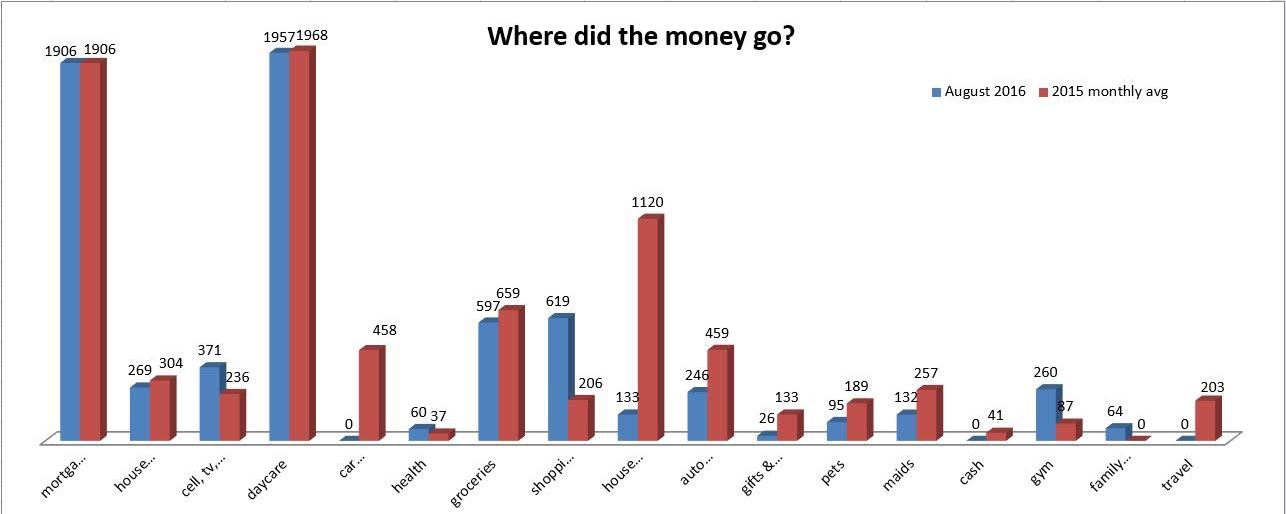

August 2016: Our Money went where?

Spent more than usual

Groceries came in a bit higher partially due to a new grocery store opening up very close by, and partially from the fact that we now have to make and send in lunches for our oldest to take to kindergarten. This shouldn’t be a big increase, but Mrs. SSC did some stocking up on some items in preparation for this. Maybe some extra spending for my birthday cake supplies? Mrs. SSC asked what kind of cake I wanted and I said “wedding cake!” She’ll never ask again, but she did make this beautiful one below.

Spending in general was a bit higher, also buoyed from school supplies which we don’t normally buy. While Mrs. SSC did shop around and get most stuff at a great deal, it’s still more than typical. We also bought 2 new booster seats for our oldest and those were about $68 each. Yipe! That still seems like an anomalously high spike in spending though.

Daycare was high because of a 5 Monday month, but will start to go down now due to free public school that one of our kids is attending. He still does aftercare, but the cost is way lower. Yeah our live near a good public school plan is working!

TV/Internet is high because of overbilling by AT&T. Evidently, when I called to cancel in July and they said, “Okay we’ll cancel your service, sorry to see you go” (it was really more of a 20 minute sales pitch as to why I wouldn’t “not cancel” – so annoying) they didn’t actually cancel anything. Yep, we still got billed in August and got a notice for a bill due in September. I resolved it yesterday and in the next 20 days we’ll get a refund for our “unused internet” we were billed for, but still… It’s a great reminder that Autopay sucks (as Mrs. SSC puts it) and if we weren’t tracking our bills, the $72 may have gotten lost in the wash for longer than 1 extra month.

Gym is up due to paying for kids swim lessons and not getting the stipend from my work yet. It covers my portion of our family plan or about $56/month. Thanks work!

Spent less than usual

Autos are still way down, like almost half, so that’s been nice.

Pet costs are down – no shots or checkups or emergencies to deal with. Although our oldest dog (~16 yrs) is having more days that remind us she’s close to 16 yrs old than days where she’s still bouncing around with her tongue hanging out.

Best News

Shockingly we had a surplus of about $1900 this month. That was with no paycheck from Mrs. SSC even. She won’t get paid until Oct. 1st, but she is now officially on the payroll, hahahaha. The great news from this is that we managed our spending and investing enough to weather that lack of pay and beat our projected $300/mo surplus. Woohoo! What does this mean? Starting next month, we won’t need a stockpile of such a huge emergency fund and we can start boosting our investments back up.

