I STILL Have a Spending Problem

My Spending Problems Revealed

MY spending problem is that I like beer, I love music, I like eating at restaurants, and I like shopping (online or otherwise), yep, shopping is my weakness. I think it stems from growing up and always hearing “We can’t afford that” and then when I started to manage my own money I never told myself that. Literally… It’s why I was about $18k or so in credit card debt after college. I saw, “I can’t afford that” as “I’m failing at life” when in fact it’s the strongest statement you can make to not fail at life. If you’re strong enough to say “I can’t afford that” you’re even further ahead than you think you are. I didn’t learn that until way later in life. Even now reviewing these year-end statements, I see that I still haven’t learned that. Shopping is my go to comfort food of sorts. If I ate like I shop, whew, I’d be buying a lot larger sizes of clothes for sure!

I also love music, and OMG do I spend some money on music. I did find that joining Amazon Prime has saved me loads on actual music purchases. Yes, I don’t own those tunes, but when I get in the mood to hear something mellow like James Taylor, Paul Simon or Jim Croce – there are playlists for them, and I can “download” those artists to my library, at least as long as I’m a Prime member and I don’t have to buy them to hear them. Although, The Grateful Dead live albums are still UBER spendy, and the same with Phish. Dang live albums costing so much and being so good.

Shopping is fine if you’re not buying – right?

However, nowadays, I shop more than buy, but even that is a slippery slope. I catch myself looking online at things thinking, I could use a new pair of swim goggles, that last pair fits perfectly, but they’re a bit dark, maybe I need a clear pair. Do I need a clear pair? No, the dark ones work fine and maybe they’ll get me more used to not being able to see well so that open water swimming won’t freak me out. Do you know why I’m shopping to begin with – boredom.

I get bored at work sometimes (I’m not the only one right?) and that leads to checking gmail, PF blogs, etc… but usually in my email there are no less than 5 emails from companies telling me about their great deals. Mostly I click and review and delete, but occasionally I’ll go check them out. This can lead to unnecessary buying. I realized this and have started unsubscribing to any email that I see as a trigger for me to shop. Lowe’s, gone, Midwest Homebrew supplies, gone, Swim Outlet (I’ll miss your great deals but I know where you are online) gone, Amazon (yes we all know you exist), gone, well, you get the idea. I have just been cleaning up all of these triggers trying to reduce the amount of unnecessary temptation to go spend.

But why? It’s my allowance, can’t I spend it on anything I want? Yes, for the most part I can. With my donors choose donations coming out every month, my once a week or so lunch out coming out every month, beer (that can be a big one), clothes if I buy any, hobby supplies, video games (rare purchase recently), restaurants when Mrs. SSC and I go out on the now rare Friday off when we’re both free, and more it can add up pretty quickly. It’s easy to see why I am constantly running near empty in my allowance.

It’s Changing for 2017!

So, I’ve made a resolve to take my own advice and track my monthly spending. Sure I review my monthly statement to make sure they’re all my purchases and then I think, man I went out to eat a lot, or man I bought a lot of beer/music, or oh yeah, I did make those Amazon purchases of God knows what… Then I put it in the trash.

Not this year! It’s changing and it’s starting with me. Actually, that’s the only place it can start because I have autonomy over my allowance, haha! I plan to be more mindful of my allowance spending because that’s one area where I still play fast and loose with the rules. Not 2017 though. This year all this blogging advice finally trickles down to my personal wallet. I’ll keep you updated and let you know how things progress over the year and see if there is any difference. I’ve always maintained that I suck at personal finance, so we’ll see if this is true and if someone with almost 40 years of horrible spending habits can finally change them.

Do you have spending problems of your own? How do you deal with identifying your triggers or being more mindful with your spending?

