According to “Retirement Calculators” I’ll Never Retire…

For these calculators to get those kinds of numbers, the assumptions they make have to be pretty ridiculous, but it makes me think that these calculators can be misleading for the uninitiated. The biggest discrepancy I see is that they don’t ask what your expected income level will be. I only found one calculator that let you put that in, and nope, it wasn’t at Vanguard. I know, I expected them to have a better version of a retirement calculator, but with the screenshots I snagged, we can see why it falls short.

Holy Crazy Assumptions Batman!

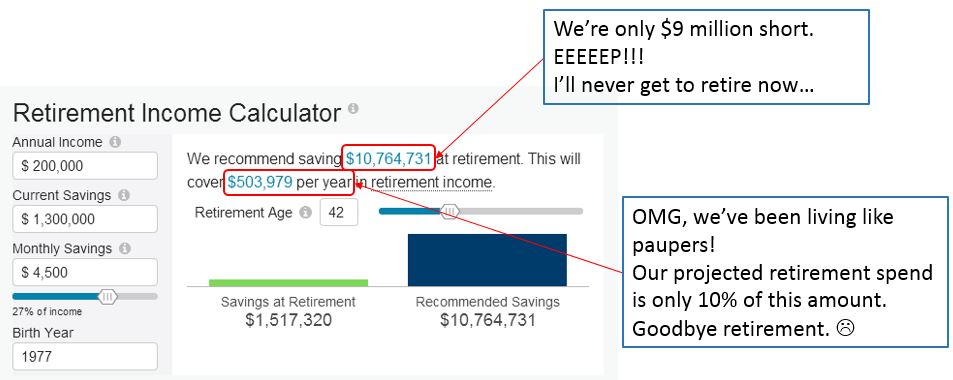

Let’s start with the calculator that sparked this whole post. Again, I don’t want to say where I found this or what company is running it, but just google “retirement calculator” and have fun playing with the different versions that are out there. This calculator basically took my assumed income (not really my income, but that would be nice) and the current savings input number (not our actual number but close enough to where we’d like to be at retirement to know if the calculator is telling the truth) and spit out a freaking ridiculous number. How ridiculous you ask? Well, let’s look at it. My assumed income is $200k/yr and evidently I need to save enough to spend $500k/yr because in 25 yrs (assuming I retire at 65) I’ll have more than doubled my spending rate, and hopefully income to support that lifestyle. How it thinks I will spend $42k/month, yes, $42k PER MONTH is mind boggling. Remember that according to the Census Bureau the median US household income is only $53k per year. PER YEAR… And this calculator is telling me that I’ll need to save enough to spend $42k per month?! Holy shit….

I’ll Never Retire…

No wonder people get dismayed when looking at retirement needs and savings levels. I’d be really discouraged if I thought this calculator was for real. I mean, to save $10.7 million I’d have to work another 110 yrs at our current savings levels. Actually to put it in real terms if I exclude compounding growth, I only need to save $376000 per year between now and when I turn 65. Oh yeah, you read that right. This calculator assumes I will magically gain a 53% increase in salary and be able to save ALL of it towards retirement. Wow, just wow… Who the F created this thing?!

Surely Vanguard Can Save Me?

So, I thought surely all calculators can’t be this bad, what about Vanguard, the crème de la crème of institutions that us FIRE folks love. Well, they don’t love early retirees that’s for sure. Evidently in their world you can’t retire before 50, yep, that’s the lowest age that their calculator goes. Boo… I can’t save more than 30% of my salary, because really, who does that? Oh yeah, us and probably most of the PF community. If you don’t save that much, don’t feel badly about it, that’s why it’s called “personal finance”. I’m just pointing out some flaws with their assumptions. I mean building a retirement calculator can’t be much different from building a house right? You start from nothing and design a blueprint, layout, and add all the bells and whistles. So why not make the age for retirement anything before 50 or savings rate anything over 30%? I’m no software engineer, but if you can cut it off at a certain point, why not set that point at a crazy range so people can estimate things outside the box of “early retiree is 50” and we can only save 30% of my income. At least they only assume I’ll spend 60% of my current income in retirement, which we don’t. Maybe closer to 25% of our income would be realistic, but not 60% otherwise, I’d have to work until I’m 65.

Bankrate’s Calculator – A Nice Way to View Retirement Projections

This fairly simple calculator from Bankrate had a different take on it. Basically, you put in your inputs and then it shows you waht your portfolio could generate in monthly income. So, again if you know your monthly needs, you can figure out what you may need to start with to get there.

