The ‘lightbulb’ emails

Last summer, I started paying attention. There was plenty of back and forth, and when Mrs. SSC was talking about “We only really need ~$60k/yr to be comfortable” I had to put the brakes on this crazy train, and I began to argue debate her assumptions on how much we would really need to live off of.

And this is where the story picks up with the email exchange below….

To: Mr. SSC

From: Mrs. SSC

Sent: August 13, 2014 9:05AM

Oh – I’ve accounted for tax, don’t worry – I added in 10% of federal tax, and 7% State tax (for Idaho – they are high!), and then also property tax. So that is all in the formula. It’s just I wonder if there are ways to avoid paying taxes…

Yeah – I like a 15% cushion. Some years we may need it, some years not. In my new & improved spreadsheet (still working on, it’s complicated) I’m adding in cash – setting it at 2 years cash (maybe we can have 1 year cash, 1 year CDs, and then our normal emergency fund in cash). Plus, if we need to tighten up, that 2 years of normal cash would last us at least 3, maybe 4 years in a bad economy – without us getting jobs, and without us taking money out the investments.

So – in the budget I’ve made a few adjustments. Note that cable TV isn’t included, I’m assuming in 5 years you will have found a way to get football streaming. Note also how I’ve added in $500/month on misc. stuff – like house misc. (broom, furniture polish, picture frame, new garden hose, etc), shopping (I guess pharmacy type stuff or just random shit), and kids’ stuff (clothes, school stuff, sports, etc.). So that is almost $6k/yr. of mostly optional crap built in Plus, I am rounding up to 65k with my calculations anyways.

To: Mrs. SSC

From: Mr. SSC

Sent: August 13, 2014 10:14AM

What I’m worried about is saying, “yeah see we can retire even earlier, we just have to tighten the belt even more. Let’s quit now, we can do it, we’d just have to tighten the belt even more, and move it up to our neck, and tie it to something high….” I’m just saying I don’t want to move our budget so far down that we retire, things go south and we’re struggling week to week. And worried about money. Especially If we live somewhere that we can’t pick up oil jobs, I’m a bit more skeptical of the 2019 date.

Just something to think about to let you know where I’m coming from. Xoxoxo

To: Mr. SSC

From: Mrs. SSC

Sent: August 13, 2014 10:41AM

I know. But don’t worry – we will have a nice big buffer in there by the time it all comes around. All I’m saying is 2019 is possible. Do you see anything missing from the ‘budget’ or what makes you think 65k wouldn’t be enough? (this is just a conversation , not an attack). The way I see it 65k has a ton of money built into it – 10k of ‘fudge factor’, 2k in rounding –up, maybe 2k in tax deductions, and if things get rough – up to 12k in deferred ‘allowances’. That is $26k of leeway even before cutting-coupons and turning town the AC/heat and duct-taping shoes to make them last… 😉

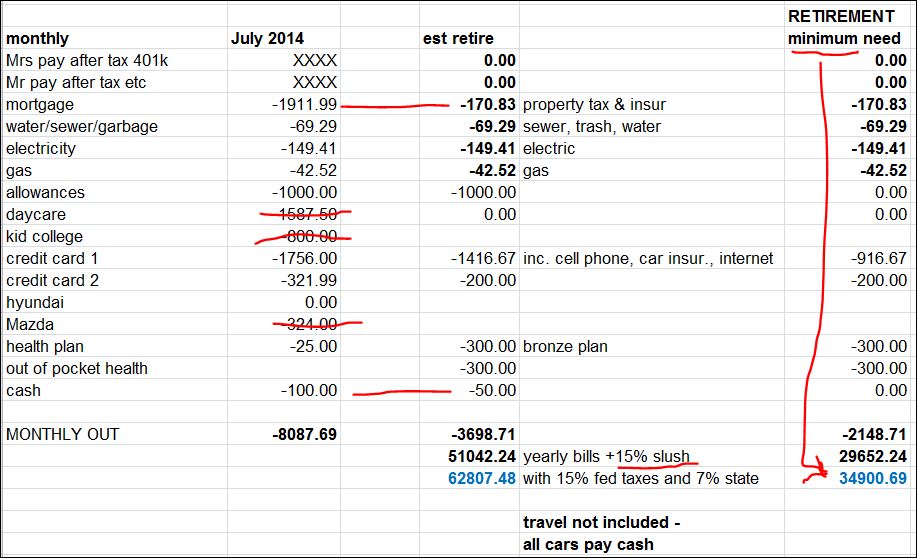

Here is a comparison… showing all our expenses currently. The credit card goes down ~$500 because no maid, cheaper cell phone plan, online TV instead of cable, less car expenses (commute/tolls gone). This is what I mean by we aren’t going to need to change our lifestyle much. The July 2014 credit card amounts shown are the average of what we’ve spent the last 6 months – and there were some pricey months… I mean daycare, mortgage and college savings are over $4k themselves that we won’t be paying when we retire early.