Mrs. Picky Pincher

January 25, 2017It’s funny because you have the same problems as Mr. Picky Pincher. 😉 He loves beer, music, and buying knickknacks on Amazon for random little projects. Although he’s trying to curtail this by just listening to music via YouTube and brewing his own beer (his beer kit comes in tomorrow; it should be cool!).

The point is that we all have areas where we can improve. Nobody’s perfect 100% of the time. Hell, I spent $12 on clothes last night (used and on sale, but still).

Mr. SSC

January 26, 2017Beware the slippery slope of homebrewing, you can end up with just as many knick knacks and special widgets with that hobby too. I have pared my home brew stuff way back to just the basics but it’s easy to go overboard when you are getting started.

I agree, noone’s perfect, I just need to be more mindful with my allowance, since I am like that evey where else. 🙂

Ellie @ The Chedda

January 25, 2017Mr. Chedda and I have very different spending priorities but we haven’t moved to the allowance method. Do you still like it and feel like it works for you?

I just try to trust that he has our household interests in mind as much as I do when he’s buying something I wouldn’t have. Like he must actually really value those bluetooth speakers and think they’ll add a lot to our happiness if he decided to spend our shared money on them. It is really hard for me to let some of them go, though, so I’ve been trying harder lately to embrace that mellow attitude about his spending.

lindy

January 25, 2017My husband loves his allowance and I love him having it for those purchases which make me roll my eyes. And while that sounds like I don’t have purchases that make him roll his eyes, for the most part I don’t. My allowance builds up and up and up until I buy something BIG or go invest it. While he loves to fritter his away on little things.

Although, I might be rubbing off on him b/c his balance is growing since he has a big toy he wants to buy in a few more months. 🙂

I highly recommend the allowance!

Mr. SSC

January 26, 2017I agree, it’s perfect for that sort of thing. I did let mine build up a couple of times, and once surprised Mrs. SSC with an anniversary cruise, and I even lined up her mom to watch the kids! But typically, it’s frittered away on little things. ALthough i do have ~$2k in Sharebuilder from allowance and ~$600 in Robinhood so I don’t fritter ALL of it away, lol.

Mr. SSC

January 26, 2017Yes, I love the allowance system! It still works for us even though it ahs evolved over the years. It started for just the reason you mention above. Also, we both knew past co-workers that had allowance systems implemented and they seemed to work well for them, so we thought it would be worth trying out.

Like i said, ours has evolved to now cover things like clothes (when Mrs. SSC was buying a lot of clothes from the general fund and I wasn’t), any meal out (one of us pays), and basically anything that the other person won’t directly benefit from. My recliner everyone benefits from, but I wanted a recliner and we didn’t necessarily NEED a recliner, so I was like, “Fine, I’ll buy it, whatever” and I did. 🙂 Easy peasy.

It totally sidesteps having to deal with those feelings and questions you brought up because that’s what allowance is for. 🙂 Ours has worked great for us, you would just find a balance that works good for your life and budget. Good luck!

Brian @ Debt Discipline

January 25, 2017I don’t think I have a spending issue myself, but the overall family gets a bit lazy sometimes. I contribute by given into request and not standing my ground when a purchase is really something we don’t need, and fall in the classic want category.

Food is a killer for us. Three teenagers tend to eat a lot. We are really looking to make some changes to reduce expenses and increase saving with college coming up for 2 of 3 children later this year.

I think the best way to tackle it is just be diligent about tracking and reviewing.

Mr. SSC

January 26, 2017Yes, that’s exactly it, I’ve just been lazy with it and not nearly as on top of it as I need to be. I did forget to mention I’ve been at almost a $0 or negative balance since about August, and just got caught up in December…. Whoops. That’s sort of what prompted this thing, I can’t believe I forgot that in the post, lol.

Yep, this is the year of diligence on where my money goes. I don’t know that I’ll spend less, but I’ll at elast be mindful of it. 🙂

Tawcan

January 25, 2017The first step is to realize your have a problem. 😉

In all seriousness, I don’t think you have a spending issue. It’s fine spending money on what you enjoy. So many people get too focused on saving, saving, and more saving. You need to enjoy life too! Perhaps a good way to do this is to allocate a certain amount of money each month for “pleasure” spending. Then you don’t feel so guilty.