Really, MarketWatch has a nice Calculator? I’m Pleasantly Surprised

Then I found a nice calculator at Market Watch that didn’t set variables on anything. PLUS, it lets you calculate what you need for retirement income totally removed from assumptions based on what you make now. You can input your yearly retirement income needed based on your assumptions, not any random made up assumptions. Brilliant! PLUS, like the Bankrate calculator, it allows you to set inflation, tax rate, retirement tax rate, rate of return before and after retirement, I mean, it has it all. If you want a quick look at how doable your situation might be. Our spreadsheet also does this, but it gets so complicated explaining it, that um, yeah, this works great for me to play around with. You can see in this scenario we run out of “pre-60” money at 56 yrs old. Yipe! Granted, I could add more tweaks, and get really specific with our numbers and get a more realistic outcome, but the main point is that this is actually a good calculator.

If you want to play around with your numbers, I’d recommend using this one. Cfiresim also has a good calculating system, but it runs your data against all the historical data. So, if you hone in on a situation that you like using this Market Watch calculator, then you can plug the same data into Cfiresim and see how that plays out for you. It also lets you add in additional costs like estimating healthcare costs in the future, additional income and more.

Summary

We found that creating our own spreadsheet worked best for us. It’s grown and changed over the years, as we find different things we want to track, but it’s essentially our version of these 2 calculators. I rarely use it, but Mrs. SSC runs different scenarios on it about every other week. I just plug our data into one or both of these calculators and let it run and then discuss specifics with Mrs. SSC. I do use the spreadsheet but I often break it, so it’s good I’m only working with a copy, lol.

What about you? Do you use your own spreadsheet or a different retirement forecasting tool? How comfortable are you with the assumptions these online calculators make? Are they realistic for you or totally off base like I found? Let me know!

Revanche @ A Gai Shan Life

June 19, 2017It’s true, the retirement calculators out there really aren’t great! I’ve been dabbling with various blogger provided spreadsheets and according to more than a few of them we’ll need to work 70+ more years before we can afford to retire. I’m not sure where it’s all going wrong, Ms ONL has me convinced they’re all overly pessimistic, but I’m sure that those numbers would be daunting to non-PF bloggers!

Thanks for doing all the digging, you’ve found at least one I haven’t tried yet so I’ll have a look at that one later and see if the results are better 🙂

Mr. SSC

June 20, 2017I shared our spreadsheet with our Mastermind group and I’d say that when we were discussing it that yep, we have a lot of the scenarios set as overly pessimistic. Flat 4% growth on our 401k’s, high inflation, higher healthcare assumptions, etc.. However, we also have the flexibility to turn those into moderate and optimistic situations with just changing a few cells. It at least gives us a “plan for the worst” scenario knowing that things shouldn’t be quite that bad.

I’d personally rather know what’s the worst case than the best case. Then the realistic case looks great, and the best case, well, we can dream right? 🙂

Mr. PIE

June 19, 2017First of all, congrats on the great interview on ChooseFI podcast. Mrs. PIE and I loved it!

LOL, this retirement calculator nonsense was the straw that broke the camel’s back when we asked our then financial advisor to run some projections for us. I think the number he initially cam back with was $7.8million. Effing hilarious. We pointed out some shortcomings of his work product, followed by some shortcomings of his support for us in general and then gave him the proverbial size ten boot! Never looked back.

The Ultimate Retirement Calculator (bit of a marketing ploy there in the name!) from Todd Tressider at the Financial Mentor is a very flexible and usable calculator. Can input all sorts of variables, assumptions (tax rate, inflation rate), income sources such as pension. Tax rate and inflation rate have a dramatic effect on projections so worth thinking about those very carefully. We like this one a lot.

The Can I Retire Yet blog has a great series of posts on retirement calculators. We still need to get round to checking out Pralana (Bronze or Gold packages), one of the calculators Darrow speaks very highly of. There is a one-time fee to buy the Gold software. It has all the bells and whistles for some very sophisticated modeling. Bronze modeler is free.

Will need to check out the Marketwatch calculator. Looks very reasonable.

I think the best practice is to run a number of projections through a few mid-to-high fidelity level calculators and revisit often.

It’s a real shame that Fidelity or Vanguard or Schwab don’t offer a great calculator. They do so much other stuff for investors very well.

Mr. SSC

June 20, 2017Thanks for the podcast compliment. It was fun doing it, and hopefully I didn’t sound too rushed while speaking. 🙂

Oh man, that reminds me of when i emt with a financial advisor. I’d even given him our projected spending needs based on tracking numbers for ~2 yrs, our college savings, etc… It was a shit show. I kept correcting him on things and pointing out that based n the numbers we gave him, we met some of his predicted metrics already. Needless to say we didnt go with them.