Trust me – I’m not trying to fudge numbers to get out of here earlier… I am just trying to understand the actual costs and balance them with being conservative, our comfort level with ‘risk’, and how much time an extra year in the office vs in the mountains hanging out with the kids is worth 😉 I hate cutting coupons!!!! Lol And honestly – there is no way I am not going to have some part time job. I might not get it until the kids go to middle school, but I will have one just to stay busy. Plus, there are ways we can start tapping the 401k early.

To: Mrs. SSC

From: Mr. SSC

Sent: August 13, 2014 12:12 PM

Ok, so you’re saying that right now we have ~$8k going out each month, BUT that includes stuff that won’t be there in 5 years or less. So essentially we drop out ~$4.5k each month. SO, make sure I’m doing this right… with those bills dropped out we are at ~$3700/mo in bills. Then you add a 15% buffer to that to get to $51k/yr for our “pseudo-minimum” needs. Then you add in taxes to work back to where that would put us “pre-tax” which is ~$63k. Then you’re rounding up to $65k as another small buffer. Hence the target of $65k/yr. Huh…

What you’re saying in the right column is that if things get really bad, we cut out allowances, and other things to get to $35k BARE minimum need, but those would be some really sucky times. But, targeting 65k/yr, we would only need about half that to cover the “non-bankruptcy option”. That’s assuming neither of us is working, just living off our saved income. So if we got any jobs that would be on top of this, and if they covered any health care, that would be less overall number.

So then, essentially, this doesn’t even factor in 401k’s because that’s “future money” not included here, this is just the “getting to 401k” type budget, not factoring in any sort of part time work, or other income? Holy shit! Seriously, if this is the budget from now until then, and we both plan on working part time or side gigs, why in the hell are we still working?! Oh right, we need to hit our number first…

I can’t believe that’s all we’d need though. I mean it’s all right there, but yeah, I’m just amazed that the number is what it is, with all those buffers built in and not counting any side income or jobs. I just thought it’d have to be higher… Seriously, I figured it’d be higher…

I think at this point Mrs. SSC read this and smacked her palm to her forehead while rolling her eyes. On the plus side, she was probably happy I finally got it and was on board.

It seems like this is common amongst FIRE couples, with someone pushing the issue and the other person is in my position until they have their own “lightbulb” moment.

Do these types of conversations seem familiar with your better half? Please let me know we aren’t the only ones out there that went through this…

Even Steven

December 1, 2014Thanks for letting me peak into your spreadsheet, I modified it more to our real estate heavy projections, created a couple extra tabs for Cash vs Taxable Investments vs Non-Taxable Investments and threw in a Actual vs Projected to see how I want things look like and what they actually are, let’s just say I had a blast and looked at it for about a week!

I have had the the can this really work conversation many a time, still have it. Right now the Mrs. is focused on paying off the FL home early, which has 2 years to go, then we will sit down and talk…..after a nice trip somewhere fun.

SSC

December 1, 2014I’m glad you found some use for the spreadsheet! Once you pay off the FL home and have a lot more extra money around you can start investing it towards the “can retire early” fund. It wasn’t until we had the extra cash after paying of Mr. SSC’s loans and showing him the track record of how much we have been saving and how little we really needed that it clicked for him. (Mr. SSC sidenote – it wasn’t until I thought the train to crazy town was rolling into the station that I really looked at stuff to defend why it shouldn’t work. But, also with Mrs. SSC having tracked everything to show a fairly airtight case for it being possible was when the light went off. Keep at it and she’ll come around eventually.)

Even Steven

December 2, 2014Haha I love the train to crazy town, ALL ABOARD!

Ryan D

August 23, 2022Hi! Love your page! I was looking forward to checking out your spreadsheet, but the link seems to be dead..I know I’m a little late to the party, but thanks for anything you might be able to do on your end, if sharing it is still an option! Thanks 🙂

Mrs. Maroon

December 1, 2014We definitely have this debate too. I’m in the “can we really do this” camp while Mr. Maroon is voting to retire tomorrow (well not quite). Mr. Even Steven speaks highly of your spreadsheet. Being nerdy engineers, we both appreciate a good dose of Excel too. Would you mind sharing?

Mrs SSC

December 1, 2014Personally, I would like to retire tomorrow too! I’ll send you the spreadsheet later tonight 🙂

Mr. Maroon

December 1, 2014Nerdy engineers indeed. A romance born of a chance meeting in a calculus class. We do love a good spreadsheet.

I’m told many couples argue on how to spend money. We argued on how to build the spreadsheet we use to track how we spend money.

Emily @ Simple Cheap Mom

December 1, 2014Thanks for following up and showing us the email exchange. I love looking at spreadsheets, so this was a fun one.

A little bit of a tangent, but you may need to replace a car at some point, so maybe that should be worked into the budget. You’ve got a nice buffer, so it won’t actually be an issue for you, but it’s just something to think about.