Maybe take a look at this article I wrote:

http://www.tawcan.com/guilty-pleasure/

Mr. SSC

January 26, 2017Yeah, I remember that article, I even commented about allowances on it, lol. I don’t think it’s a spending problem it’s an accounting problem, as I find myself spending more than I have allotted. I just now recovered from a negative balance that started in ~August… Mrs. SSC pointed out I should’ve mentioned that in the post, and i was like, “OH yeah.. Whoops”.

I need to be more diligent with my accounting so that I’m not at $0 or “overdrawn” each month, because that’s just ridiculous.

Mrs. Groovy

January 25, 2017I second Tawcan as I really don’t think you have a spending problem. I think you just need to have a little more awareness. Tracking every penny will be a huge eye opener. It was for us.

Mr. SSC

January 26, 2017Yes, definitely more awareness, especially when it comes to spending more than I have… Hahaha… Much like in college, keeping a running tally in my head month to month is clearly not working well for me. So yes, more awareness for sure. 🙂

Miss Mazuma

January 25, 2017I normally don’t look at my yearly spending reports but you inspired me! The categories were a bit off but it showed my love of Dollar Tree, Aldi, and Groupon quite clearly! I am sure if they broke it down proper my Restaurants would be up as much as you but in Groupon form. Now I have to go back and compare to 2015 – I am sure I will see my love of Whole Foods clearly revealed. Yikes!! My how the times have changed. 🙂

Mr. SSC

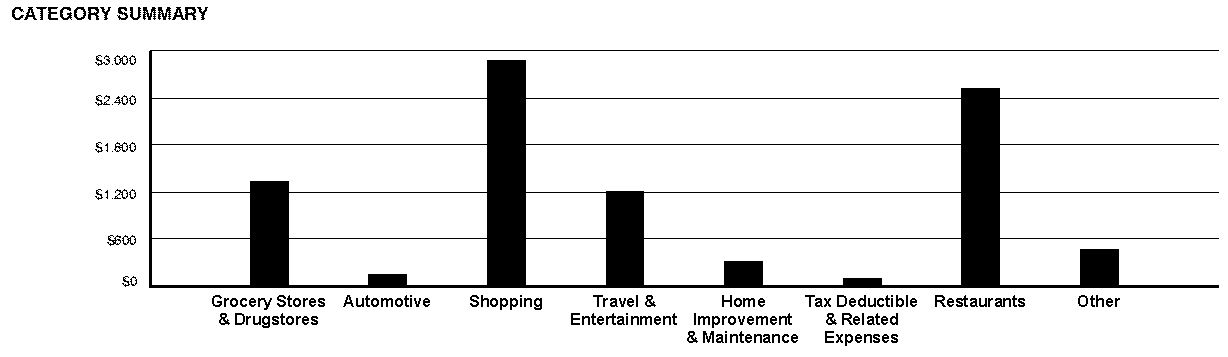

January 26, 2017Yep, the categories didn’t quite catch everything perfectly, but hey for a free compilation of my yearly spending it caught enough for me that like you I was like, YIpe! I also picked 2015 because it was way higher spending than the same categories in 2016. It helped make it more dramatic, but the overall trends are the same.

For me, iIt highlighted beer, music, and restaurants as my top spends, with bored Amazon shopping eating up the rest. Fortunately, i’ve broken that habit of shopping due to boredom, and Amazon Prime has curbed my music spend a LOT, but I do still appreciate restaurants and the social aspect of that. I just need to not spend more than I have… 🙂

Full Time Finance

January 25, 2017I tend to be the buy big expensive things type of splurged. I’ll go years without spending a cent and then bam I buy a car. In general I avoid exposure to those big thing hat would tempt me. I.e. I m not going to a Ferrari dealer and testing a car because heaven knows how it would turn out. Thankfully small knickknack have never been my kryptonite so it’s easier to avoid. My wife would say she avoids it because I nag her.