Oh man, Mrs. SSC’s spreadsheet factors in tax rate, inflation, fees for our accounts, dividends, growth, extra income, extra “outflow” of cash, car costs every 10 years, etc… It took a while to develop and it grew organically, but it’s pretty comprehensive. Or rather it works well for us. 🙂 I shared it with a Mastermind group, and it took me almost an hr to make a powerpoint explaining everything. This was just putting boxes around items with colored arrows saying things like “This is inflation”, “these are your taxable income fees”, “this is taxable income growth”, “this is tax rate”, etc…

After doing that I udnerstand the sheet now and pay with it more than calculators, but OMG, the $10 mil number that initial calculator suggested had me laughing and upset. No wonder people get dismayed thinking retirement is unattainable.

Yeah, I agree that it’s too bad that Vamguard doesnt have a better calculator. I mean, really? It can’t be that hard to design it with lower settings and better ranges on inputs.

At least the Market Watch claculator lets you input spending needs per year, tax rates before and after retirement, growth, inflation, etc… You can add as many as you want in extra income, retirement accounts and all that. It was pretty reasonable.

Amber tree

June 19, 2017Well, sad to read you can never retire… 🙂

I never used an online simulator as they tend to assume too much: regular career, spend 60 pct of last income in pension,…

In defence of these calculators: most people have no idea of their numbers anyway, so something is better than nothing. We can hope it makes the people think and take action.

I have my own one.for now, it only guesstimate the year I will be fire based on some inputs like current asset, expected spending, inflation and investment returns.

Mr. SSC

June 20, 2017It is sad, and to think, I thought we wre so close now… 🙂

I agree something is better than nothing, but it could lead to reactions like when Iw as first introdced to MMM and his $25k/yr budget. I took a look at it and said, “Nope, not doing that.” and promptly forgot about it. If I was single and hadn’t met Mrs. SSC, I’d see those numbers and think I would be spending more than $50k/yr and think I would have to work until I’m 65 or close to it.

Then I’d have no real motivation to decrease spending, reduce lifestyle inflation or any of that because, “I’m working until I’m 65, so what does it matter? I may as well enjoy it now, right?”

I guess that’s my main complaint is that they seem to be more fearmongering than provide a realistic model to use.

The Green Swan

June 19, 2017I haven’t played around with the Market Watch calculator before so thanks for pointing that out. I get so frustrated with the mainstream calculators that basically ignore them these days and primarily just play around on cfiresim as well.

I guess early retirement is just too far removed from the mainstream for retirement calcs to consider it even as an option… Too bad!

Mr. SSC

June 20, 2017Yep, same here. I like the variability of inputs and models and ease of changing scenarios with Cfiresim that except for our spreadsheet, it’s my go to. Especially when I want to run some quick one off scenarios.

I was surprised that I only found a couple of calculators like MarketWatch and Bank rate that let you input almost all of the variables. Especially key ones like retirement spending per year. It seems so simple but makes a HUGE difference in outcomes and amounts needed.

Mrs. Picky Pincher

June 19, 2017I agree; we have our own spreadsheets for monitoring our money and early retirement dates. I think retirement calculators are cool and all, but they aren’t nearly as robust as they need to be to give you a true number.

Mr. SSC

June 20, 2017I totally agree. If you ahve your own spreadsheet, then you at least have an idea of a nubmer and can use Cfiresim to run varying scenarios with that number and how it holds up against historical data. I find that interesting.

Maybe I should do a whole Cfiresim review. This post got so long I didn’t want to clutter it with that, but it would be easy to setup a Cfiresim review and all the awesome variabilities you can play with.

EZ Does It FI

June 19, 2017I’ve always used my own sheets and even played with some monte carlo and solver functions. Now that I’m getting into R and SAS at work, I’d love to build some empirical models of ERE prediction. Unfortunately, the data set is too narrow, so all the useful predictions are extrapolative.

Mr. SSC

June 20, 2017Mrs. SSC likes running Monte Carlo scenarios with our spreadsheet too. 🙂

It’s tough getting a wide enough range of data to make the model statistically valid, but it’s still a good gut check of lows and realistic outcomes to let you gauge your comfort factor with your scenario.

Tim Kim @ Tub of Cash

June 19, 2017Oo nice. I love running numbers through different FIRE type calculators. And I agree, that many of them don’t even allow you to put anything pre-50, or a crazy savings rate. Because I guess, the developers probably thought why program for that type of functionality if the majority of people won’t retire that early. At least that’s my assumption. Thanks for compiling this list!