FFLC Cost Projections

How does this shake out with our FFLC cost projections (which is all just voodoo and black magic guessing if you ask me)? This months’ spend was about on par for our FFLC costs. Accounting for the removal of things we won’t be doing in FFLC like mortgage, daycare, cleaning service, etc… we are looking at about $3500 spend for the month. 12 months of that would stick us at ~$42k/yr which is on par with our FFLC projection of about $49k. Using a simple 4% rule would set our target at ~$1.225 million, with a paid off house – but feel free to tell me if I’m wrong in those calculations. Better to know now right?

Hope your August went well and you didn’t have any major financial surprises (unless they’re the good kind like lottery winnings, casino jackpot score, long lost relative bequeaths you their entire debt free expensive estate, you get the idea)

Brian @ debt discipline

September 7, 2016A $1900 surplus? Sounds like a great month! The cake look delicious. Did you wife feed it to you too? 🙂 A 16 year old dog. Wow, what breed? At that age I would expect they would slow down a bit.

Mr SSC

September 7, 2016Yeah, it was not a bad month overall! The cake was delicious, and it will definitely be the last time she asks my opinion on a birthday cake. She said I am generally so apathetic with those things, but not this time. 🙂

The dog is a mutt, but looks like a border collie – black, long hair. Her sister looked like an Australian cattle dog, and she made it to 14 before she passed with bladder cancer. Booo… Funny how they’re both from the same litter and look totally different. 🙂

Our Next Life

September 7, 2016OMG — That wedding birthday cake almost made me spit out my coffee. LOL. I love it! Did you save a slice for the anniversary of this birthday? Haha. 😉 I love how you put your future budget (“black magic”) since it feels like such a huge guess. But I want to show this budget to some of our friends who were incredulous when we told them what we’re planning to spend in ER. I think they were thinking of the number in terms of gross income, not spending, and we had to keep saying, “But we’ll be mortgage free, and pay almost no income tax, so it actually spends like a lot more.” Since you guys are in the same ballpark but also have kids, I’m going to treat your future budget as independent verification that we’re not crazy. 🙂

P.S. You’re going to get some late comments from me soon. Have been so underwater at work, but have had tabs open for your recent posts for ages!

Mr SSC

September 7, 2016I figured I HAD to post a picture and story behind the cake. We did discuss saving a piece, but it was too tasty. Everyone else I’ve told so far also thought it was hilarious. I did have to tell Prof SSC that it had to be at least 3 tier, otherwise, it’s just a cake. 😛

Feel free to use our FFLC projected numbers vs our “now spending” to show how it does work. We have a post somewhere called estimating our FFLC budget or something similar where we have our current expenses, monthly and yearly, and then subtract out expenses we won’t have when that time comes. $1900/mo for mortgage and $2000/mo for daycare is ~$24k per year we won’t need to spend.

That’s a LOT! Plus, cleaning service and other things and it breaks down to ~$50-$55k/year. That’s assuming a current silver plan health care rate as well, and Lord knows how that’s going to pan out in a few years, but with what we know now – yes, that’s a really comfortable living guesstimate (haha I love using that word) of what our yearly costs could be. I can find it and send you the link if you want to have better numbers to use.

Looking forward to the comments and sorry you’re so underwater at work. You can add that to phrases you won’t have to be using very shortly though. 🙂 Also, I’m very afraid of what your laptop browser window looks like with probably dozens of open tabs. 🙂

Ms. Montana

September 7, 2016I love the cake! And that is a great surplus. I have been geeking out over all the spreadsheets of our expenses. It’s makes logging all the expenses almost worth it. It’s been great to see what we actually spend when neither of us are working. Some things have gone way down and others (like travel) up a bit.

Mr SSC

September 7, 2016Thanks, I loved it too! I’m shocked at the surplus as well. I thought it was going to be tighter, although our investing was lower anticipating a tight squeeze through October. Clearly we overestimated. 🙂

I’m not as big of an excel user as Mrs. SSC, but I do occasionally like digging into the projected spread sheets and seeing trends in spending and that sort of thing. I did a post showing toll road usage overlain with me finding a new job, trying to find a better way to and from the new job, and then finding ways that avoided the toll road mostly. It was neat seeing the spending jump, then level off, then drop. 🙂

That kind of stuff is interesting when you see how life events affect spending positively and negatively.

The Jolly Ledger

September 7, 2016You are going to love that drop in daycare costs next month. Looks like you guys have done a lot to reduce your expenses over the last few months. Great job. Your expenses will likely decrease in retirement, so I think your estimate will provide a healthy cushion. I certainly don’t think you are underestimating.