Mr. SSC

January 26, 2017Yeah I got my allowance up pretty high a couple of times and then went big. Once I had been shopping for a “new” banjo for about a year and came across a great deal on a Stelling Red Fox for $2100 and from a dealer, not private sale so I didn’t have to worry about scams, damage, etc… I love that banjo. Another time I had enough built up and noticed a cruise around our anniversary and lined up some childcare to cover while we were gone, ad then bought that and surprised Mrs. SSC with it.

I do have close to $3k in sharebuilder and robinhood accounts, but if I’m not eyeing any big purchases, I tend to fritter it away. This year, I’m just trying to fritter away less than I have allowed and not go negative. There’s always time for a first right? 🙂

Go Finance Yourself!

January 25, 2017We are the exact same as you guys only in opposite roles. We’ve used an allowance system for a while now. People poke fun at it, but as you say, it beats arguing over what each of us is buying. Glad to hear others are using this same system.

My wife used to always be the one in the red as she is more of a constant spender. She buys a lot of little things that add up to more than she thought. I on the other hand spend less often but make bigger purchases when I do spend. A few summers ago I joined a golf club right next to my work. I fund the initiation fee and monthly dues through my allowance. In just a few more months I’ll finally be back in the black after paying the initiation fee. My wife has a good laugh at this as she used to always be the one running a deficit and having to scale back spending to even it up.

Mr. SSC

January 26, 2017Exactly, it’s all the little things that add up to more than I think. Seriously, I’ve been in the red since about August and just got back to black in December. Embarassing… Especially because there haven’t been any real big purchases lately.

We’ve both run into that where we might have a big purchase and we’re fine running a deficit to repay it if the amount is 100% there, as long as it’s not every month sort of thing.

Yeah, it’s a great system and works well for us.

Edifi

January 25, 2017Yeah, dude, keep the allowance but tighten its budget. Also, give yourself a quarterly splurge chunk for that one big item every x months. If you want to cut that even more, start the diary. On days where you feel spendy/particularly non-spendy, write what you’re feeling. I’ve found that stress tends to drive my spendiness.

Mr. SSC

January 26, 2017Oh, good call about a spend diary. I mean somewhere to blather about whatever the stress is vs buying more random things that I think I “need”, lol. I bet stress is the underlying thing vs boredom, because i’ll get busy and stressed at work, and work like mad for a few hrs and then need to step back and take a breather. That’s when i try to go for small walks now instead of bounce over to Amazon or similar to shut off the brain.

I have cut back my mindless spending this past year, 2015 was a bit ridiculous, and I’ve cut back on my zombie online perusing. If I’m not just randomly shopping I can’t get tempted to buy that one little knickknack I just can’t live without that I didn’t even know about 30 seconds ago. 🙂

ZJ Thorne

January 25, 2017I currently spend too much eating at restaurants. Mainly with my girlfriend, who has nicer tastes than me. I’m in a busy period in my business and we think she may move hundreds of miles away soon. So that will still keep happening for at least the next month. Then it is buckle down time.

I love beer, too. So sad that the liquor store by me burned down. The one by work is often closed by the time I leave.

Mr. SSC

January 26, 2017Oh man, hopefully things go well with the move if she ends up moving. I can understand that aspect of hang out time, especially if you’re busy other times. Nothing like a meal to force you to talk and hang out and not have tv, work, etc… distracting you.

Tough spot with liquor stores too. Fortunately, grocery stores can sell full strength beer here (I’m looking at you CO and your 3.2 beer outside of liquor stores) so it’s usually not a problem to get beer when needed. 🙂 Ha, needed…

The Green Swan

January 26, 2017Interesting to see it broken out like that huh?! I like the “I can’t afford that” mantra you mentioned. Not a bad habit to get intro to start asking if you can afford every time you want a discretionary purchase.