Mrs SSC

December 2, 2014Don’t worry Emily – I have a car built in! In another (more complex) spreadsheet, which I don’t show here, I have a column where I add ‘extra items’, like a car every 8 years or so, a house move (assuming downsizing after the kids leave), and even a little extra money in the budget each year when the kids are teenagers.

Amy K

December 2, 2014I’m with Emily – there’s no car replacement/house maintenance/ Oh Crap! fund built in to the $65K. Mrs SSC with a part time job should more than cover it, but I think it’s important to acknowledge that there will be irregular expenses. For us it’s about $12K/year. Over hte years we have remodeled the kitchen, bought a new car, re-roofed the house, repaired the basement, repainted the house and replaced the carpets, next year we have to regrade the lawn and install gutters and I want a new car… There’s always something!

Also: travel? We live in Massachusetts and have family in Michigan that we fly to see 3x/year, plus we go somewhere warm in February each year. That tallies up to $8K in travel for us each year. Our goal is to move back to Michigan so we can drive to see family, dropping that to more like $4K/year for travel in retirement.

SSC

December 5, 2014I do have some of that built in — we only posted part of the spreadsheet – over the last year or so, I’ve done some more complex calculations, adding in big expenses like cars every 8 years, and moving when the kids leave the house. I’ve budgeted $100/month for house stuff – although maybe that isn’t enough. But I also added in a 15% ‘slush’ which is ~$4000 that can be used for any random big purchases or travel that come up.

Mr. SSC

December 5, 2014There’s definitely always something. As Mrs. SSC pointed out this is the “simple” version trying to get me on board with the early retirement. I definitely don’t want to not have budgeted for travel or similar items and feel they’re as important as having free time. Maybe we’ll revisit the home maintenance expenditures and make sure we’re covered in that category. Thanks for pointing that out!

TheMoneyMine

August 3, 2016I love the format of email exchanges between Mr and Mrs!

This kind of discussion was initiated by me in our couple and we definitely had a very similar “look what we can do”, “no seriously, this is real”, “glad you’re onboard!” kind of discussion.

Interestingly, we are also targeting 65k$ of spend and we have a similar ‘bare minimum’ spend of about 15-20% less, in case we need to retire earlier or things go south with the markets.

This is a very good story and one that I’m sure many couple can relate to. I’ll add a link to this in my post!

Mr SSC

August 4, 2016Thanks for the link add! We’ll be putting together a more direct How we FIRE’d type of post shortly, so I’ll send you that link as well, but I figured this at least got the point of my side of it across. 🙂

Like mentioned in the comments, this is a simple version of a more complex spreadsheet with irregularities and cars and kids and college built in, but it gets the point across just the same.

It’s funny on the emails because we were still working at the same company in the same building and would have exchanges like that mst days about different things, but back then, our whole FIRE plan was a heavy topic. 🙂

Realizing that we could live like we have been, and have a decent bare minimum buffer built in was surprising to me, as youc ould tell, but it was key in getting me on board.

Todd

March 26, 2017I just came back and reread these for the first time in a while (I recently suggested this particular post to the folks over at ChooseFI.com – maybe a podcast appearance could be in your future)?

Seriously, this is the most influential/inspiring post of anything I’ve ever read in the FIRE community. Just absolutely fantastic – can really experience that “ah-ha” moment.

And as I’ve mentioned to you guys before via email, this post single-handily was able to bring my wife on-board with the entire FIRE concept.

Mr SSC

March 27, 2017Hey, thanks for the recommendation, and yeah, we got a shoutout over at ChooseFI recently.

I’m glad you are still enjoying that post, that’s awesome! If nothing else, I feel like it’s been worth it just from your experience with our blog. I didn’t expect anyone would get much from it or how long it would go or anything like that, so to have someone say they think something we wrote was that influential with them, is awesome. Thanks man!

Thanks for the heads up on that podcast site too. I hadn’t heard about them, but have enjoyed listening to them and have been bingeing lately. Which is significant because I NEVER listen to podcasts, unless it’s on road trips and that’s usually Stuff You Should Know, or Things You Missed in History Class. 🙂 But listening at the office? And to Finance related stuff, nope, not until recently. 🙂

Retiring@somepoint

April 5, 2019Hi,

Late to the party, I know, but I just found this post by bingeing on old ChooseFI podcasts and thought it was really cool to see your process. My wife (the “what are you talking about?” one in the family) will need some serious convincing when the time comes, but I feel like I really need to have all my ducks in a row before telling her about my FI plan for us. I’ve been mentioning the concept in general terms, but she’s heard enough hare-brained ideas from me that her tolerance is pretty low at this point, so I have to be extra-prepared! Thanks for sharing the spreadsheet. I’m going to look around and see if you guys ended up posting the more complete version somewhere that I can work off of… We’re still beginning our journey, so I’ve got time. And lots of homework to do!

Thanks again! Looking forward to reading more!