Mr SSC

September 7, 2016I think we’ll like it even more when the youngest gets to school too. 🙂

with the change in vehicle for me, and no more car payment for Mrs. SSC, the drop in the general auto category is still shocking to me. Were we really wasting that much gas and even at only 45k miles, that Hyundai of mine had a lot of maintenance to it… Ugh…

I see our retirement spending being a bit lower in some areas, and higher in others, but hopefully it will all balance out around where we’re guessing. Fingers crossed!

Edifi

September 7, 2016Given the monthly swings, have you ever tracked rolling 12 months avg? It helps us normalize for a lot of seasonal costs like travel, utilities, or school supplies.

Mr SSC

September 7, 2016Mrs. SSC has a spreadhseet that would impress some of you while boring to death the rest, but yes, it has all sorts of projections and spending analyses in it. It also includes bumps in costs for kids clothes and school activities in a few more years, vehicle replacments ~every 8 yrs, and all sorts of minutia that has helped us feel more comfortable we’re in the ballpark with our FFLC number.

That’s a great tip though. Gemerally, a version of that is what we use to see whether our spending is going up, down or sideways relative to our previous years averages. I bet it would show some interesting trends if we plotted it all up in bar chart or some other graph format. Maybe a good idea for an upcoming post. 🙂

Edifi

September 10, 2016Yeah, you can use your wife to get academic licenses on visualization software like tableau or Fourier transform in Rstudio. It’s really powerful

Tawcan

September 7, 2016That’s a good chunk of surplus, congrats! Love the birthday wedding cake. Mrs. SSC did a great job. My birthday is coming up later this month, maybe I should ask Mrs. T to make me a birthday wedding cake too!

Mr SSC

September 7, 2016Thanks, but I think most of it came from scaling back our investments thinking we would be a lot tighter. Either way, it can go back in the investment kitty since it didn’t get spent. Yeah!!

That was a delicious cake, but I knew it would be my last time having any input on it, so be warned if you want to go that route. 🙂

Harmony@CreatingMyKaleidoscope

September 7, 2016LOL on the black magic and voodoo guessing! I take the position that our future plans are “flexible,” depending on how quickly we can pay off our debt.

Gotta love decreased daycare expenses. Actually, that’s something I had not really factored into our calculations. We still have a ways to go before we reach that point, but those little differences add up.

And kudos on that surplus!

Mr SSC

September 8, 2016Seriously, I feel like it’s all sorcery beyond a year or so away. Looking back, I haven’t accurately guessed what the next year or two would be like since I got out of grad school. 🙂

I can’t wait until our youngest gets out of daycare in ~2 more years. I know some people are all about “live close to work, don’t commute” but we chose to live in a little better school district and save the extra $1-$2k/mo per kid for private kindergarten and grade schools. We just didn’t see how that would pay out – ever…

Thanks, I think it was just ratcheting back putting $ into investments and leaving a bit more cushion than we anticipated. Either way, I’ll gladly take the extra to put back into the investment pile. 🙂

ambertree

September 8, 2016Hey fellow Leo! Rick solid month for you.

Our August was fine. September will be painful with all the kids activities bills to pay, our wedding anniversary and the golden wedding of parents in law. Add to that a big house repair that is needed…

The good news: so far we have a great Indian summer.

Mr SSC

September 8, 2016Hey fellow Leo! It’s great to be a Leo isn’t it? At least we think so, hahahaha

Septmember sounds like a rough one for you guys, but congrats on your wedding anniversary, and your parents too! That’s no small feat these days. Good luck getting your house repair cost down as far as you can, but sometimes, they just cost what they cost and there’s not much room to reduce it. Booo….

Enjoy your Indian summer, we’re stil in “Summer – Summer” around here. I went for a run last night and was a mile into it and already coevred in sweat… Ugh… Nothing like staying in the 90’s through August. We did ahve a little break from the weather a week ago and it was just in the 80’s whichw as nice. Haha, just in the 80’s… Sigh….

The Green Swan

September 8, 2016Wow your wife made that cake?! That’s incredible…and awesome you got a wedding cake for your birthday! J

Nice tactic by AT&T: “yeah we’ll cancel your service…not!” Good thing you caught it early.

I like how you are tracking your FFLC cost projections. I think ours would be in line with that as well once we remove things like daycare and mortgage as well. But we are excited to travel a lot more when we kick the bucket so we may experience intentional lifestyle inflation with that regard. Thanks for the update!

Mr. SSC

September 9, 2016I know right?! She’s pretty amazing with her decorating skills and it was delicious!

I couldn’t believe the AT&T deal, I mean seriously? Since they bill a month ahead of time, i figured the first one was already done, and jsut waited for the refund, and then instead of that got another bill. Amazing…

We are planning more for travel as well, maybe a few bigger trips than we take now. Rather longer, maybe not bigger but it is factored in with the overall, master spreadsheet.

Fervent Finance

September 8, 2016Got to love a surplus!