Dining out can be a slippery slope for us too. We like trying new restaurants and occasionally grab a dinner with friends.

Mr SSC

January 27, 2017Yeah it has been pretty interesting, especially over the course of a year.

I like new restaurants and old favorites, but yep, it turns into a slippery slope pretty quickly with me, especially with co-workers. I’m fine saying no, but sometimes I’ll make plans for 1 lunch and then something comes up and the next thing you know I’ve eaten out 3 times that week. It’s usually buffered with me always bringing my lunch so it’s more rare for me to go out more than once a week if that, but when it happens it seems to come in waves.

ambertree

January 26, 2017It is unclear if I have a spending problem aside so nottrack where my personal fun money goes… Roughly 20 per week to eating with colleagues… Other than that, I have no real idea.

Mr SSC

January 27, 2017Maybe I should go that route, lol. No tracking = no spending issues, I like it!

Mrs. BITA

January 26, 2017You and Mr. BITA share two spendy categories – beer and music. We pay for Pandora and Google Music and that has helped. We don’t have a good solution yet for the beer. It is one of those things that really makes him happy and we can’t convince ourselves that sacrificing that to save a little harder will be worth the loss of day-to-day happiness.

I used to shop when I was bored. A lot. Now I play with my spreadsheets, read other blogs, work on my own or browse reddit instead.

Mr SSC

January 27, 2017I’m with you on that aspect of saving a little more now would just make me miserable and maybe even resentful towards the whole FIRE concept. That’s been my deal with trying to get to FIRE anyway – “As long as we don’t turn into those people who become cheap and scrimp and save over some happiness or comfort I’m in.” You have to draw a line somewhere.

Amazingly, our COL has been quite low and yet remained perfectly comfortable for all of us. I just need to start being as mindful with my allowance because I did forget to mention it ran at a negatve deficit for the last half of 2016 – whoops. I was considering a post about Mrs. SSC needing to “Up the deficit ceiling” or how my allowance was running off a fiscal cliff, but then I went this route instead. Maybe later this eyar now that I’m watching it more I might do that if it gets out of hand again. To be fair, 2016 was a LOT better than 2015, even with the mild deficit issue. Yikes, that even sounds worse now that I’m thinking about it. Oh well…

Dr Sock

January 26, 2017I paid my own way through university, mostly working at low paying summer jobs. (This was many years ago.) By necessity, I lived a frugal lifestyle. Whenever I felt a desire to purchase something wanted but not needed, I used to calculate the cost of the item in terms of the number of hours I would have to work at my mind-numbing job to pay for it. That method often helped restrain my spending. Exception: books. I always found money to buy books!

Mr SSC

January 27, 2017I did the same and it sort of forced a frugal lifestyle. Sort of because I supplemented mine with credit. Not the best idea, inf act it was a horrible idea. Not only did it teach me it’s okay to spend more than you make, I never got the discipline built in to my brain to say no and live within my means.

Better late than never I suppose, but it’s still hard changing those overspending habits.

Jacq

January 27, 2017After my new coat arrived I realized I partly purchased it to have control over something and the tracking to obsess over instead.of other stuff going on in life. On the practical side, my blue coat has another tear, and my mom has patched 3 for me already. I don’t know it will be weather worthy in the next big snow storm. Then the new coat was on sale, the website had a 25% off code, starting price qualified me for free shipping, I had a gift card from returns that covered half, and a visa gift card for the reminder. So it wasn’t completely an impulse buy, or a spending issue.

Other that the family trip in the fall (sun protection shirts saved my arms!), I have been good about not buying clothes. The aforementioned life stresses have meant a smidge more eating out than normal, and also abnormal extra travel this month (gas + tolls + parking). The 80/20 rule applies sometimes as giving yourself a break 20% of the time when you’ve stuck to your guns the other 80% of the time.