Mr. SSC

June 20, 2017Oh, the laziness factor crept into the retirement calculators. Interesting concept, and i bet it’s probably closer to the truth than we know. 🙂

I like seeing how close or far off different calculators tell me how I’m doing. At least I have my own spreads sheet to ground truth their results.

Mrs. COD

June 19, 2017Wow, so glad you know your own numbers and don’t have to listen to all these calculators! The sad thing is that so many people will simply pick one of these sites at random and believe whatever it tells them. True, many can and should be saving more, but what a bummer to look at this and think you need $42K a month or something equally ridiculous. Keep spreading the FIRE word!

Mr. SSC

June 20, 2017I know right?! Like, $42k/month, is just ridiculous. That’s like Tori Spelling or Angelina Jolie level of spending, but at least they have the incomes to cover it. Well, maybe not Tori Spelling, but that’s a different story. 🙂

I know I’d get dismayed and dejected if I didn’t know that we only needed $50k/yr or close to it for our numbers to work.

Brian

June 20, 2017Can you let me know where you work and making $200K, I’d like a recommendation for a job there. 🙂 This is why I still like spreadsheets and running the numbers myself. Although the MarketWatch calculator looks pretty good, I’d still double check any assumption made on any type of a calculator like this.

Mr. SSC

June 22, 2017Well, that’s the up and down of Oil and Gas. Granted that’s not necessarily my salary but rather an approximation of our incomes to test out the calculators. They do pay well though, until you get laid off, lol. 🙂

Yeah, the assumptions it starts off with are pretty normal, but I like it in that you can change almost anything it uses to calculate – growth before retirement, growth after retirement, interest rates before and after, yearly spending in retirement, etc…

For me it was interesting seeing how they split out things like housing, healthcare, and the like, coonsidering we’re not going to have a mortgage. Since we know what we spend per yr, it doesn’t matter what how they divvy up that “yearly spend” portion. We know where it goes. 🙂

You do need to be wary of these things though because sometimes the assumptions get beyond ridiculous.

Laurie @thefrugalfarmer

June 20, 2017I like the Bankrate calculator, personally. I think the first calc you mentioned is probably correct, if based the spending habits of most Americans. 🙂

Mr. SSC

June 22, 2017Hahaha, maybe I DO need to be spending $42k/month. I mean seriously, we must have been living like paupers not to be spending that much. 🙂

Fruclassity (Ruth)

June 20, 2017I’m not enough of a numbers nerd (and I use that term with respect) to bother with retirement calculators. I have a good old-fashioned pension plan, so I know what to expect for retirement. Our goal is to get completely out of debt so that we can actually live off of it – and we’re getting there : ) Very interesting that most retirement calculators are based upon assumptions like max 30% savings rate and “early” retirement being at 50. Perhaps you will design a retirement calculator for FIRE types once you are living your FFLC?

Mr. SSC

June 22, 2017Ooohhh, that could be an idea. Or at least make ours user friendly enough that anyone can plug and play with their numbers, accounts, etc… On that note, Cfiresim is the best one I’ve seen that can let you validate your numbers against historical data and returns. It’s gained a lot of flexibility and added all sorts of cool functions over the years.

Maybe I’ll have to do a follow up post just on Cfiresim and all of the variables it lets you play with.

Jason

June 22, 2017I do like the Marketwatch calculator although some of their assumptions on spending on interesting. Supposedly I would spend 10k on transportation or $20k on housing (I suppose that is possible if I have a mortgage). The good thing is based upon their assumptions I can retire at 55. I have no intention of retiring at 55 (I don’t want to the do the RE at least now of FIRE). However, some of these things they expect (e.g. that you will spend at least 75% of your current salary and the like). I don’t know how that is possible considering I save about 30% of it now.

Mr. SSC

June 22, 2017Yeah I saw how it bracketed out spending assumptions on stuff like housing and healthcare, and all that within the “yearly spend” number you give it. BUT, if you’re like us and know what your yearly spend will be, it doesn’t matter how they divide up that number into what they think it should be. I agree, it is interesting seeing how much they assume goes towards housing, and all the other necessities in life.

I liked the flexibility in it that lets you change almost any variable they use to calculate your scenario. Don’t like their spending number, type in your own yearly spend number. Think their inflation is too low or high, change it and see how that affects things.

For me, it’s easy once you spend about 5-10 minutes inputting your parameters and getting a baseline. THEN, I screw around with inflation, yearly spending, decreasing 401k growth, etc… and can see how each tweak affects the outcome. Adding in $20k/yr for healthcare for instance had an impact but not nearly as horrid as I was expecting. I like seeing how those things affect outcomes, which is why I also like Cfiresim.