Thought of you today when I saw the news of the huge shale find in Texas. Did you find it!?!?!? 🙂

Mr. SSC

September 9, 2016Nice! And no, I did not find it – uh oh, one more company I don’t work for… Soon i’ll be found out, lol.

It’s an interesting play and the previous 110 dry holes all found hydrocarbons, just not in an economic sense with the extraction methods and lack of fracking at the time they were drilled. It’s always exciting reading about those stories when “non-economic” fields turn into huge discoveries all because of persistence.

The Bakken was discovered the same way. One guy just knew there was oil there, but there wasn’t the technology at the time to get it out of the ground. A lot more appraisal wells and 20 yrs later and it turned into one of the key shale oil plays. 🙂

Mr. PIE

September 8, 2016Love the cake. Mrs. SSC and Mrs. PIE need to compare notes. I have been badgering my other half to get a post out on her mad cake making and extraordinary decorating skills. It will blow your mind. Well, not literally, maybe your belly…

It is so good to think of budget down the line without daycare, mortgage. Your numbers are not far off ours – we are projecting higher though. The hard thing is the ongoing stuff for kids activities in sports that we choose to do as a family. For example, Skiing gear is not cheap even if you look for the creative ways to get at less expensive gear. And things like lift passes. But hey, that’s intentional spending for us and not “spendy” spending. The growing capacify of kids for food is also another item to consider. We are seeing that with our two boys who are now 9 and 7. Appetite is voracious, and that is before teen years have them devouring half a cow for dinner. And every time I read something about the ever present bad news with the ACA, I wince with pain. Still, most of these cost factors are manageable.

Cable story is funny, would make you cry also and oh too familiar. We cut the cord last month. Yeah! And got rid of my personal cell phone. I will use the work cell phone, which I have been using for a while anyway.

On to September and fall around the corner here. Will be raking leaves soon enough…

Mr. SSC

September 9, 2016They should compare notes – Mrs. SSC took a decorating class back when we were pre-kids and had some free time, lol. It’s paid off quite well i would say.

The budget down the line is nice to daydream about. No daycare, no mortgage, just mundane bills. Our grander more detailed master spreadsheet does account for upping the budget down the road for things just like you mentioned. Kids activities, kids clothes, groceries, omg the groceries – we saw our cousins (8-11) just devour hamburgers and hotdogs and realize we may need to up that category even more. Sigh….

I saw you guys “unexpectedly” cut the cord – nice one! Hope you got to catch the game last night, it was a great kickoff to the new season!

I’m also dreading what sounds like possible death knells for the ACA. If not death knells, just the lack of providers is probably going to drive up costs as well. That’s for future Mr. SSC to worry about, oh wait, I’m future Mr. SSC, dangit! Yeah, that’s a big unknown expense just lurking in the background.

TheMoneyMine

September 8, 2016That cake looks awesome! Definitely a lot of skills (and love) put into it 🙂

Congrats on the surplus this month, with less daycare to pay for, it can only be easier from now on!

Looking forward to an update on the FFLC date!

Mr. SSC

September 9, 2016Thanks! She does have some pretty mad decorating skills!

The surplus was a nice surprise, and it will be nice to see if our projected investments can be bumped up with Mrs. SSC’s new job since this last month went so well. We’ll see.

Currently the FFLC date is still ahnging steady at mid-summer 2018, hwoever, it may get bumped back to 2019 if all is well at that time, i.e. job is still good, commute is still good, etc… I don’t see it getting moved up too much from 2018, but maybe….

Mrs Groovy

September 9, 2016Way to go on the surplus. And that cake is so exquisite I think my hand would shake at the thought of slicing it.

Are the booster seats the last ones you’ll need to buy? Or will your children outgrow them before they reach the age/height for no-booster-seat requirements?

Mr. SSC

September 9, 2016Thanks for the compliment on the cake! She did a grapfruit curd in the middle which cut the sweetness of all that icing… OMG it was tasty!

Those booster seats would be the last ones we need to buy – for our oldest. Ugh… Our youngest is still in a regular car seat, so at some point we’ll need to “upgrade” hers to a booster type system that she can grow with as well. Oh well….

Dividends Down Under

September 11, 2016Wow that cake looks amazing SSC, she really went all out to make you that fine piece of baking. I hope you appreciated it!

Congrats on having a very positive month, to have a good surplus with only 1 income is a great place to be,

And wow AT&T service sounds bad! How can they get away with that – didn’t they issue some kind of confirmation?

Tristan

Finance Solver

September 11, 2016Happy belated birthday and congratulations on your expenses being so low! I’m tracking my expenses like a hawk as well and making sure that no unnecessary cost leaves my sight. I’m so glad that finances are something that I can control, directing where I want it to go without any complaints or repercussions. Have to love that fact about money!