Sounds like you have a plan to adjust your spending. Keep up the good work!

Mr. SSC

February 3, 2017Yeah the 80/20 rule should work well I just find I spend like I have 80 when really I just have 20….

I don’t stress about it I just buy and when the bill shows up at the end of the month I look at it and go, Ugh… when it’s been a bad month. Need to stop doing that.

Elephant Eater

January 31, 2017I’ve been reading a lot about changing habits, and so if you tend to shop when bored at work, maybe you need to just find a different positive habit to substitute such as clicking to a page with something productive to read, or doing some postural exercises at your desk, etc. Of course if work boredom is the trigger for your bad habit, you could also just quit working…just saying.

Mr. SSC

February 3, 2017Another blogger recommended habits of change or something like that. I think I should read it st least for my allowance if not other areas of my life.

Retraining my brain down time at work to not involve the internet would be a great first step. ?

Mustard Seed Money

January 31, 2017I love to eat out for lunch. I don’t know why I hate eating at my desk or bringing in a brown paper bag. There is something about getting out of the office and clearing my head before I hit the rest of the day. So I look at as some mental therapy spending 🙂

Mr. SSC

February 3, 2017Dude! Same here. I always brown bag it but when someone IM’s me and is like, “hey up for empanadas today?” Hell yeah empanadas sound better than my sandwich and I get some socialization… no brainer there, lol. I wish I could afford to eat out most days because yep, I sure would. Like you, I love it.

Fruclassity (Ruth)

February 3, 2017“This year all this blogging advice finally trickles down to my personal wallet.” Last night, I asked my husband if he’d read the post I’d put up in the morning. “Yeah,” he said. “I was thinking ‘Miss Fruclassity’ hasn’t kept up with her own finances . . .” I was so mad at him! Of course he was right (but I was still mad). Your resolution for the year is the same as mine. I have “Ruth’s discretionary spending” posted on the fridge (pen and paper) for all to see. I’m hoping that faithful tracking, high visibility and heightened awareness will do the trick. Because nothing else does!

Mr. SSC

February 3, 2017Ahhh, my soul mate in allowance spending, lol. Just a warning I put up a chart for cursing and charged myself $1 per word in feb. (it’s the shortest month) and trying hard and having the chart I still spent $92 cursing… that’s like 3 a day which was still low for me, but I’m just saying don’t set the bar high the first few months. Ease into it or it won’t stick. At least with me I find that’s true. Like set a goal to decrease your allowance spending by 15% or so the first month and see how that goes. If good then do it another month.

THEN try 10% more or whatever it is you need to get your spending where you want it. Ease into it, otherwise it sucks so bad you’ll just fail. Let me reiterate, you may not, but if I did that it doesn’t matter if it’s visible and accountable I’ll just say, yep, not today.. not mere ting that goal today… and break it and move on.

BUT when I ease into a new goal target I find I’m more successful. You could be totally different, but that’s me. Good luck! I’m pulling for you!

Fruclassity (Ruth)

February 6, 2017I am “easing in” in a sense. I’m just tracking without judgment for now – in the hopes that a brilliant light bulb will suddenly shed light of its own accord. I appreciate your warning. I’ll give this “awareness” thing at least a couple of months.

Laurie @thefrugalfarmer

February 5, 2017“I saw, “I can’t afford that” as “I’m failing at life” when in fact it’s the strongest statement you can make to not fail at life.” Oh my gosh – I didn’t realize that “this was us” until I read that statement. Great work on diagnosing that. I know you will ROCK your 2017. You deserve it!

Mr SSC

February 7, 2017It took many, many years to figure that out. Not the “failing at life” part but the fact that being able to say no was way more successful attitude to have than just being able to spend money.

Good work with diagnosing that with you guys too. It’s pretty powerful. Hope you rock 2017!