I may just do a follow up post on it since I barely mentioned it here. It’s just too cool to not cover in its’ own post. 🙂

Mrs. BITA

June 22, 2017Great roundup of some decent and some laughably ridiculous calculators. I hadn’t seen the Marketwatch one before, so thanks for that.

https://financialmentor.com/calculator/best-retirement-calculator is also pretty decent but the one I use most of all is still cfiresim.

I have no idea why so many retirement calculators try to size your retirement stash based on your income instead of on your expenditures – that is such a fatal flaw.

Mr SSC

July 23, 2017Oh man, seriously that is a killer flaw in loads of them. Like me needing 10 million because I need to spend so much… wtf, man, wtf…

I use cfiresim the most still too and love that it has my scenarios saved so I can log in and run thru 3-8 scenarios all in under 20 minutes. It makes me laugh, think I need more, think I need less and see how a $20k/yr additional health care costs could affect things. Thanks for that link to another calculator! I did like that you could tweak all the variables in the market watch calculator similar to the cfiresim variables. Since I’m looking at an overall yearly number needed, I don’t care that it breaks out how much would go to housing, health, etc… Seriously though, $10 mil needed? I’d never hit that number unless I really worked until 65 and then, what am I going to do with all that coin except try and fix all the health issues caused by 25 more years at the office. I literally just shuddered thinking about it. 🙂

EL

June 23, 2017Yeah most of these calculators are broken or skewed to keep people working. If we are not working and investing, they lose money. Banks, brokerages, mutual fund companies – they need that steady stream of assets so they can use it to pad their revenues. IF we start using principle it is not good for them.

Mr SSC

July 23, 2017That’s the truth, they aren’t setup to make you want to retire early or ever, lol. I understand why they need some rates and have people keep their accounts longer than need be or use them instead of the DYI approach, but still. It’s just so easy to DIY nowadays and it’s good to have some calculators that you can tweak your own assumptions and see what your number is and how close your plan will cut it.

Liz

June 23, 2017Stumbled on this site and think your FFLC is an awesome idea! A lot of your story resonates with me – being burdened by a mountain of debt from grad school and feeling like I might never get out from under it…even from a rather modest state university in the Midwest. I’ve only recently started thinking about my financial future (or lack thereof), but you’ve given me some hope. Graduating in midst of the recession, I’ve felt like it has been one wave of bad news after another. Thanks for giving me hope!

Mr SSC

July 23, 2017Glad you could get some hope out of that, and fear not, things are possible to turn around. Tracking your savings can show spending leakage that you could convert into savings. At the least it lets you know where everything goes and whether some of those things are as big of a priority for you to keep spending on them or cut them out. Good luck!

Jennifer

June 25, 2017I love your site! For the past few years I have listened and read all about financial independence – and no matter what I enter in the calculators out there, I should be about 86 years old if I can put 100% of my salary into investments starting NOW.

So – now you have written an article just for me! I will take a long look at these calculators and hopefully come out with some sort of plan besides no plan that is possible…

THANK YOU!!!

Mr SSC

July 23, 2017That’s depressing right? I get the same thing when I enter stuff into the calculators even when I know that’s SO far from the truth. Ugh…

I’m glad you connected with the article. The whole point was, these things are so ridiculous it can discourage someone from even starting. Hopefully you got a good plan put together with one of those calculators.

Mrs. Groovy

June 30, 2017I’m surprised,too, about Market Watch. Who knew?

Mr. Groovy ran the cfiresim calculator a few years ago but it didn’t tell us anything we didn’t already know. The one blogger who keeps good updated information on all the calculators is Darrow Kirpatrick at caniretireyet.com. Oops I see Mr. PIE already mentioned him, so I second that.

I see Mr. PIE also mentioned your podcast interview on ChooseFI, too. I missed it but I’m going to look for it right now and put it in my queue for tomorrow’s walk!

Very informative post!

Mr SSC

July 23, 2017Thanks for the other calculator source recommendation. And yeah, who would’ve thought Market Watch has a reasonable calculator?

Yeah cfiresim isn’t super revealing if you already know your numbers, but it’s super easy to figure out weird quirky things like, what’s my max spend number or how could adding in health care affect things. Hope you enjoyed the podcast! 🙂

theFIway

April 4, 2018I noticed the same. These online calculators take a snapshot in time, don’t account for random changes over the years and 20 other variable. They also make assumptions based on old school data regarding income vs expenses. I went the spreadsheet route and it makes much more sense.